- United States

- /

- Communications

- /

- NasdaqCM:LTRX

Lantronix, Inc. (NASDAQ:LTRX) Looks Inexpensive After Falling 29% But Perhaps Not Attractive Enough

Unfortunately for some shareholders, the Lantronix, Inc. (NASDAQ:LTRX) share price has dived 29% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 39% share price drop.

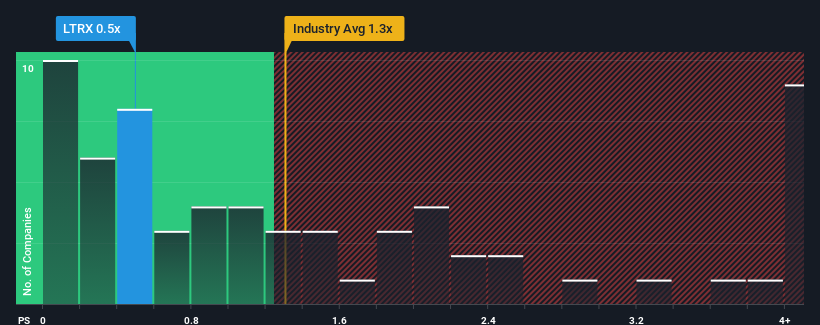

Since its price has dipped substantially, when close to half the companies operating in the United States' Communications industry have price-to-sales ratios (or "P/S") above 1.3x, you may consider Lantronix as an enticing stock to check out with its 0.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Lantronix

How Lantronix Has Been Performing

Recent times have been advantageous for Lantronix as its revenues have been rising faster than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Lantronix's future stacks up against the industry? In that case, our free report is a great place to start .Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Lantronix would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 13% last year. Pleasingly, revenue has also lifted 57% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 2.1% per year during the coming three years according to the five analysts following the company. With the industry predicted to deliver 8.5% growth each year, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Lantronix's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

The southerly movements of Lantronix's shares means its P/S is now sitting at a pretty low level. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As expected, our analysis of Lantronix's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 3 warning signs for Lantronix that you need to take into consideration.

If these risks are making you reconsider your opinion on Lantronix, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:LTRX

Lantronix

Develops, markets, and sells industrial and enterprise internet of things (IoT) products and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific Japan.

Excellent balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Landlord of Orbit" – A Deep Value Play Ahead of the Starlab Era

The "AI-Immunology" Asymmetric Opportunity – Validated by Merck (MSD)

The Hidden Gem of AI Hardware – Solving the Data Center Bottleneck

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026