- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:LFUS

Is Littelfuse's (LFUS) Dividend Approach a Sign of Sustained Strength or Cautious Optimism?

Reviewed by Sasha Jovanovic

- Littelfuse, Inc. recently reported its third quarter and nine-month earnings, showing increased sales and net income year-over-year; the company also affirmed its quarterly dividend and provided guidance for the upcoming quarter, while concluding a share buyback program announced in April 2024.

- The combination of ongoing dividend payments, clearer earnings guidance, and solid quarterly financials provides investors with greater transparency around Littelfuse’s operational momentum and financial outlook.

- We’ll explore how Littelfuse’s strong third quarter earnings and updated guidance influence the company’s investment narrative and future expectations.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

Littelfuse Investment Narrative Recap

To be a Littelfuse shareholder, you need to believe in the company's ability to capture growing electrification demand across automotive, industrial, and data center sectors, while navigating volatility in cyclical markets. The latest earnings report, dividend affirmation, and guidance increase transparency but do not materially shift the short-term catalyst: consistent margin improvement in power semiconductors. The most pressing risk remains weakness in power semiconductor volumes, which could pressure profitability if recovery is slower than expected.

Among recent announcements, the completion of Littelfuse’s share buyback program in October stands out. While this indicates a regular approach to capital allocation, it does not offset the importance of delivering sustained operating leverage and margin recovery as the key near-term driver for shareholder sentiment.

Yet, for those watching closely, uncertainty around Littelfuse’s exposure to the still-challenged power semiconductor cycle means investors should also be aware that...

Read the full narrative on Littelfuse (it's free!)

Littelfuse's outlook projects $2.9 billion in revenue and $400.8 million in earnings by 2028. This is based on an assumed annual revenue growth rate of 8.6% and an earnings increase of about $293.6 million from current earnings of $107.2 million.

Uncover how Littelfuse's forecasts yield a $307.50 fair value, a 27% upside to its current price.

Exploring Other Perspectives

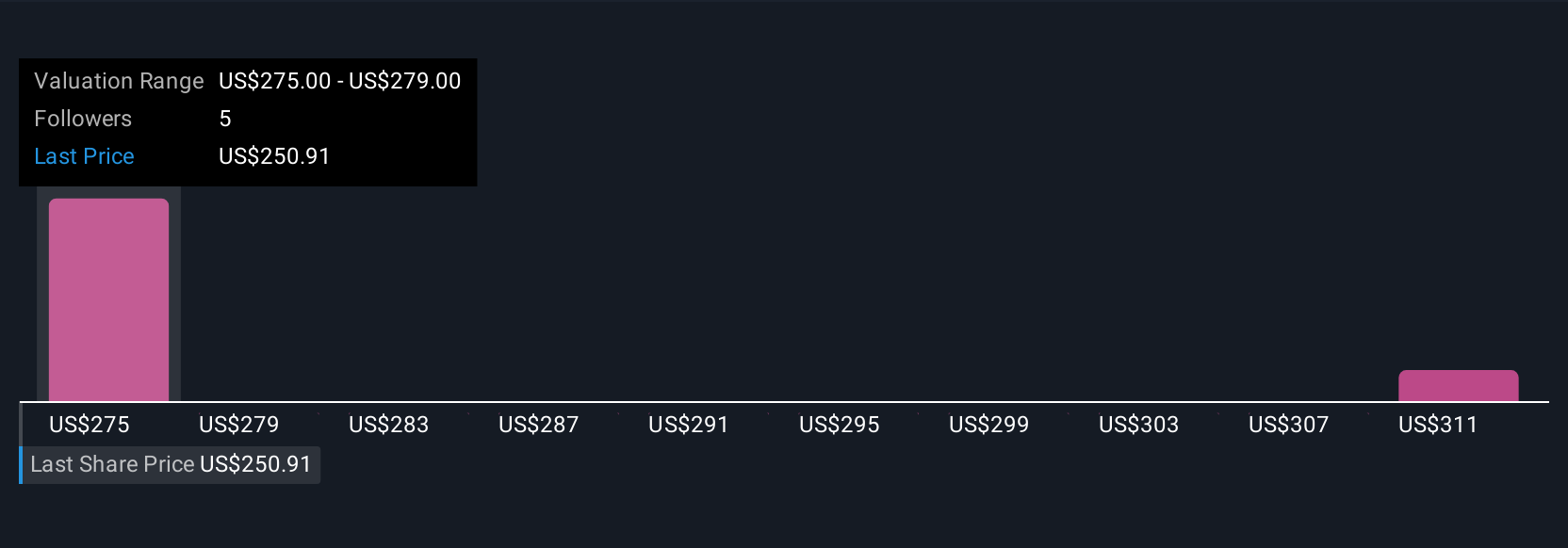

Simply Wall St Community fair value estimates for Littelfuse range from US$296.97 to US$307.50, drawn from two independent viewpoints. While these opinions vary, the recurring concern about ongoing power semiconductor margin pressure signals why broad consensus on the company's outlook has remained cautious.

Explore 2 other fair value estimates on Littelfuse - why the stock might be worth as much as 27% more than the current price!

Build Your Own Littelfuse Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Littelfuse research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Littelfuse research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Littelfuse's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LFUS

Littelfuse

Designs, manufactures, and sells electronic components, modules, and subassemblies.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives