- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:PLUS

What Does Ben Xiang's Sudden Exit Mean for ePlus's (PLUS) Strategic Trajectory?

Reviewed by Simply Wall St

- On July 18, 2025, Mr. Ben Xiang resigned from the Board of Directors of ePlus inc., effective immediately, to pursue new career opportunities.

- Such a sudden board resignation can raise important questions among investors about potential changes to company oversight and strategic direction.

- We’ll consider how the abrupt departure of a board member may influence ePlus’s long-term service-led strategy and growth outlook.

AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

ePlus Investment Narrative Recap

Shareholders in ePlus tend to believe in the company’s ability to transition toward a service-led, subscription-based revenue model, leveraging investments in AI and security offerings. The abrupt resignation of Mr. Ben Xiang from the Board on July 18, 2025, is unlikely to materially impact the biggest short-term catalysts or change the current risk profile, which includes slower product sales and ongoing revenue recognition shifts. Oversight and strategic direction appear robust given the board’s current experience and balance.

In the context of governance changes, the recent appointment of Melissa Ballenger to the Board and Audit Committee signals ePlus’s intent to maintain strong financial oversight and expertise. While this action isn’t a direct response to the recent resignation, it complements the company’s service-led outlook and suggests sustained board focus on long-term strategy and stability amid ongoing market challenges.

On the other hand, persistent headwinds from lower hardware demand and pressures on margins are risks investors should be mindful of as...

Read the full narrative on ePlus (it's free!)

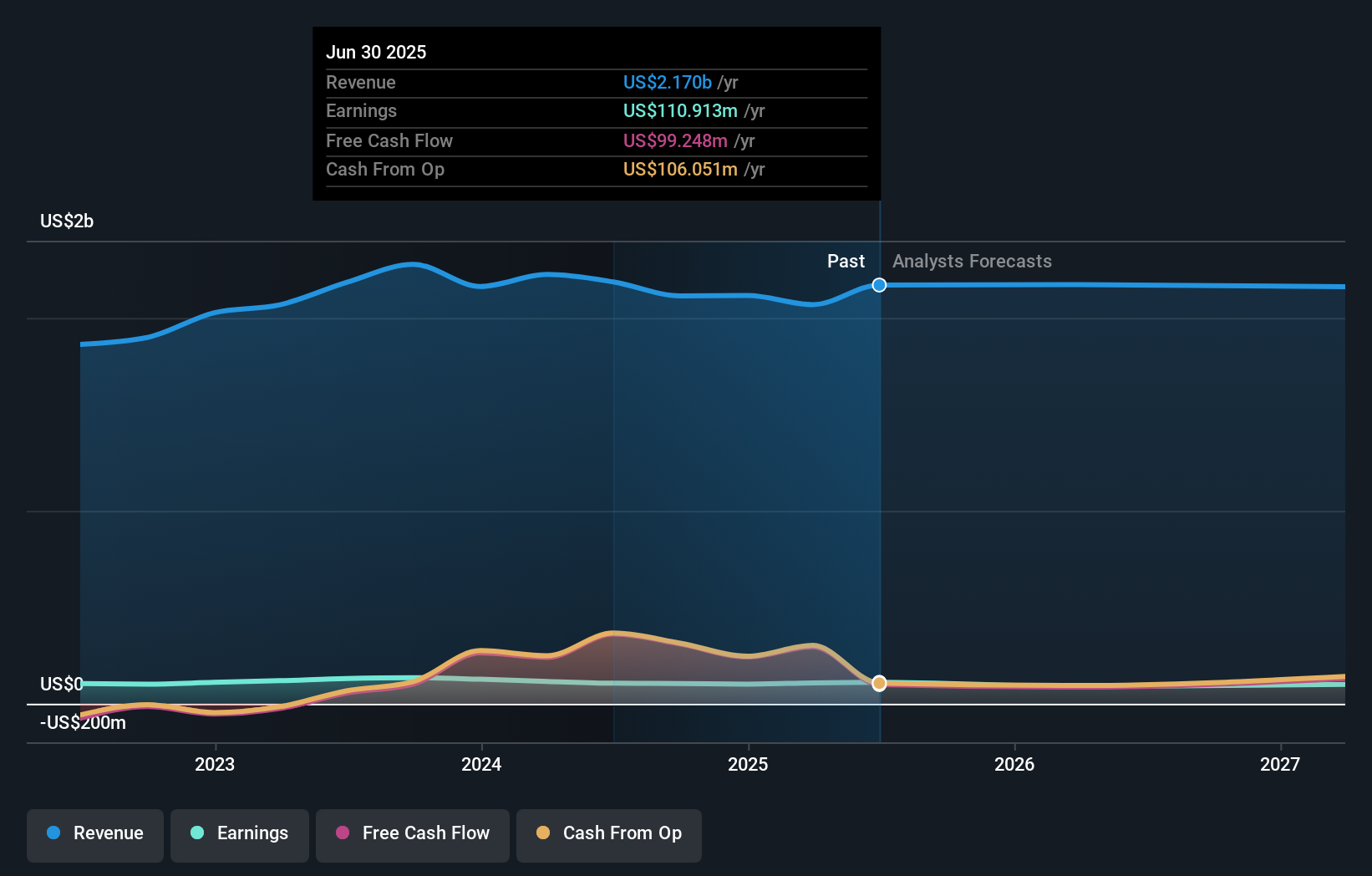

ePlus' narrative projects $2.2 billion in revenue and $109.4 million in earnings by 2028. This requires 1.8% yearly revenue growth and a $1.4 million earnings increase from $108.0 million today.

Uncover how ePlus' forecasts yield a $92.00 fair value, a 34% upside to its current price.

Exploring Other Perspectives

Private investors in the Simply Wall St Community set ePlus’s fair value between US$45.73 and US$92, reflecting two distinct outlooks. Amid these perspectives, the shift to subscription-based revenues remains key to understanding future opportunities and risks for ePlus.

Explore 2 other fair value estimates on ePlus - why the stock might be worth as much as 34% more than the current price!

Build Your Own ePlus Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ePlus research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free ePlus research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ePlus' overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLUS

ePlus

Provides information technology (IT) solutions that enable organizations to optimize IT environment and supply chain processes in the United States and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives