- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:NSSC

Napco Security Technologies, Inc. (NASDAQ:NSSC) Shares May Have Slumped 31% But Getting In Cheap Is Still Unlikely

Napco Security Technologies, Inc. (NASDAQ:NSSC) shareholders that were waiting for something to happen have been dealt a blow with a 31% share price drop in the last month. Looking at the bigger picture, even after this poor month the stock is up 47% in the last year.

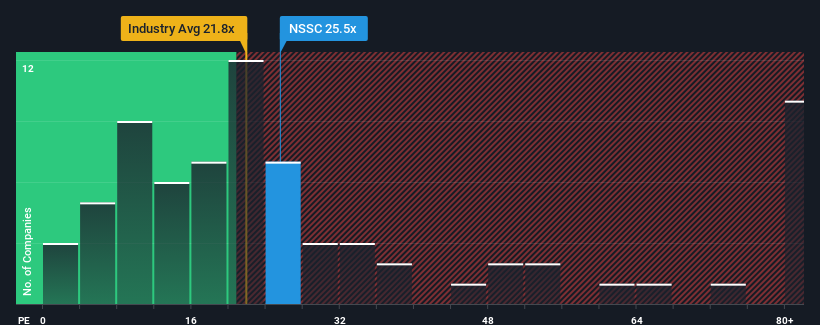

Even after such a large drop in price, Napco Security Technologies' price-to-earnings (or "P/E") ratio of 25.5x might still make it look like a sell right now compared to the market in the United States, where around half of the companies have P/E ratios below 17x and even P/E's below 10x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Napco Security Technologies certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Napco Security Technologies

How Is Napco Security Technologies' Growth Trending?

The only time you'd be truly comfortable seeing a P/E as high as Napco Security Technologies' is when the company's growth is on track to outshine the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 83% last year. The strong recent performance means it was also able to grow EPS by 222% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the seven analysts covering the company suggest earnings should grow by 16% over the next year. With the market predicted to deliver 15% growth , the company is positioned for a comparable earnings result.

In light of this, it's curious that Napco Security Technologies' P/E sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Key Takeaway

Despite the recent share price weakness, Napco Security Technologies' P/E remains higher than most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Napco Security Technologies currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Plus, you should also learn about these 2 warning signs we've spotted with Napco Security Technologies.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Napco Security Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:NSSC

Napco Security Technologies

Engages in the development, manufacturing, and sale of electronic security systems for commercial, residential, institutional, industrial, and governmental applications in the United States and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success