- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:PLUS

What ePlus (PLUS)'s AI‑Savvy Board Appointment Means For Shareholders

Reviewed by Sasha Jovanovic

- ePlus Inc. appointed Mike Portegello to its Board of Directors on January 6, 2026, adding him to both the Audit and Compensation Committees and bringing more than 37 years of accounting, finance, and capital markets experience to the company.

- Portegello’s blend of global audit leadership at Ernst & Young, advisory work with emerging tech and generative AI companies, and recent corporate governance training introduces a deeper layer of financial and technology oversight that could influence how investors assess ePlus’ boardroom expertise.

- Next, we’ll examine how Portegello’s extensive capital markets and AI-focused background may reshape ePlus’ existing investment narrative and risk profile.

We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

ePlus Investment Narrative Recap

To stay invested in ePlus, you need to believe in its positioning as a pure-play IT solutions provider leveraged to AI, security, and cloud demand, while managing margin pressure and lumpy enterprise projects. The appointment of Mike Portegello modestly strengthens governance and financial oversight but does not materially change the near term catalysts around AI infrastructure demand or the key risk of revenue volatility from large, project-based deals.

Among recent announcements, the initiation and continuation of the US$0.25 per share quarterly dividend stands out as most relevant, because it frames how investors think about capital allocation alongside governance changes. Portegello’s deep experience in capital markets and complex, high growth tech companies may influence how the board weighs future investments in AI-related services versus returning cash to shareholders at a time when earnings forecasts point to potential pressure on profitability.

Yet behind the stronger boardroom expertise, investors should be aware of the risk that large, one off enterprise projects may not...

Read the full narrative on ePlus (it's free!)

ePlus' narrative projects $2.2 billion revenue and $78.4 million earnings by 2028.

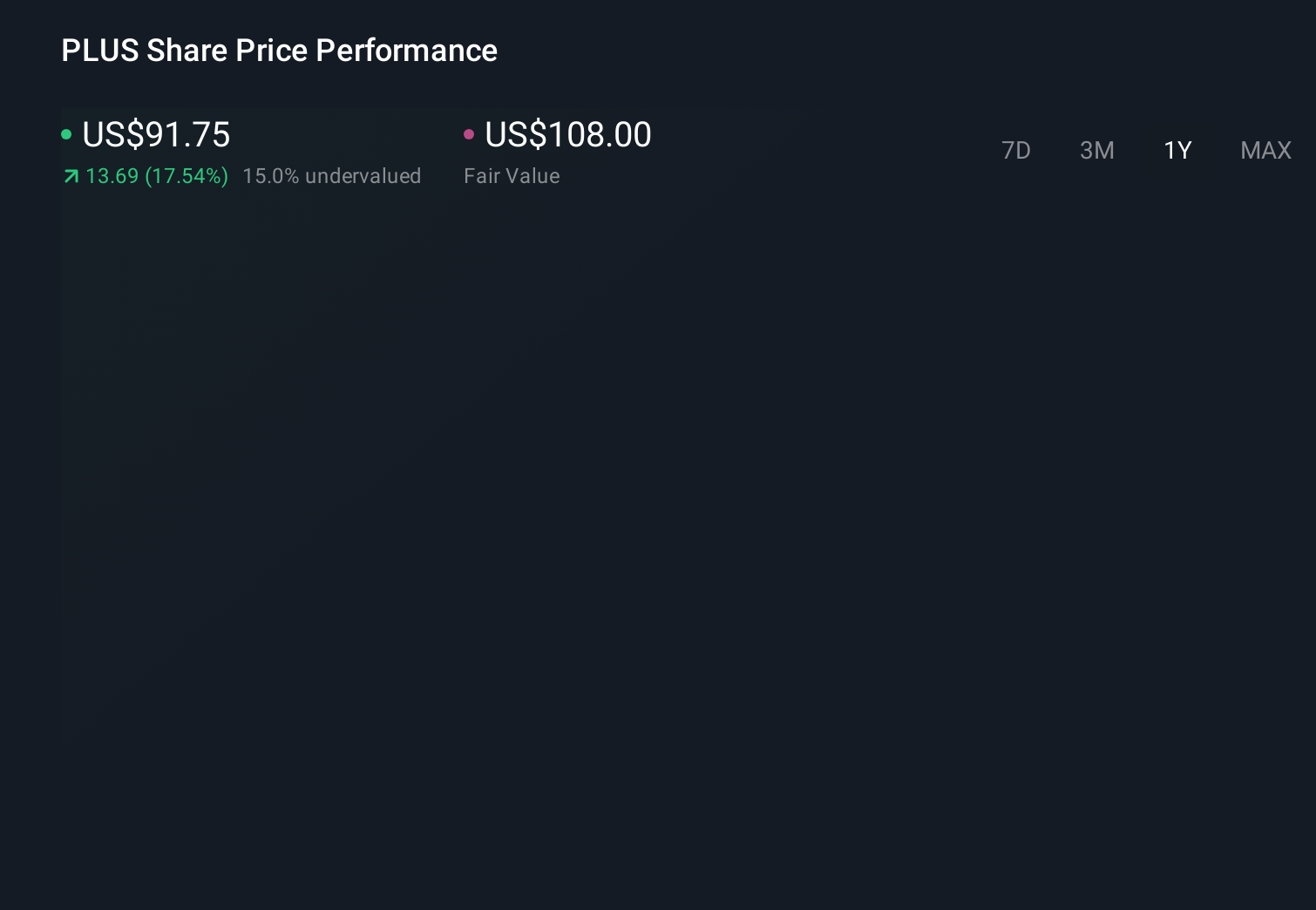

Uncover how ePlus' forecasts yield a $108.00 fair value, a 23% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community span a wide range, from about US$36.87 to US$108, showing how far apart individual views can be. As you weigh these perspectives, remember that ePlus’s dependence on large, project based IT deals raises the risk of uneven revenue and earnings, so it is worth exploring several alternative viewpoints before deciding how this fits into your portfolio.

Explore 2 other fair value estimates on ePlus - why the stock might be worth less than half the current price!

Build Your Own ePlus Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ePlus research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ePlus research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ePlus' overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLUS

ePlus

Provides information technology (IT) solutions that enable organizations to optimize IT environment and supply chain processes in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Is Global Payments (NYSE:GPN) The Undervalued Cash Cow Your Portfolio Needs?

Broadcom - A Fundamental and Historical Valuation

Hims & Hers Health aims for three dimensional revenue expansion

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026