- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:OUST

Is Ouster’s (OUST) Software Pivot a Catalyst for Sustainable Margins or a Strategic Hurdle?

Reviewed by Sasha Jovanovic

- Earlier in 2025, Ouster Inc. announced improved net margins and a continued business shift toward software-enabled solutions, with third-quarter revenue guidance of US$35 million to US$38 million.

- This transition aims to establish recurring revenues and operational efficiency while scaling software offerings and targeting stronger long-term growth and profitability.

- We will explore how Ouster’s accelerated move to software-enabled solutions now reshapes its investment narrative and future trajectory.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Ouster Investment Narrative Recap

Ouster’s investment case centers on confidence in its transition from a hardware-driven model to software-enabled solutions for secure, recurring revenue and improved margins. The recent announcement of better net margins and the guidance for third-quarter revenue of US$35 million to US$38 million reinforce the company’s push toward operational efficiency, but do not materially alter the immediate catalyst: the market’s focus remains on Ouster’s ability to scale software adoption while facing the ongoing risk of strong competition from Chinese lidar firms potentially impacting pricing and market share.

Among recent updates, Ouster’s strategic partnership with Constellis to enhance global security solutions stands out as highly relevant, illustrating efforts to leverage its software-attached offerings and expand into broader markets. This expansion aligns directly with current catalysts, supporting Ouster’s ambition for recurring revenue and signaling the real-world traction behind its evolving business model.

However, investors should be aware that while Ouster pursues growth through software, pressure from low-cost competitors outside the US could...

Read the full narrative on Ouster (it's free!)

Ouster's outlook points to $335.6 million in revenue and $30.3 million in earnings by 2028. Achieving this would require 38.7% annual revenue growth and a $122.3 million increase in earnings from the current $-92.0 million.

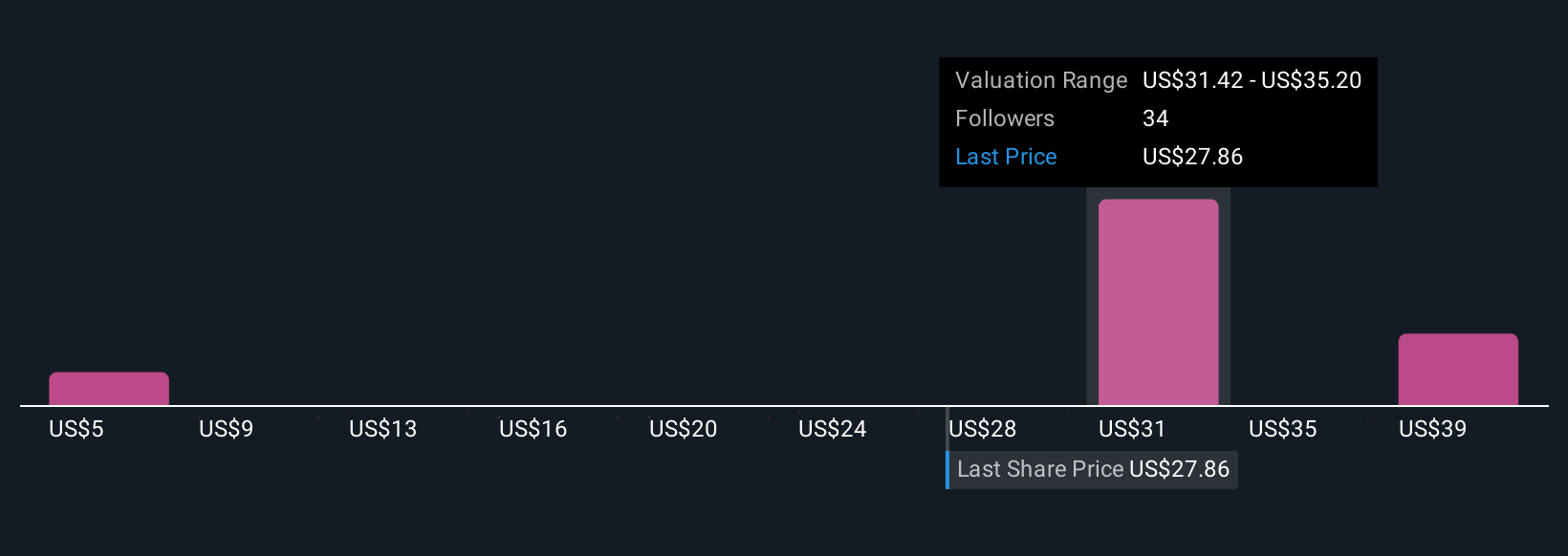

Uncover how Ouster's forecasts yield a $35.00 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provide 12 fair value estimates for Ouster between US$5.77 and US$49.14 per share. With revenue projected to grow 27.6 percent annually, you can weigh these diverse opinions against the company’s evolving risk from intense industry competition and consider which viewpoint best fits your own outlook.

Explore 12 other fair value estimates on Ouster - why the stock might be worth as much as 56% more than the current price!

Build Your Own Ouster Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ouster research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Ouster research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ouster's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OUST

Ouster

Provides lidar sensors for the automotive, industrial, robotics, and smart infrastructure industries in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives