- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGM:MVIS

Is Narrowing Net Losses in Q3 Changing the Investment Thesis for MicroVision (MVIS)?

Reviewed by Sasha Jovanovic

- MicroVision, Inc. recently announced its third quarter 2025 results, reporting sales of US$241,000 and a net loss of US$14.22 million, both showing improvement compared to the same period last year.

- Despite experiencing lower sales over the first nine months of 2025 versus the previous year, the company reduced its net losses and basic loss per share, reflecting progress in managing expenses.

- To assess how this focus on narrowing net losses may influence MicroVision’s investment narrative, let’s explore the implications of the earnings announcement.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is MicroVision's Investment Narrative?

For investors considering MicroVision, the key premise is a belief in the company’s ability to transition from a development-stage business into a commercially viable player in advanced sensor technology. The latest earnings report shows some headway with smaller net losses and marginally improved sales for the third quarter, but revenue over the first nine months remains well below last year as the company continues to operate at a loss. Many had viewed cost discipline as an essential short-term catalyst, and the recent results support some progress here, though the sales figures likely do little to alter near-term expectations. Risks around persistently low revenue, shareholder dilution, and the ability of new leadership to accelerate commercial traction remain, and the recent news does not appear to materially reduce these concerns. The bottom line is that the outlook still depends on MicroVision’s future capacity to generate meaningful sales amid ongoing cash burn.

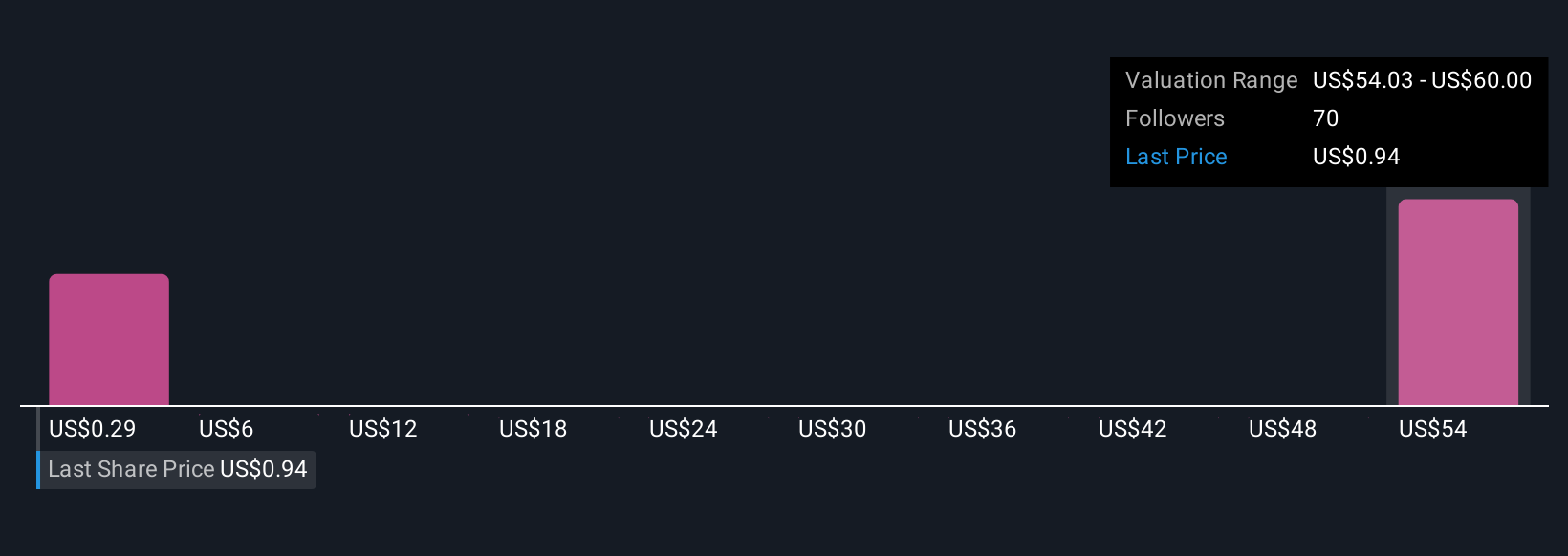

On the other hand, dilution risk remains especially important for existing shareholders. Our valuation report here indicates MicroVision may be overvalued.Exploring Other Perspectives

Explore 8 other fair value estimates on MicroVision - why the stock might be a potential multi-bagger!

Build Your Own MicroVision Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MicroVision research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free MicroVision research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MicroVision's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:MVIS

MicroVision

Develops and commercializes perception solutions for autonomy and mobility applications.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives