- United States

- /

- Tech Hardware

- /

- NasdaqGS:NTAP

NetApp (NasdaqGS:NTAP) Partners With NFL For Cutting-Edge Data Infrastructure Solutions

Reviewed by Simply Wall St

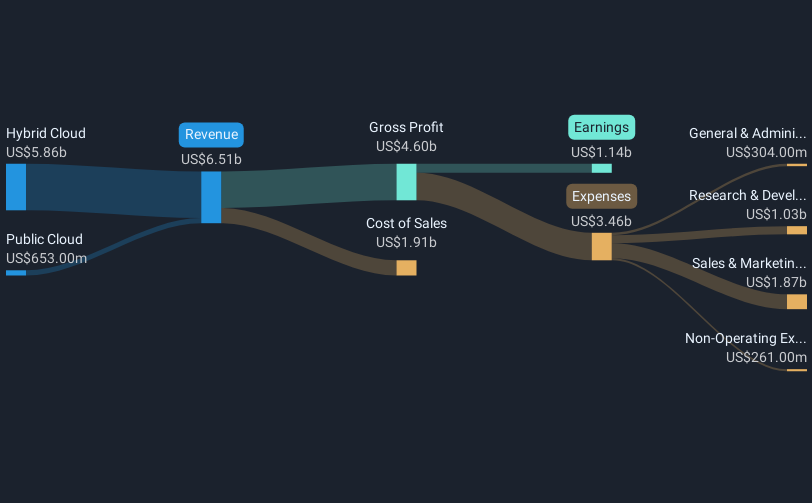

NetApp (NasdaqGS:NTAP) recently garnered attention as the Official Intelligent Data Infrastructure partner for the NFL, advancing its profile in secure data management and storage. This collaboration likely bolstered investor confidence, contributing to the 8% price increase seen last week. Moreover, their enhanced collaboration with Google Cloud further highlights the company's efforts to innovate in the tech sector, aligning with the broader market's positive movement, driven by gains in tech stocks. While broader economic and market conditions remain varied, these strategic partnerships emphasized NetApp's role in technological development, further amplifying its stock's performance.

Buy, Hold or Sell NetApp? View our complete analysis and fair value estimate and you decide.

The NFL partnership and collaboration with Google Cloud underscore NetApp's proactive approach to reinforcing its presence in secure data management and cloud solutions. These initiatives could enhance the company's narrative focused on AI and cloud innovations poised to boost revenue and earnings growth. Given the company's long-term total shareholder return of 132.40% over the past five years, these partnerships bolster confidence in continued growth, despite the 1-year underperformance relative to the US Tech industry, which returned 14.4% compared to NetApp's lower return.

While the recent share price increase of 8% is encouraging, it shows some alignment with the consensus price target of US$117.40, which still represents a notable gap from the current price of US$76.14. This suggests room for further appreciation if NetApp can meet forecasts. Analysts predict a revenue increase to $7.5 billion by 2028, supporting advances in SA scale-out all-flash systems and other cloud innovations. Whether these collaborations can sustain such growth amid challenges like market caution and a strong US dollar remains a key factor.

Learn about NetApp's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if NetApp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTAP

NetApp

Provides a range of enterprise software, systems, and services that customers use to transform their data infrastructures in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion