- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:LINK

Why We Think Interlink Electronics, Inc.'s (NASDAQ:LINK) CEO Compensation Is Not Excessive At All

Key Insights

- Interlink Electronics' Annual General Meeting to take place on 3rd of June

- Salary of US$294.0k is part of CEO Steven Bronson's total remuneration

- The total compensation is 36% less than the average for the industry

- Over the past three years, Interlink Electronics' EPS fell by 63% and over the past three years, the total shareholder return was 2.2%

The performance at Interlink Electronics, Inc. (NASDAQ:LINK) has been rather lacklustre of late and shareholders may be wondering what CEO Steven Bronson is planning to do about this. They will get a chance to exercise their voting power to influence the future direction of the company in the next AGM on 3rd of June. Voting on executive pay could be a powerful way to influence management, as studies have shown that the right compensation incentives impact company performance. In our opinion, CEO compensation does not look excessive and we discuss why.

View our latest analysis for Interlink Electronics

How Does Total Compensation For Steven Bronson Compare With Other Companies In The Industry?

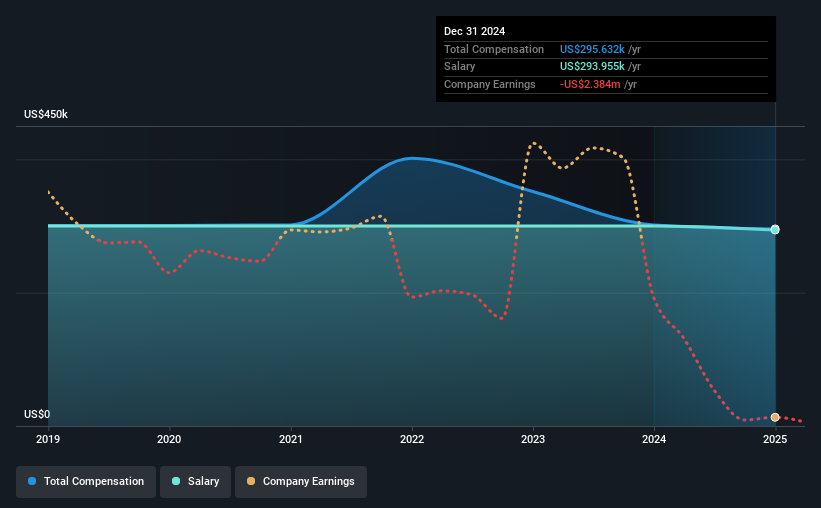

At the time of writing, our data shows that Interlink Electronics, Inc. has a market capitalization of US$59m, and reported total annual CEO compensation of US$296k for the year to December 2024. That is, the compensation was roughly the same as last year. In particular, the salary of US$294.0k, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the American Electronic industry with market capitalizations under US$200m, the reported median total CEO compensation was US$462k. This suggests that Steven Bronson is paid below the industry median. What's more, Steven Bronson holds US$40m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | US$294k | US$300k | 99% |

| Other | US$1.7k | US$1.7k | 1% |

| Total Compensation | US$296k | US$302k | 100% |

Speaking on an industry level, nearly 24% of total compensation represents salary, while the remainder of 76% is other remuneration. Interlink Electronics pays a high salary, concentrating more on this aspect of compensation in comparison to non-salary pay. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Interlink Electronics, Inc.'s Growth Numbers

Over the last three years, Interlink Electronics, Inc. has shrunk its earnings per share by 63% per year. It saw its revenue drop 19% over the last year.

Overall this is not a very positive result for shareholders. And the fact that revenue is down year on year arguably paints an ugly picture. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Interlink Electronics, Inc. Been A Good Investment?

Interlink Electronics, Inc. has not done too badly by shareholders, with a total return of 2.2%, over three years. It would be nice to see that metric improve in the future. As a result, investors in the company might be reluctant about agreeing to increase CEO pay in the future, before seeing an improvement on their returns.

In Summary...

Interlink Electronics pays its CEO a majority of compensation through a salary. While it's true that shareholders have seen decent returns, it's hard to overlook the lack of earnings growth and this makes us wonder if the current returns can continue. These concerns could be addressed to the board and shareholders should revisit their investment thesis to see if it still makes sense.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We did our research and identified 2 warning signs (and 1 which shouldn't be ignored) in Interlink Electronics we think you should know about.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:LINK

Interlink Electronics

Provides sensors and printed electronics for use in human-machine interface (HMI) devices and internet-of-things solutions in the United States, Asia, the Middle East, Europe, and internationally.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Micron Technology will experience a robust 16.5% revenue growth

Amazon will rebound as AI investments start paying off by late 2026

Inside Harvey Norman: Asset-Heavy Retail in an Online World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion