- United States

- /

- Communications

- /

- NasdaqCM:ONDS

Ondas Holdings (ONDS) Is Up 7.7% After Expanding Into Defense Robotics With Sentrycs Acquisition and Major Order

Reviewed by Sasha Jovanovic

- In November 2025, Ondas Holdings completed the acquisition of Israel's Sentrycs, integrating advanced 'Cyber-over-RF' protocol manipulation with its Iron Drone Raider system, and made a US$35 million investment in Performance Drone Works to expand NDAA-compliant combat robotics production for U.S. defense needs. Soon after, Ondas secured an US$8.2 million order from a major European security agency for deployment at a large international airport, highlighting immediate commercial traction for its expanded product suite.

- These moves underscore Ondas Holdings' increased focus on defense and security sector growth, positioning the company to respond to evolving global threats and government demand for advanced autonomous and security solutions.

- We'll explore how Ondas Holdings' acquisition-driven entry into defense robotics could reshape its investment narrative and long-term growth outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Ondas Holdings Investment Narrative Recap

To own shares of Ondas Holdings, you need to believe in its ability to scale cutting-edge autonomous systems and secure repeated, sizable defense contracts that drive revenue growth faster than expenses, even as it faces ongoing losses and funding needs. The recent acquisitions and order wins may boost commercial momentum, but the most important short-term catalyst remains sustained order flow in defense sectors; the biggest risk continues to be the significant gap between revenue and high operating costs, which the news does not immediately resolve.

Of the recent company announcements, the November 2025 shelf registration filing to potentially raise up to US$219.45 million stands out. With ongoing net losses and heavy investments in growth, this move ties directly to the key risk of funding future operations, highlighting the ongoing reliance on raising additional capital while executing on ambitious expansion plans.

But while product demand draws attention, investors should carefully weigh what additional fundraising could mean for their holdings if...

Read the full narrative on Ondas Holdings (it's free!)

Ondas Holdings' narrative projects $151.6 million in revenue and $16.3 million in earnings by 2028. This requires 141.1% yearly revenue growth and a $63.2 million earnings increase from the current earnings of -$46.9 million.

Uncover how Ondas Holdings' forecasts yield a $10.86 fair value, a 29% upside to its current price.

Exploring Other Perspectives

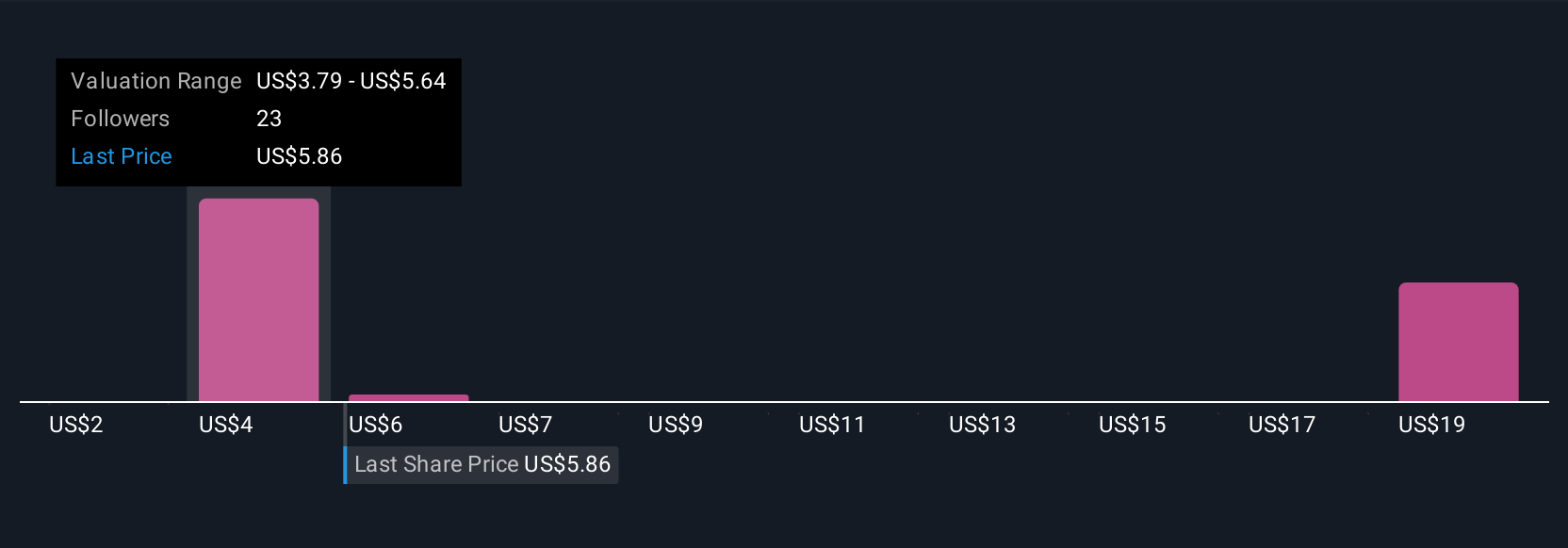

The Simply Wall St Community has produced 14 fair value estimates for Ondas Holdings, ranging from US$0.47 to US$18.17 per share. While opinions are split, many analysts see accelerating revenue as critical to bridging the company’s persistent losses, so it’s worth considering how sentiment varies before forming your view.

Explore 14 other fair value estimates on Ondas Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own Ondas Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ondas Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Ondas Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ondas Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ONDS

Ondas Holdings

Provides private wireless, drone, and automated data solutions in the United States and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success