- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:NSIT

Does Insight Enterprises’ 49% Slide Signal Opportunity After Recent Cloud Contract Loss?

Reviewed by Bailey Pemberton

If you’re staring at the Insight Enterprises stock chart and wondering if now is the moment to buy, sell, or hold, you’re definitely not alone. A year ago, few could have predicted just how much volatility would sweep through the broader tech and IT solutions sector. With Insight Enterprises coming off a five-year gain of 78.2%, but down around 49% over the last 12 months, it is enough to make even the most seasoned investor want a second opinion. The slide has not been isolated to recent weeks either, with the stock down 12.7% in the past month and a tough 25.4% year-to-date. Compared to a gain of 30.9% over the last three years, it is clear there has been a dramatic shift in the market’s risk appetite.

So, is this a golden buying opportunity or is there a real reason for caution? Market turbulence and changing narratives about digital transformation and IT spending have certainly played a part, but Insight Enterprises is now showing a value score of 5 out of 6. In plain English, that means the company looks undervalued in five of the six major checks analysts use to test a stock’s relative price. It is a compelling setup, but raw numbers alone do not always tell the whole story.

Let’s break down exactly how those valuation checks stack up, and then go a step further to explore an even sharper way to look at whether Insight Enterprises is truly undervalued right now.

Why Insight Enterprises is lagging behind its peers

Approach 1: Insight Enterprises Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a core valuation method that estimates a company’s true worth by projecting its future cash flows and discounting them back to today’s value. This approach gives investors a snapshot of what a business might genuinely be worth, rather than relying on market sentiment alone.

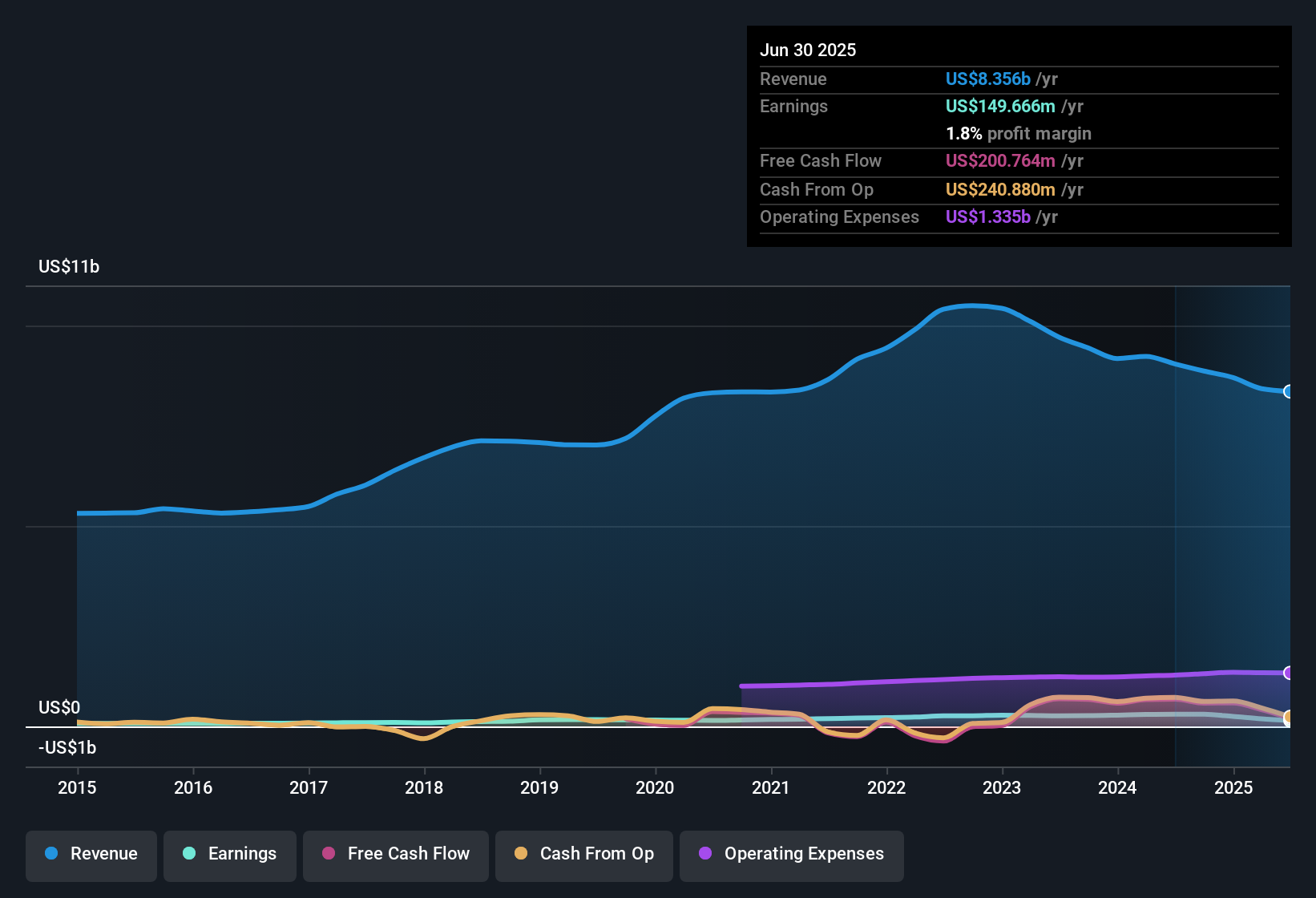

For Insight Enterprises, the company generated $203.4 million in free cash flow over the last 12 months. Analysts estimate further growth, with free cash flow expected to reach $273 million by the end of 2027. While specific forecasts are typically limited to five years, further projections (using Simply Wall St’s methodology) suggest increasing free cash flow reaching approximately $600 million by 2035. All these projections are denominated in US dollars.

Based on these cash flow estimates and after applying appropriate discount rates, the DCF model calculates that Insight Enterprises’ intrinsic value is $204.86 per share. This is roughly 45.6% higher than the current market price. According to this analysis, the stock appears undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Insight Enterprises is undervalued by 45.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Insight Enterprises Price vs Earnings

The price-to-earnings (PE) ratio is one of the most widely used metrics for valuing a profitable company like Insight Enterprises. This ratio indicates how much investors are willing to pay for each dollar of current earnings, making it a useful shorthand for whether a stock is expensive or potentially a bargain relative to its profit performance.

It is important to note that the PE ratio reflects not just how much profit a company is generating today, but also what investors expect for its future earnings growth and risk. Higher growth or lower risk usually justifies a higher PE, while slower-growing or riskier companies typically trade on lower multiples.

Insight Enterprises currently trades at a PE ratio of 23.4x. This is nearly in line with the broader electronic industry average of 24.0x, and notably above its peer average of 17.0x. However, relying just on peer or industry comparisons can miss key differentiators such as profitability, growth projections, and company size.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio, which for Insight Enterprises is calculated as 35.1x, uses a range of company-specific factors such as earnings growth outlook, margins, industry positioning, risks, and market cap to set a more tailored benchmark. Unlike a basic comparison to the average, it reflects a fuller picture of what is actually justified for this business right now.

When comparing the Fair Ratio of 35.1x to the company’s current PE of 23.4x, Insight Enterprises appears to be trading below what might be warranted based on its fundamentals and prospects. This suggests some undervaluation according to this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Insight Enterprises Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a simple, approachable tool available on Simply Wall St's Community page, where millions of investors share the story behind the numbers, explaining not just what they think Insight Enterprises is worth, but why. Instead of relying only on figures or ratios, creating a Narrative means connecting your perspective about the company’s future (like its growth, risks, or industry shifts) directly to a financial forecast and a tailored fair value.

This approach gives every investor a way to blend their own research or feelings with hard estimates for future revenue, earnings, and margins. It is as easy as stating your assumptions, comparing them to others, and seeing what it all means versus the current market price. Narratives are updated dynamically when important news or quarterly results are released, so your view can automatically reflect the latest information.

For example, some investors might have a bullish Narrative, projecting rapid AI-related demand and higher long-term profits, leading them to assign a fair value as high as $175.00 per share. Others might be more cautious, concerned about industry risks and estimating a fair value closer to $144.00. Narratives help you see these diverse opinions, so you can decide when to act based on your own logic and the real market context.

Do you think there's more to the story for Insight Enterprises? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NSIT

Insight Enterprises

Provides information technology, hardware, software, and services in the United States and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives