- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:PLUS

Why ePlus (PLUS) Is Up 6.3% After Raising 2026 Growth Guidance and Reporting Strong Results

Reviewed by Sasha Jovanovic

- ePlus announced strong financial results for the quarter and six months ended September 30, 2025, with revenue rising to US$608.83 million for the quarter and net income reaching US$34.86 million, accompanied by a quarterly dividend declaration of US$0.25 per share.

- The company also raised its fiscal year 2026 guidance, expecting mid-teens growth in net sales and gross profit, along with a higher increase in adjusted EBITDA, reflecting ongoing operational momentum.

- We'll assess how ePlus's raised full-year outlook, driven by broad-based growth, impacts the current investment narrative for the company.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

ePlus Investment Narrative Recap

To be a shareholder in ePlus right now, you need to believe in its ability to sustain broad-based growth in IT services, managed solutions, and AI-led infrastructure, despite prior reliance on lumpy, large enterprise deals. The recent raised guidance highlights management’s confidence in ongoing demand and helps support the short-term growth catalyst, but it does not materially change the chief risk: unpredictable future revenue streams if large deals are not repeated or recurring growth fails to offset volatility.

Among the latest announcements, the increase in full-year guidance for net sales and adjusted EBITDA stands out most, as it directly reinforces the company's ability to deliver against its most important growth catalysts. Investors now have increased clarity around management’s expectations for operating leverage and near-term expansion, with stronger momentum supporting the shift toward a services-driven business model.

But for investors, it’s critical to remember that this momentum may face challenges if large, one-time customer projects do not recur as expected...

Read the full narrative on ePlus (it's free!)

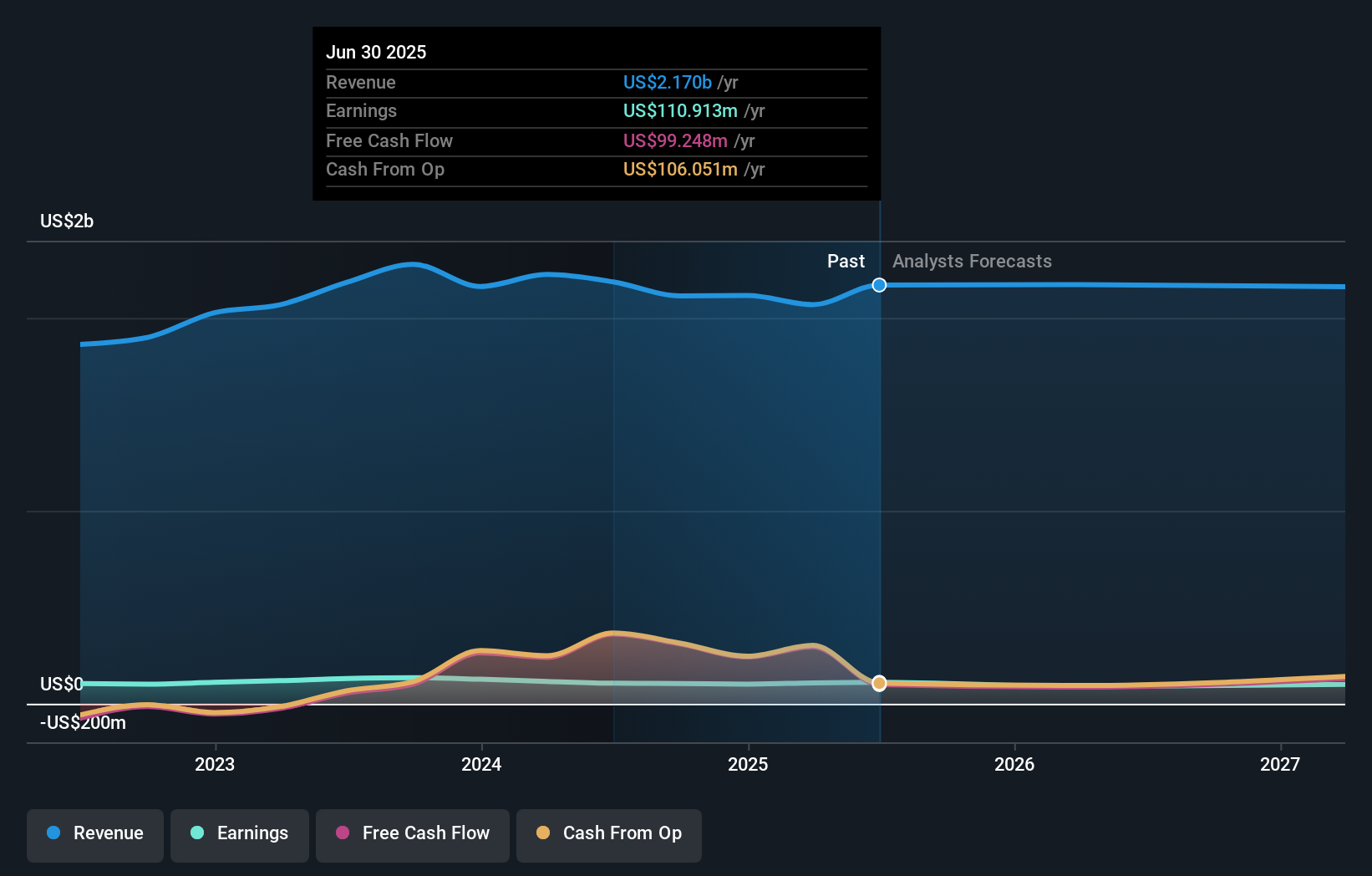

ePlus' outlook anticipates $2.2 billion in revenue and $78.4 million in earnings by 2028. This reflects a -0.2% annual revenue decline and a decrease of $32.5 million in earnings from the current $110.9 million level.

Uncover how ePlus' forecasts yield a $108.00 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for ePlus range from US$39.11 to US$108 across two perspectives. Investors should also consider that strong revenue visibility from raised guidance could be offset by future unpredictability if major project wins are not sustained.

Explore 2 other fair value estimates on ePlus - why the stock might be worth as much as 20% more than the current price!

Build Your Own ePlus Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ePlus research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free ePlus research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ePlus' overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLUS

ePlus

Provides information technology (IT) solutions that enable organizations to optimize IT environment and supply chain processes in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives