- United States

- /

- Electronic Equipment and Components

- /

- OTCPK:LUNA

If You Had Bought Luna Innovations (NASDAQ:LUNA) Shares Five Years Ago You'd Have Earned 784% Returns

Luna Innovations Incorporated (NASDAQ:LUNA) shareholders might be concerned after seeing the share price drop 10% in the last week. But that doesn't undermine the fantastic longer term performance (measured over five years). In that time, the share price has soared some 784% higher! So it might be that some shareholders are taking profits after good performance. The most important thing for savvy investors to consider is whether the underlying business can justify the share price gain.

We love happy stories like this one. The company should be really proud of that performance!

See our latest analysis for Luna Innovations

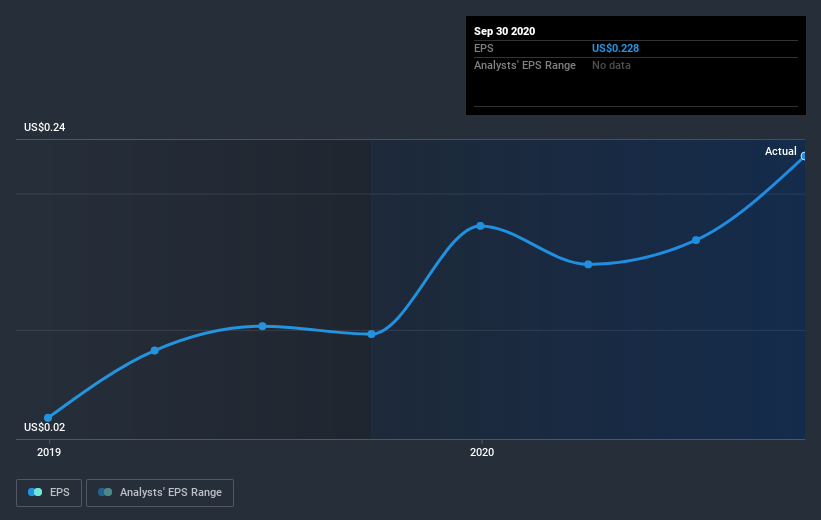

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the five years of share price growth, Luna Innovations moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Luna Innovations has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at Luna Innovations' financial health with this free report on its balance sheet.

A Different Perspective

It's good to see that Luna Innovations has rewarded shareholders with a total shareholder return of 32% in the last twelve months. However, the TSR over five years, coming in at 55% per year, is even more impressive. The pessimistic view would be that be that the stock has its best days behind it, but on the other hand the price might simply be moderating while the business itself continues to execute. It's always interesting to track share price performance over the longer term. But to understand Luna Innovations better, we need to consider many other factors. For example, we've discovered 2 warning signs for Luna Innovations that you should be aware of before investing here.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade Luna Innovations, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OTCPK:LUNA

Luna Innovations

Provides fiber optic test, measurement, and control products worldwide.

Low risk with weak fundamentals.

Similar Companies

Market Insights

Community Narratives