- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:NSSC

Napco Security Technologies (NSSC) Margin Slippage Challenges Bullish Profitability Narratives

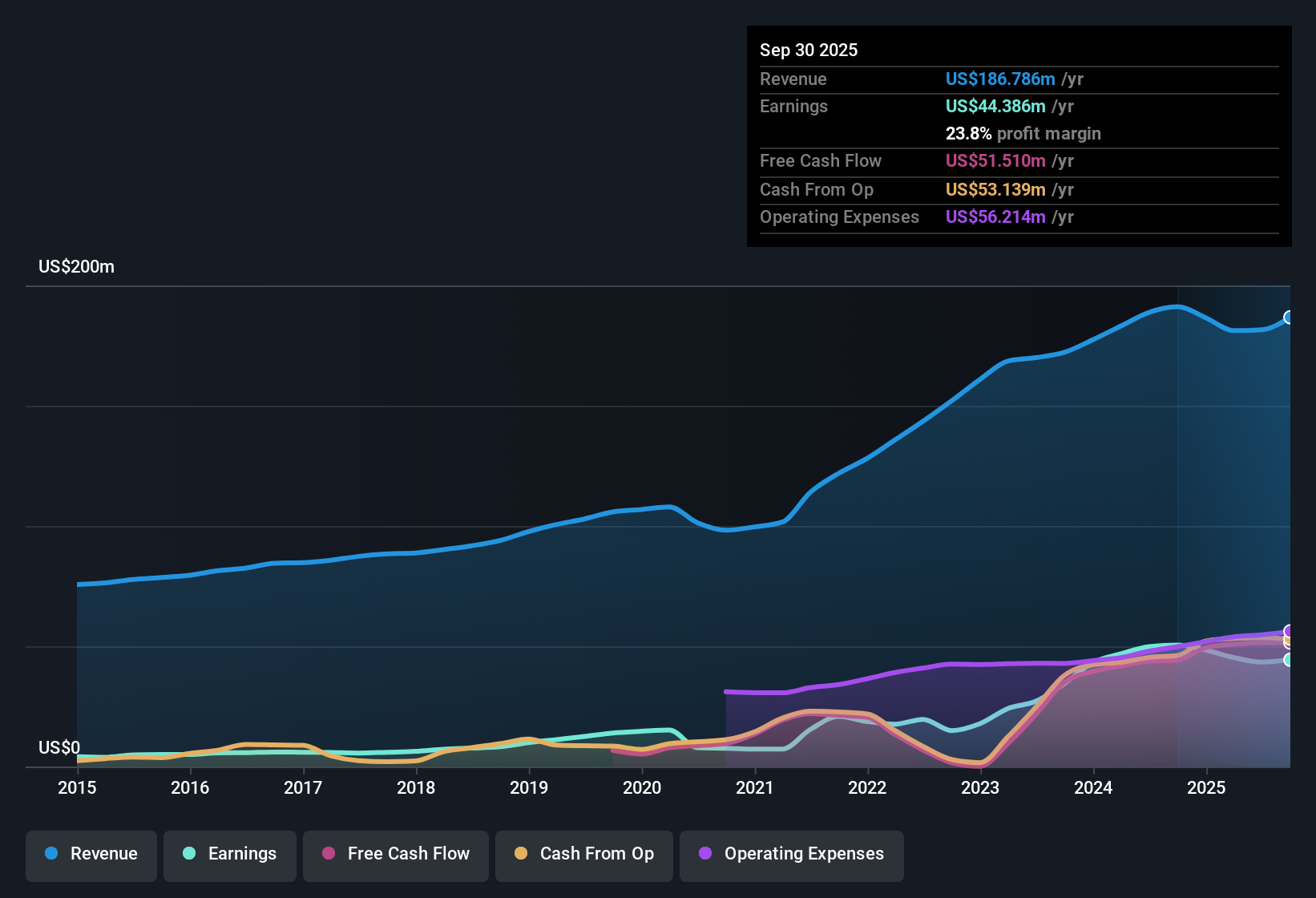

Napco Security Technologies (NSSC) just posted Q2 2026 results with revenue of US$48.2 million and basic EPS of US$0.38, alongside net income of US$13.5 million, putting fresh numbers on the table for investors tracking its profitability. The company has seen quarterly revenue move from US$42.9 million in Q2 2025 to US$48.2 million in Q2 2026, while basic EPS shifted from US$0.29 to US$0.38 over the same span. Trailing twelve month EPS stands at US$1.33 and net income at US$47.4 million, setting up a story that now hinges on how durable its mid 20% margin profile really is.

See our full analysis for Napco Security Technologies.With the latest figures in place, the next step is to weigh these margins and growth expectations against the dominant narratives around NSSC to see which views hold up and which start to look out of sync.

Curious how numbers become stories that shape markets? Explore Community Narratives

Trailing 12‑month profits at US$47.4 million

- Over the last twelve months, Napco generated US$192.0 million of revenue and US$47.4 million of net income, which lines up with the 24.7% net margin figure that has been referenced.

- What stands out for a more bullish view is that trailing EPS of US$1.33 sits above any single quarter in the recent set, yet the same data shows one year of weaker earnings compared with the roughly 29.7% per year pace over five years, which means:

- Supporters can point to steady profits, with net income moving from US$10.5 million in Q2 2025 to US$13.5 million in Q2 2026.

- Cautious investors can point to the fact that trailing net income of US$47.4 million is lower than the US$50.5 million reference point in the earlier LTM data, which is consistent with the comment that one year earnings growth turned negative versus that multi year trend.

Margins ease from 25.9% to 24.7%

- The latest trailing net margin of 24.7% compares with 25.9% in the prior year, which lines up with full year net income moving from US$48.4 million on US$186.5 million of revenue to US$47.4 million on US$192.0 million of revenue.

- Critics who worry about pressure on profitability get some backing here, because:

- The margin slip from 25.9% to 24.7% shows profits did not scale in lockstep with revenue, even though revenue across those two trailing periods stayed in a tight band around US$186 million to US$192 million.

- The negative one year earnings growth that has been flagged sits alongside this softer margin, which together suggests that, over the last year, Napco converted each dollar of sales into slightly less profit than in the prior period.

P/E of 30.8x versus 26.6x sector and DCF fair value

- Napco is referenced at a P/E of 30.8x against a US Electronic industry average of 26.6x and a peer group average of 87.6x, while a DCF fair value of about US$30.02 sits below the current share price of US$41.02.

- Skeptics who focus on valuation find several data points to work with, because:

- The P/E of 30.8x is above the 26.6x industry marker and the share price of US$41.02 is above the DCF fair value reference of roughly US$30.02, which is consistent with the view that the stock may be pricing in more than the cash flow model implies.

- At the same time, the P/E being well below the 87.6x peer average and forecasts calling for about 9.8% revenue growth and 11.0% earnings growth per year give investors some context for why the market might still be comfortable with a premium to the broader industry.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Napco Security Technologies's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Napco’s softer net margin, weaker one year earnings trend versus its multi year pace, and P/E above industry alongside a lower DCF fair value all lean toward valuation risk.

If paying up for that kind of earnings wobble feels uncomfortable, use our pre screened these 877 undervalued stocks based on cash flows to hunt for companies where pricing and cash flow assumptions look more aligned.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Napco Security Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NSSC

Napco Security Technologies

Engages in the development, manufacturing, and sale of electronic security systems for commercial, residential, institutional, industrial, and governmental applications in the United States and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Why I invest in Sofina (Dividend growth)

Great dividend but share numbers have increased 100% in last 12 months!!

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

As a gamer, I would not touch this company now. They are hated by the community and have been releasing major flops on their AAA games during the last 5 years (for good reasons). It is true that the valuation is ridiculously low compared to what the licenses are worth, but if the trend continues the value of those will also decline. Management needs to almost make a 180° turnaround to get things right. I agree that a take-private deal before it is too late might be the best option for an investor entering today. We might also see a split sales of the different studios. It is a very risky play, but potentially with high reward.