- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:LFUS

Littelfuse's (NASDAQ:LFUS) five-year earnings growth trails the notable shareholder returns

If you buy and hold a stock for many years, you'd hope to be making a profit. Furthermore, you'd generally like to see the share price rise faster than the market. Unfortunately for shareholders, while the Littelfuse, Inc. (NASDAQ:LFUS) share price is up 56% in the last five years, that's less than the market return. Zooming in, the stock is actually down 2.7% in the last year.

Since it's been a strong week for Littelfuse shareholders, let's have a look at trend of the longer term fundamentals.

See our latest analysis for Littelfuse

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

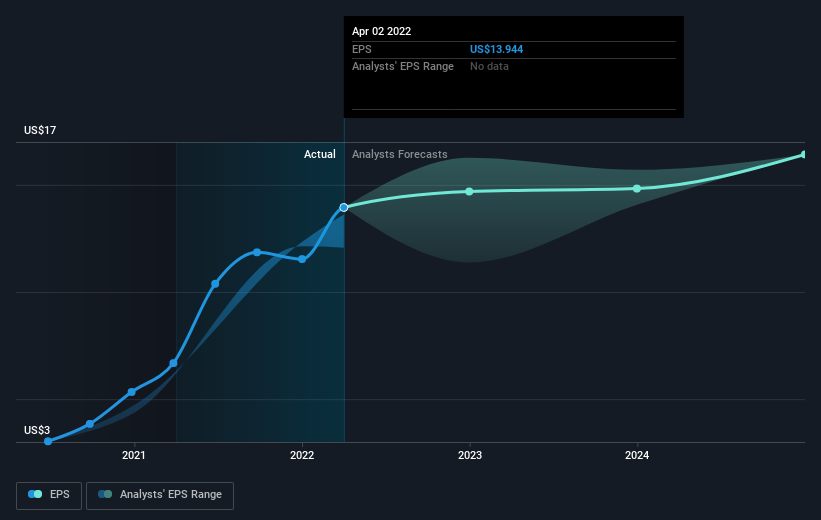

Over half a decade, Littelfuse managed to grow its earnings per share at 20% a year. This EPS growth is higher than the 9% average annual increase in the share price. So it seems the market isn't so enthusiastic about the stock these days.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Littelfuse has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Littelfuse will grow revenue in the future.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Littelfuse's TSR for the last 5 years was 63%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

While it's certainly disappointing to see that Littelfuse shares lost 2.0% throughout the year, that wasn't as bad as the market loss of 8.4%. Longer term investors wouldn't be so upset, since they would have made 10%, each year, over five years. It could be that the business is just facing some short term problems, but shareholders should keep a close eye on the fundamentals. If you would like to research Littelfuse in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LFUS

Littelfuse

Designs, manufactures, and sells electronic components, modules, and subassemblies.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives