- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:PLUS

Will Weakening IT Demand And Falling Sales Projections Change ePlus' (PLUS) Growth Narrative?

Reviewed by Sasha Jovanovic

- Recently, commentary around ePlus (NASDAQ:PLUS) highlighted that its sales have been flat for the past two years and are projected to fall over the next 12 months as demand for its IT solutions fades.

- This shift in demand expectations raises questions about the durability of ePlus’s business model and its ability to sustain prior operating trends.

- We’ll now explore how weakening demand and expectations for declining sales could reshape ePlus’s existing investment narrative.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

ePlus Investment Narrative Recap

To own ePlus, you need to believe it can convert its IT solutions expertise into durable, recurring revenue despite lumpier project demand. The latest commentary on flat sales and expected declines makes the near term revenue trend a more pressing risk than before, but it does not directly change the main positive catalyst, which is the company’s positioning in AI, security and cloud infrastructure where demand remains an important swing factor.

The recent initiation and affirmation of a quarterly US$0.25 dividend, alongside ongoing share repurchases, is the announcement that sits closest to this debate, because it highlights management’s current confidence in cash generation at a time when some forecasts are turning more cautious on sales. These capital returns may appeal to investors, but they also sharpen the question of how resilient earnings will be if demand for large projects weakens further.

Yet behind these reassuring capital returns, one specific risk around revenue concentration is something investors should be aware of...

Read the full narrative on ePlus (it's free!)

ePlus’ narrative projects $2.2 billion revenue and $78.4 million earnings by 2028. This implies a 0.2% yearly revenue decline and a $32.5 million earnings decrease from $110.9 million today.

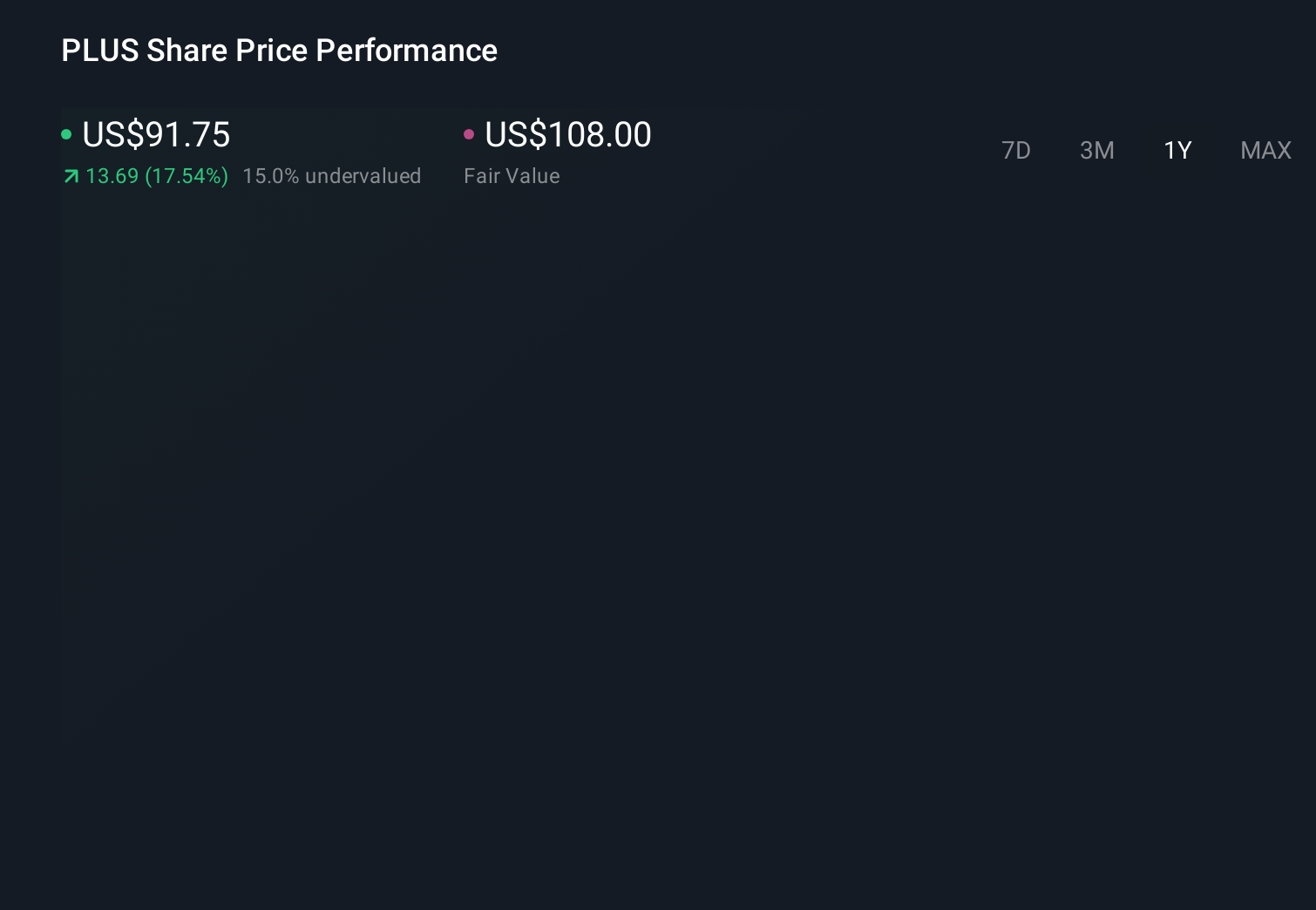

Uncover how ePlus' forecasts yield a $108.00 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community span a wide range from about US$37 to US$108, underscoring how far apart individual views can be. When you set that against concerns about flat to declining sales and potential revenue volatility, it becomes even more important to compare several perspectives on what might drive ePlus’s performance over the next few years.

Explore 2 other fair value estimates on ePlus - why the stock might be worth less than half the current price!

Build Your Own ePlus Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ePlus research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ePlus research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ePlus' overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLUS

ePlus

Provides information technology (IT) solutions that enable organizations to optimize IT environment and supply chain processes in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion