- United States

- /

- Communications

- /

- NasdaqGS:LITE

Is Lumentum Still a Smart Bet After 135% Surge in 2025?

Reviewed by Bailey Pemberton

- Wondering if Lumentum Holdings is too hot to handle or a bargain hiding in plain sight? You are not alone, especially with so much buzz around its stock lately.

- The share price has delivered a remarkable run, rising 12.4% in the last week and 135.5% year-to-date, leaving even long-term holders smiling with a 208.4% gain over the past year.

- Recent headlines have highlighted Lumentum’s key role in the surge for optical and photonics technology stocks, as optimistic industry forecasts and investor enthusiasm about next-generation networking equipment draw attention to this area. With increased analyst coverage and sector-wide optimism, these stories offer helpful context to the big moves seen in the share price.

- Despite the excitement, Lumentum scores only 0 out of 6 on our undervaluation checks. There is more to the valuation story than meets the eye. Next, we will examine the main ways investors approach valuation and explore why the best insights might still be to come at the end of this article.

Lumentum Holdings scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Lumentum Holdings Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to their value today. This approach gives investors a sense of what a business is truly worth based on its ability to generate cash in the years ahead.

For Lumentum Holdings, the DCF analysis relies on recent and forecasted Free Cash Flow (FCF) figures. Currently, Lumentum reported trailing twelve month FCF of -$43.37 Million. Looking ahead, analysts expect steady growth, with projected FCF reaching $534.33 Million in 2028. Since analysts typically forecast up to five years, longer-term projections such as the estimated $804.50 Million in 2035 are extrapolated by Simply Wall St to reflect potential continued expansion.

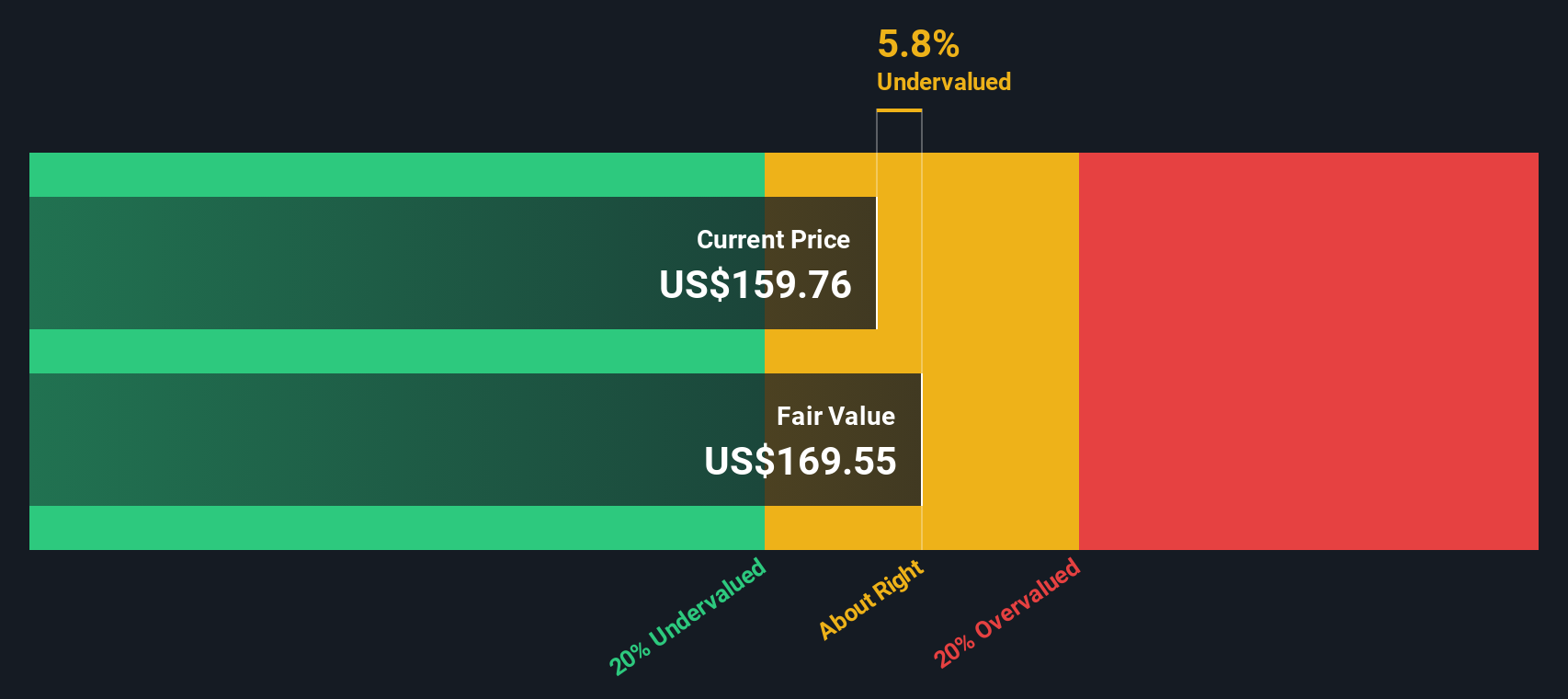

In dollar terms, the DCF model calculates Lumentum’s fair value at $146.62 per share. Relative to the current share price, this suggests the stock is trading at a 37.5% premium to its intrinsic value; in other words, it is overvalued according to these cash flow projections.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Lumentum Holdings may be overvalued by 37.5%. Discover 831 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Lumentum Holdings Price vs Sales

For technology companies like Lumentum Holdings, the Price-to-Sales (P/S) ratio is often used to assess valuation, especially when earnings may be volatile or not always positive. The P/S multiple works well because it provides a quick way to compare how much investors are currently willing to pay for each dollar of the company’s sales. This can be particularly insightful for fast-growing, high-margin businesses.

Growth expectations and company risk are crucial in determining what a “normal” or “fair” P/S should look like. Higher expected sales growth, strong profit margins, or lower risks generally justify a higher multiple. The opposite holds true for companies with slower growth or more uncertain prospects.

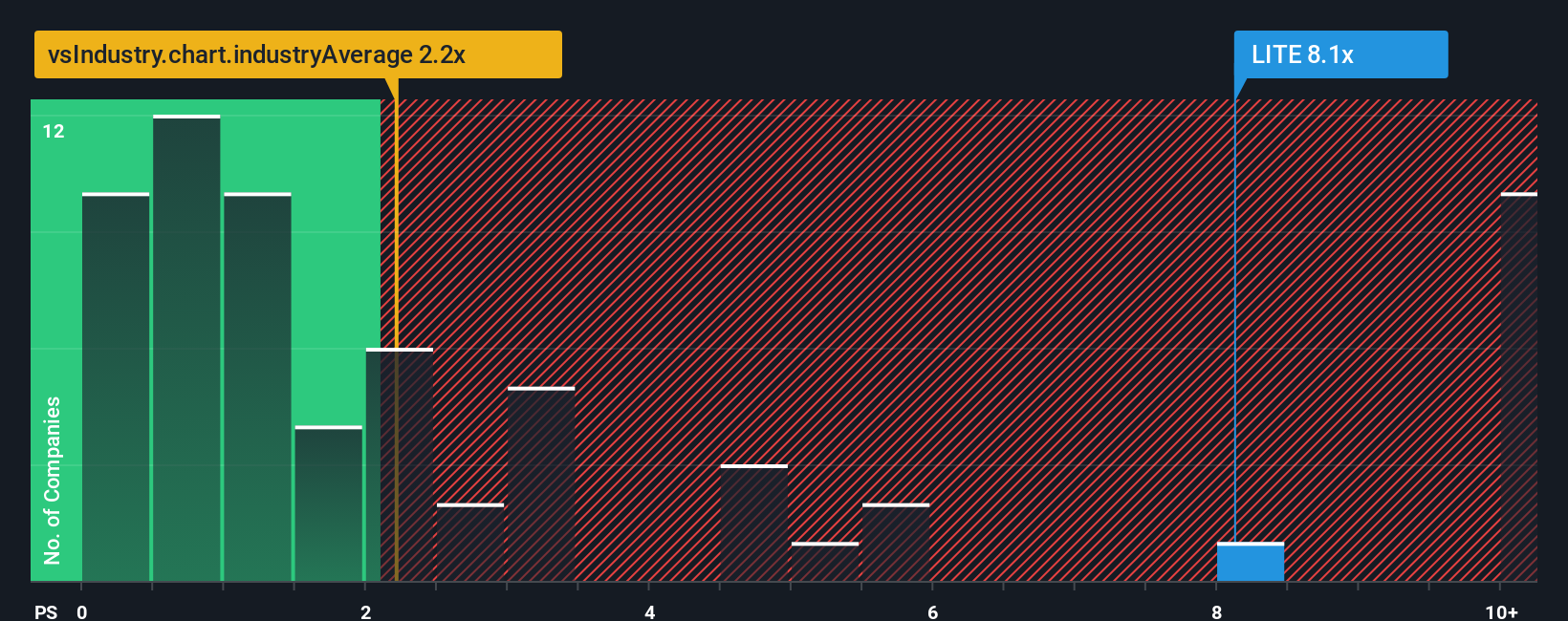

Currently, Lumentum Holdings is trading at a P/S ratio of 8.69x. This is only slightly above its peer group average of 8.48x and stands out as significantly higher than the communications industry average of 2.20x. To refine this comparison, Simply Wall St calculates a custom Fair Ratio for the stock, in this case 4.36x, which reflects a multiple you would expect based on Lumentum's growth profile, profitability, industry sector, and market capitalization.

The Fair Ratio is a more comprehensive benchmark than simply comparing with peers or industry norms, as it adjusts for factors that make each company unique. This helps investors get a more nuanced sense of value.

Given that Lumentum’s actual P/S is well above its Fair Ratio, the stock appears overvalued using this approach.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Lumentum Holdings Narrative

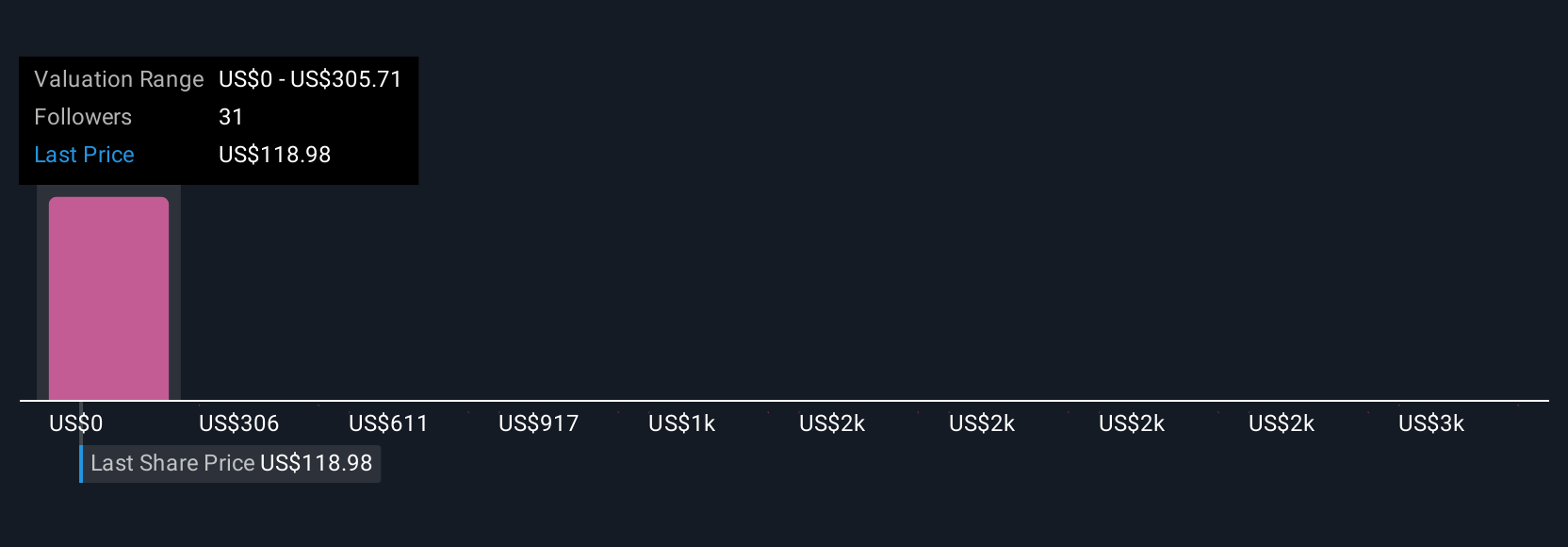

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Narratives offer a clear, holistic way for investors to connect Lumentum Holdings’ story by linking what you believe about its business, future growth, and industry directly to the numbers by building a personal financial forecast and fair value. With Narratives, you do not need to be a finance expert. Simply Wall St’s Community page lets anyone quickly outline their own “what if” scenario using up-to-date information, so your fair value reflects both the latest news and your expectations about future revenues, profits, and margins.

Narratives are dynamic, updating automatically as new data and developments emerge, and help guide your investment decisions by letting you compare your fair value with the current share price to judge whether to buy, sell, or hold. For example, one investor might build an optimistic narrative for Lumentum with strong growth forecasts based on booming demand for photonics and data center products, which could support a high fair value near $165 per share. Another, more cautious investor might focus on rising competition and margin risks for a lower fair value closer to $83. Narratives make it easy to compare different perspectives, understand your position, and act with clarity and confidence.

Do you think there's more to the story for Lumentum Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LITE

Lumentum Holdings

Manufactures and sells optical and photonic products in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Exceptional growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives