- United States

- /

- Communications

- /

- NasdaqGS:LITE

Why Lumentum Holdings (LITE) Is Down 5.1% After Returning to Profitability and Issuing Upbeat Guidance

Reviewed by Sasha Jovanovic

- Lumentum Holdings recently reported results for the first quarter ended September 27, 2025, showing sales of US$533.8 million, up from US$336.9 million a year earlier, and a return to net profitability with net income of US$4.2 million versus a net loss of US$82.4 million last year.

- The company also issued new guidance for the second quarter of fiscal 2026, projecting net revenue between US$630 million and US$670 million, suggesting confidence in continued business momentum.

- Given the guidance for higher upcoming revenues, we'll explore how Lumentum's return to profitability shapes its future investment outlook.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Lumentum Holdings Investment Narrative Recap

For anyone considering Lumentum Holdings, the key narrative centers on belief in the enduring surge of AI-driven cloud demand and Lumentum’s ability to keep its hyperscale customer base engaged. The sharp sequential jump in revenue and return to profitability is encouraging, but does not fully address the ongoing risk of revenue concentration, since just a handful of major customers drive much of Lumentum’s cloud business, any reduction in their orders could rapidly impact results.

The most pertinent recent announcement is Lumentum’s updated earnings guidance, projecting second quarter fiscal 2026 revenue of US$630 million to US$670 million. This outlook implies that robust customer demand for cloud and networking solutions persists, supporting optimism around key growth catalysts, though it remains to be seen how expanding cloud module shipments will affect gross margins as sales accelerate.

On the other hand, investors should be aware that reliance on three major hyperscale customers means ...

Read the full narrative on Lumentum Holdings (it's free!)

Lumentum Holdings' outlook anticipates $3.1 billion in revenue and $389.1 million in earnings by 2028. This scenario is built on a projected 23.4% annual revenue growth rate and requires a $363.2 million increase in earnings from the current $25.9 million.

Uncover how Lumentum Holdings' forecasts yield a $163.85 fair value, a 13% downside to its current price.

Exploring Other Perspectives

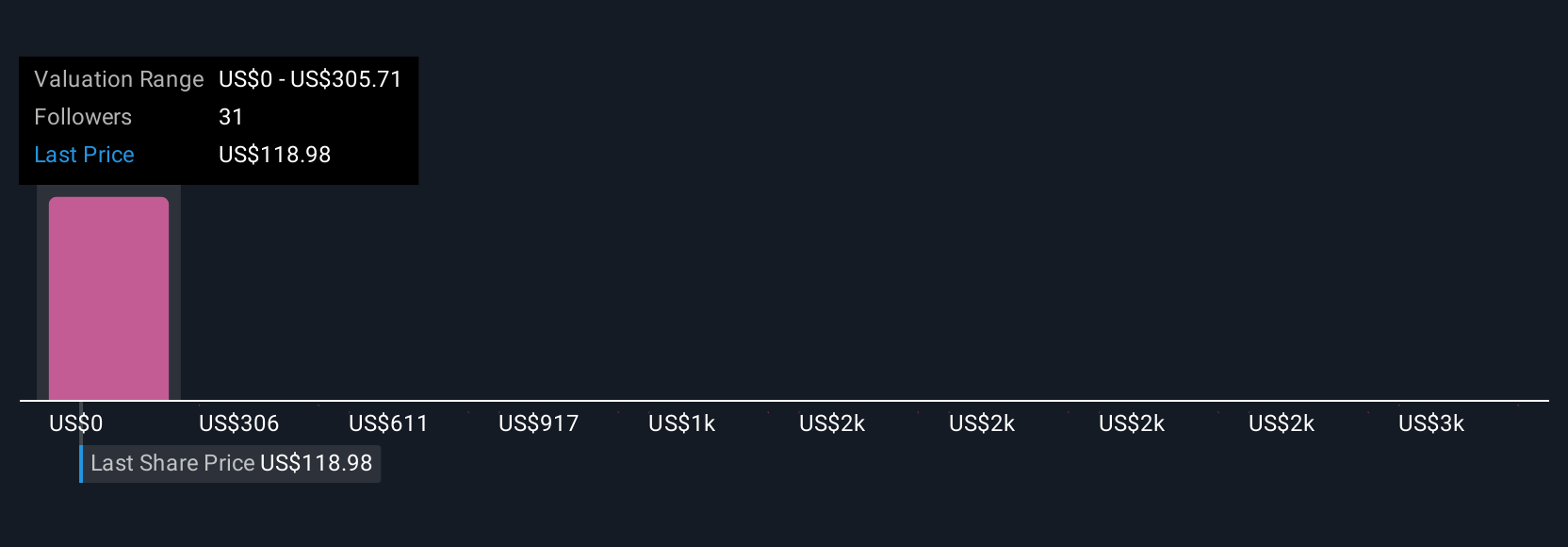

Simply Wall St Community members provided 11 unique fair value estimates for Lumentum, ranging from US$68.28 to US$577.91. While these perspectives differ widely, keep in mind that rising demand for advanced optical components continues to play a central role in shaping Lumentum’s trajectory and could affect future market sentiment.

Explore 11 other fair value estimates on Lumentum Holdings - why the stock might be worth less than half the current price!

Build Your Own Lumentum Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lumentum Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Lumentum Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lumentum Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LITE

Lumentum Holdings

Manufactures and sells optical and photonic products in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Exceptional growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives