- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:OSIS

A Look at OSI Systems (OSIS) Valuation Following $500 Million Convertible Notes Offering and Dilution Potential

Reviewed by Simply Wall St

OSI Systems (OSIS) just completed a $500 million convertible senior notes offering, which not only raises fresh capital but also introduces the potential for share dilution if these notes are converted. This event has become a key focus for investors.

See our latest analysis for OSI Systems.

After a strong run so far this year, OSI Systems' share price jump of 7.3% in the last session stands out, especially in the wake of its sizable new convertible notes offering. Even with a recent dip, the year-to-date share price return is a robust 51.8%. The stock’s three- and five-year total shareholder returns of 183.1% and 185% underline its long-term growth trajectory. Momentum remains clearly on the company’s side. However, fresh capital raises always bring a new set of dynamics and investor questions.

If you want to spot other fast-moving opportunities, now is a great moment to widen your search and discover fast growing stocks with high insider ownership

With these factors at play, investors face a pivotal question: Is OSI Systems trading at an attractive valuation, or is the current share price already reflecting the company’s prospects for further growth?

Most Popular Narrative: 12.2% Undervalued

With OSI Systems’ fair value set at $286 according to the most popular narrative, the stock closed at $251.10, suggesting meaningful remaining upside if expectations are met. The stage is set for a high-stakes stretch driven by policy, government contracts, and the company’s ability to prove its growth assumptions.

“Bullish analysts are raising long-term growth estimates based on expectations of continued benefits from increased U.S. border security spending. They anticipate sustained revenue streams through the end of the decade.”

Want to know how the current price target stacks up? The secret sauce lies in bold multi-year revenue forecasts and much higher profit margins than OSI Systems has ever delivered. Dig deeper to see which blockbuster assumptions power the case for a premium valuation; some may surprise you.

Result: Fair Value of $286 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, delays in government contract payments or slower healthcare division growth could challenge OSI Systems’ upbeat projections and put pressure on future results.

Find out about the key risks to this OSI Systems narrative.

Another View: What Does Our DCF Model Suggest?

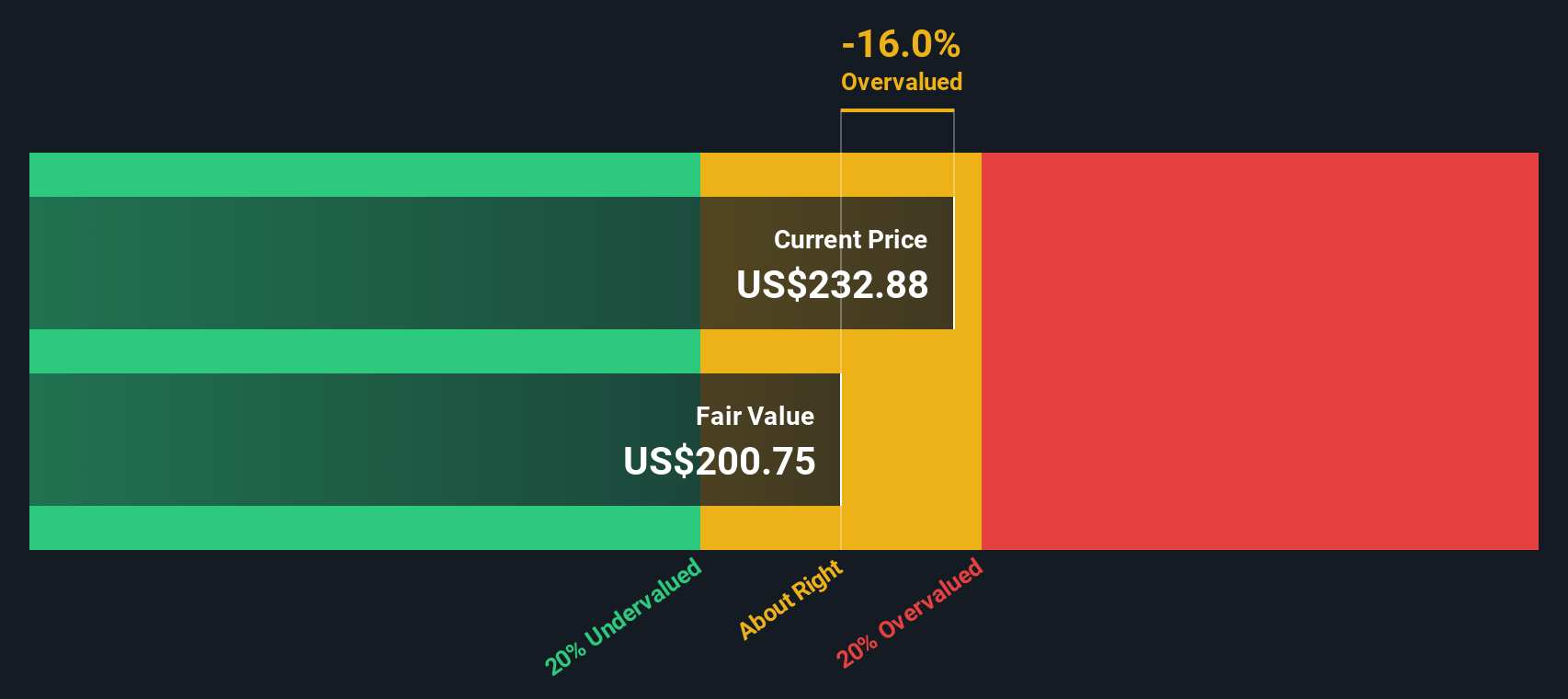

While the fair value based on analyst targets implies upside, our SWS DCF model offers a different perspective. According to this approach, OSI Systems appears overvalued at current prices, suggesting a more cautious outlook if future cash flows or margins do not meet expectations. Which method provides clearer insight for investors at this time?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out OSI Systems for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 922 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own OSI Systems Narrative

If you have your own perspective or want to analyze the numbers firsthand, you can build your own valuation scenario in just a few minutes. Do it your way

A great starting point for your OSI Systems research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t just stop at OSI Systems when there are other exciting opportunities waiting to be found. Use these standout lists to find investments that could transform your portfolio before the market catches on.

- Tap into future breakthroughs by tracking these 26 quantum computing stocks and get ahead of advances in quantum computing and next-generation tech.

- Pursue reliable income by checking these 15 dividend stocks with yields > 3%, which features high-yielding stocks that reward shareholders with consistent payouts.

- Gain an edge with these 26 AI penny stocks, giving you access to companies powering artificial intelligence innovation and shaping entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OSIS

OSI Systems

Designs and manufactures electronic systems and components in the United States and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives