- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:PLUS

ePlus (PLUS): Assessing Valuation After Raised Guidance and Strong Security-Led Earnings Growth

Reviewed by Simply Wall St

ePlus (PLUS) just raised its financial guidance for fiscal 2026 after reporting another quarter of double-digit revenue and profit growth, mainly fueled by impressive gains in its security and cloud solutions business.

See our latest analysis for ePlus.

After surging on upbeat earnings and a freshly declared dividend, ePlus is riding a wave of building momentum. The stock’s 30-day share price return of 26.4% stands out, contributing to a 21.9% gain year-to-date. These moves are backed by a strong 1-year total shareholder return of 15.2% and an even more impressive 124% over five years. The outsized recent price gains suggest investors are increasingly confident in ePlus’s ability to translate its tech-driven growth into long-term value.

If you’re looking for other companies capturing attention this quarter, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares not far from recent highs and strong results drawing attention, the key question is whether ePlus’s future growth potential is already fully reflected in the stock price or if there is still room for upside.

Most Popular Narrative: 16% Undervalued

With the narrative fair value of $108 suggesting considerable upside from the last close at $90.22, the current price leaves room for debate on whether the market is truly factoring in ePlus’s projected growth trajectory.

The transition to a pure-play technology product and services company, following the sale of the financing business, simplifies operations and reduces earnings volatility. This allows management to focus capital on higher-growth, higher-margin areas and unlocks the potential for higher net margins and more consistent earnings over time. The company's healthy balance sheet, with record cash levels after the financing business sale, enables further investment in organic growth, strategic acquisitions, and expansion into high-growth verticals. All of these can accelerate revenue growth and support long-term EBITDA expansion.

Want to know what’s behind the narrative’s bold price target? The path hinges on a dramatic shift in business mix, margin expansion, and strategic reinvestment. Discover which foundational assumptions and surprising growth levers are baked into this valuation. You won’t want to miss what’s driving the forecast.

Result: Fair Value of $108 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, large one-off deals and ongoing margin pressure could challenge ePlus’s ability to deliver the steady and predictable growth implied by optimistic forecasts.

Find out about the key risks to this ePlus narrative.

Another View: Are The Numbers Really That Supportive?

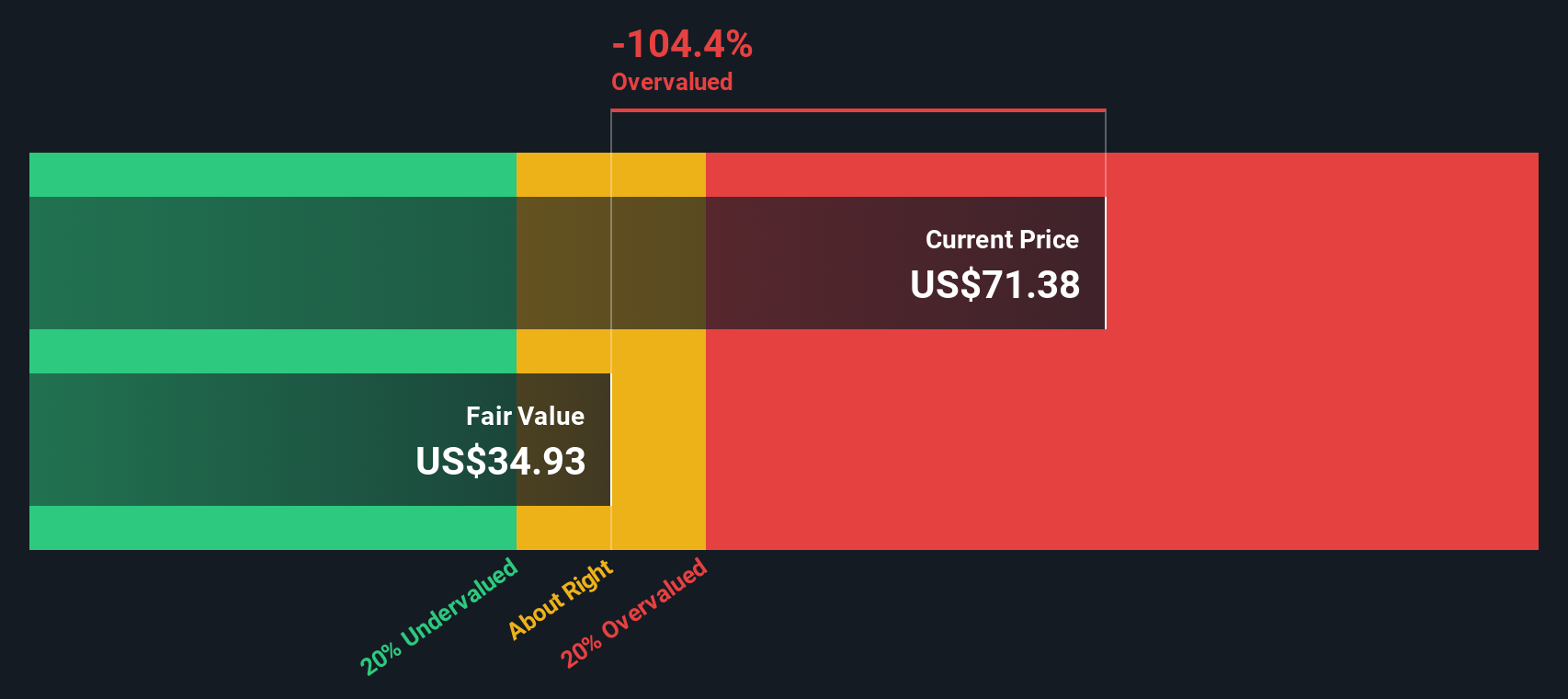

While the narrative valuation points to ePlus being undervalued, our DCF model offers a different perspective. According to the SWS DCF model, ePlus is actually trading above its estimate of fair value. This contrast highlights how much depends on assumptions about long-term growth and cash flows. Is the future more optimistic than the numbers suggest?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ePlus for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 886 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ePlus Narrative

If you’d like to challenge these assumptions or see things differently, you can put together your own narrative in under three minutes, with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding ePlus.

Ready for More Winning Ideas?

Opportunity does not wait around. Use the Simply Wall Street Screener now and see what other exciting stocks could help move your portfolio ahead.

- Unlock potential by scouting these 886 undervalued stocks based on cash flows that analysts believe are currently trading below their intrinsic worth.

- Capture yield with these 16 dividend stocks with yields > 3% boasting yields over 3% and steady cash returns for your investments.

- Capitalize on innovation with these 25 AI penny stocks tapping into the artificial intelligence boom reshaping industries worldwide.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLUS

ePlus

Provides information technology (IT) solutions that enable organizations to optimize IT environment and supply chain processes in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives