- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGM:MASS

Earnings Update: 908 Devices Inc. (NASDAQ:MASS) Just Reported And Analysts Are Trimming Their Forecasts

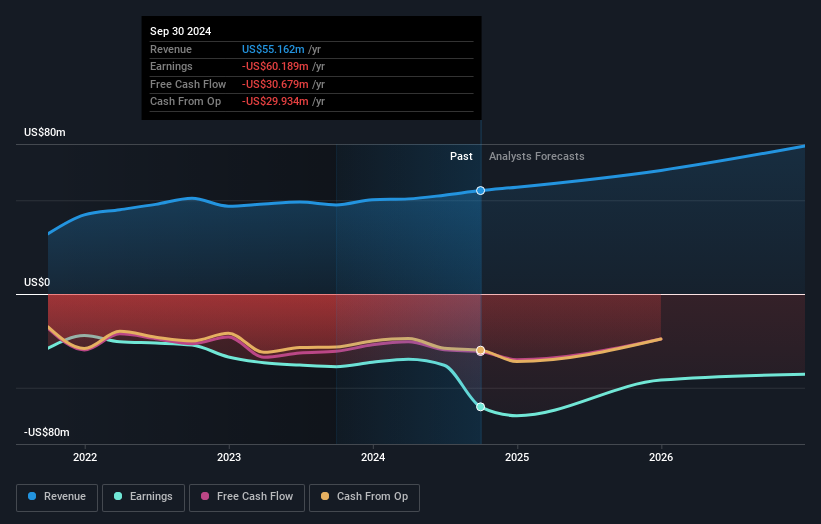

The analysts might have been a bit too bullish on 908 Devices Inc. (NASDAQ:MASS), given that the company fell short of expectations when it released its third-quarter results last week. Revenues missed expectations somewhat, coming in at US$17m, but statutory earnings fell catastrophically short, with a loss of US$0.84 some 196% larger than what the analysts had predicted. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

See our latest analysis for 908 Devices

Taking into account the latest results, the consensus forecast from 908 Devices' five analysts is for revenues of US$65.9m in 2025. This reflects a decent 20% improvement in revenue compared to the last 12 months. The loss per share is expected to greatly reduce in the near future, narrowing 26% to US$1.27. Yet prior to the latest earnings, the analysts had been forecasting revenues of US$80.6m and losses of US$1.04 per share in 2025. So there's been quite a change-up of views after the recent consensus updates, withthe analysts making a serious cut to their revenue outlook while also expecting losses per share to increase.

The consensus price target fell 60% to US$5.67, with the analysts clearly concerned about the company following the weaker revenue and earnings outlook. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. Currently, the most bullish analyst values 908 Devices at US$7.00 per share, while the most bearish prices it at US$4.00. These price targets show that analysts do have some differing views on the business, but the estimates do not vary enough to suggest to us that some are betting on wild success or utter failure.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. It's pretty clear that there is an expectation that 908 Devices' revenue growth will slow down substantially, with revenues to the end of 2025 expected to display 15% growth on an annualised basis. This is compared to a historical growth rate of 20% over the past five years. Juxtapose this against the other companies in the industry with analyst coverage, which are forecast to grow their revenues (in aggregate) 7.3% per year. Even after the forecast slowdown in growth, it seems obvious that 908 Devices is also expected to grow faster than the wider industry.

The Bottom Line

The most important thing to note is the forecast of increased losses next year, suggesting all may not be well at 908 Devices. Regrettably, they also downgraded their revenue estimates, but the latest forecasts still imply the business will grow faster than the wider industry. Furthermore, the analysts also cut their price targets, suggesting that the latest news has led to greater pessimism about the intrinsic value of the business.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. At Simply Wall St, we have a full range of analyst estimates for 908 Devices going out to 2026, and you can see them free on our platform here..

Before you take the next step you should know about the 4 warning signs for 908 Devices that we have uncovered.

Valuation is complex, but we're here to simplify it.

Discover if 908 Devices might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:MASS

908 Devices

A commercial-stage technology company, provides various purpose-built handheld and desktop mass spectrometry devices for use in life sciences research, bioprocessing, pharma/biopharma, forensics, and adjacent markets.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.