- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:PLUS

ePlus (PLUS) Valuation Check as Flat Sales and Forecast Revenue Decline Test Growth Expectations

ePlus (PLUS) is back in focus after fresh analysis flagged something investors never like to see: flat sales over the past two years and a projected revenue decline that points to softer demand ahead.

See our latest analysis for ePlus.

Despite that softer top line outlook, the market has largely looked through the noise. A strong 90 day share price return of 26.06 percent has helped lift ePlus to 93.08 dollars and added to an impressive three year total shareholder return of 112.72 percent. This suggests momentum is still firmly on the side of longer term holders even as near term expectations cool.

If this kind of mixed growth story has you comparing options, it could be worth scanning other high growth tech names through high growth tech and AI stocks for fresh ideas beyond ePlus.

Yet with earnings under pressure, a slight premium to analyst targets, and a stellar multi year run already in the bag, investors now have to ask whether ePlus is an overlooked bargain or a stock where future growth is fully priced in.

Most Popular Narrative: 13.8% Undervalued

With ePlus last closing at 93.08 dollars against a narrative fair value of 108 dollars, the storyline leans toward upside, hinging on profitable growth in services and operating leverage.

The company's healthy balance sheet, with record cash levels after the financing business sale, enables further investment in organic growth, strategic acquisitions, and expansion into high-growth verticals, all of which can accelerate revenue growth and support long-term EBITDA expansion.

Want to see why a company facing softer revenue expectations still earns a richer future earnings multiple than many peers, and how modest margin shifts completely change the valuation picture? Read on to uncover the specific growth mix and profitability path this narrative is banking on, and how those assumptions bridge the gap between today’s price and that higher fair value.

Result: Fair Value of $108 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside depends on replacing lumpy, project driven revenue and managing rising operating costs, which could squeeze margins if demand cools.

Find out about the key risks to this ePlus narrative.

Another Take on Valuation

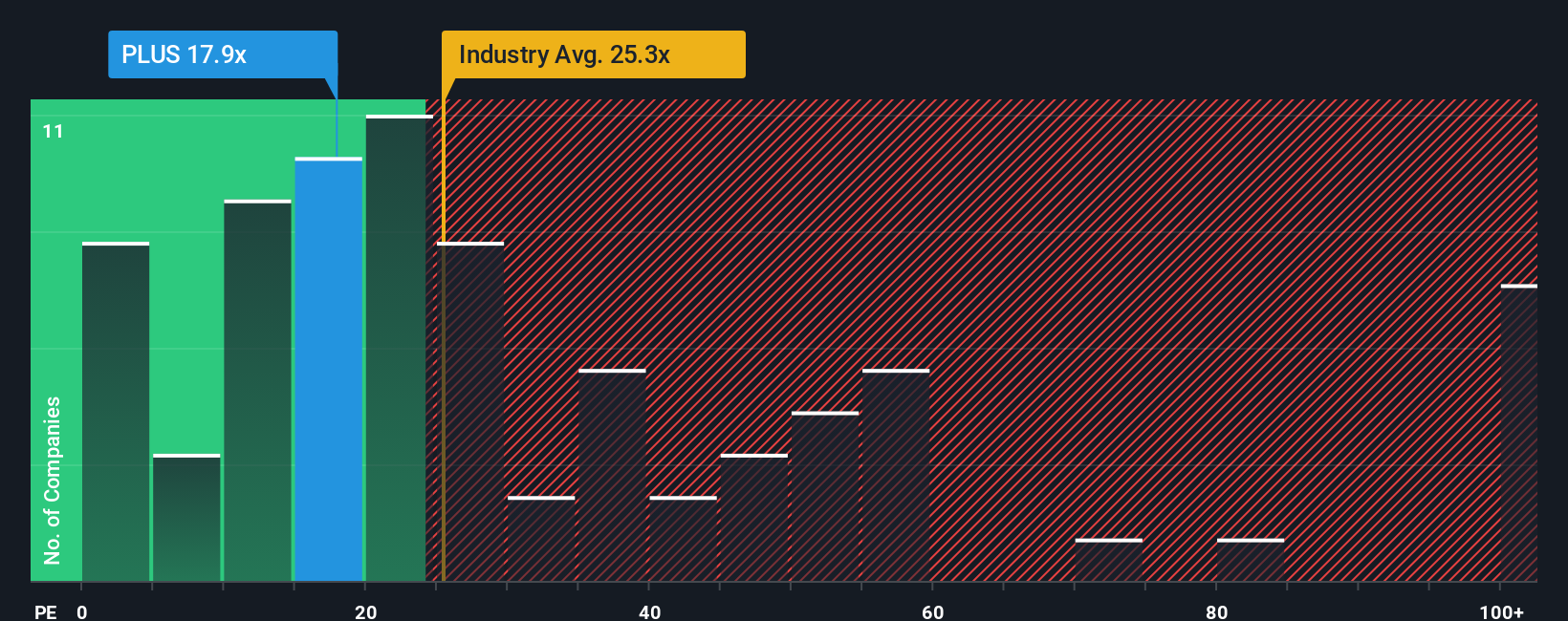

While the narrative points to 13.8 percent upside, the market is sending a different signal. On a simple price to earnings lens, ePlus trades at 18.9 times earnings, slightly above its 17 times fair ratio and peer average of 18.4 times, even if still cheaper than the US Electronic sector at 25.4 times.

That mix of modest premium to fair ratio but discount to the wider industry suggests less of a slam dunk bargain and more of a finely balanced risk reward. It leaves investors to decide whether recent execution justifies paying up or demands a wider margin of safety.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ePlus Narrative

If you are skeptical of this view or prefer to dig into the numbers yourself, you can build a custom narrative in just minutes: Do it your way

A great starting point for your ePlus research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before you stop at ePlus, give yourself an edge by scanning fresh opportunities on Simply Wall St’s screener, where curated ideas can sharpen your next portfolio decision.

- Capture potential mispricings by targeting companies trading below their estimated cash flow value through these 905 undervalued stocks based on cash flows, before the rest of the market catches on.

- Capitalize on the AI transformation by hunting for future winners across these 26 AI penny stocks, where rapid innovation meets scalable business models.

- Lock in income potential by filtering for reliable payers via these 12 dividend stocks with yields > 3%, so your capital works harder even when markets move sideways.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLUS

ePlus

Provides information technology (IT) solutions that enable organizations to optimize IT environment and supply chain processes in the United States and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Rare Pure High Grade Silver with 35% Insider (Near Producer)

Swedens Constellation Software

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.