- United States

- /

- Communications

- /

- NasdaqGS:LITE

US Stock Market Today: S&P 500 Futures Rally as Rate Cut Bets Surge

Reviewed by Sasha Jovanovic

The Morning Bull - US Market Morning Update Monday, Nov, 24 2025

US stock futures are pointing higher as the opening bell approaches, with the E-mini S&P 500 futures up nearly 0.7% and the Nasdaq-100 futures ahead by about 1%. The big story is consumer confidence, which inched up to 51.0 in November but remains close to historic lows. This means many Americans still feel squeezed by high prices and slower wage growth. At the same time, investors are paying close attention to fresh signals from the Federal Reserve, with the odds of a rate cut in December climbing above 70% after inflation expectations cooled to 4.5%. The main question now is whether companies that depend on consumer spending can keep growing if shoppers remain cautious, and if banks and real estate firms will get a boost from falling borrowing costs or get held back by a still-worried public.

Today’s shifting confidence means you need insights fast. That is why we’ve found undervalued stocks based on cash flows before they rebound.

Top Movers

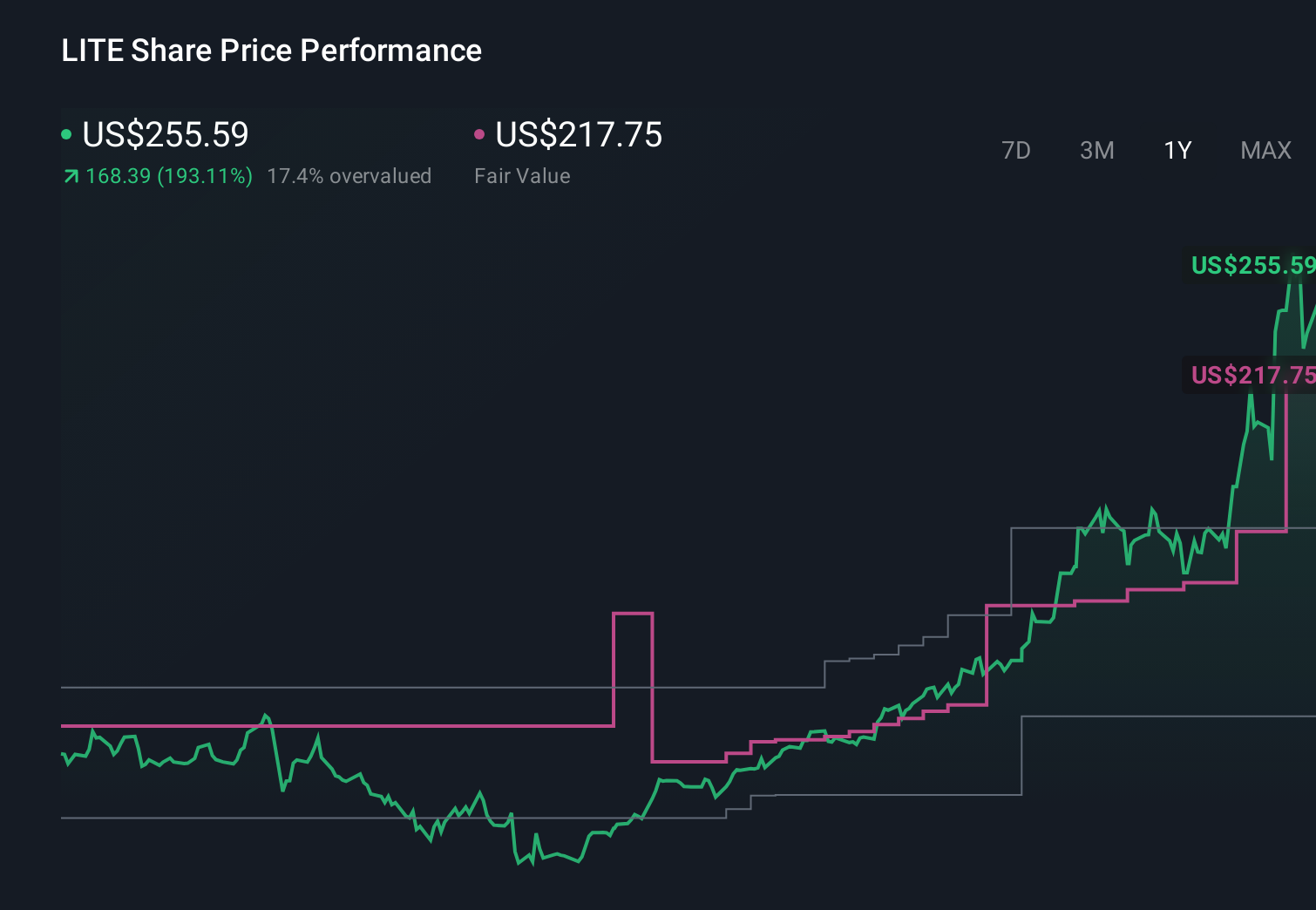

- Lumentum Holdings (LITE) jumped 9.58% with no major news released.

- Ross Stores (ROST) soared 8.41% following robust Q3 results, buyback updates, and raised guidance that lifted analyst targets.

- Rocket Companies (RKT) climbed 7.85% with no major news released.

Is Ross Stores still a smart investment or just hype? Read our most popular narrative and get all the answers you need.

Top Losers

- Veeva Systems (VEEV) tumbled 9.77% after earnings, guidance, and analyst downgrades outweighed healthy revenue growth.

- Oracle (ORCL) slid 5.66% as ongoing market value losses continued even with recent board changes.

- Snowflake (SNOW) declined 4.34%.

Look past the noise - uncover the top narrative that explains what truly matters for Oracle's long-term success.

On The Radar

Earnings season remains in focus as major tech, retail, and industrial names are set to deliver results that will headline market action.

- Analog Devices (ADI) reports Q4 results early Tuesday. This will offer clues on chip demand trends and guidance after recent sector volatility.

- Workday (WDAY) unveils Q3 earnings after the bell Tuesday, with investors watching subscription growth and enterprise software momentum.

- HP (HPQ) releases Q4 numbers Tuesday, spotlighting PC and printer demand prospects in a crowded hardware market.

- Alibaba Group Holding (BABA) will post Q2 results pre-market Tuesday, providing a pulse check on China’s consumer recovery and e-commerce outlook.

- Li Auto (LI) announces Q3 earnings pre-market Wednesday, as EV investors look for delivery growth and profitability targets from a key China player.

Use our Portfolio or Watchlist features to track market-moving events like these and get alerts for the companies you own, free!

Find Stocks Poised To Move

Missed the early moves? Act now and discover 26 AI penny stocks identified for explosive growth by our experts. These offer cutting-edge opportunities in a rapidly evolving sector.

Ready to take control? Use our stock screener to uncover hidden gems that fit your unique strategy and receive timely alerts when new opportunities arise.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LITE

Lumentum Holdings

Manufactures and sells optical and photonic products in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Exceptional growth potential with low risk.

Similar Companies

Market Insights

Community Narratives