- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:LASR

Assessing nLIGHT (LASR) Valuation After Recent Share Price Pullback and 1-Year Rally

Reviewed by Simply Wall St

See our latest analysis for nLIGHT.

Even with today’s modest uptick, nLIGHT’s share price has pulled back over the past month, following a period of significant gains earlier this year. Despite some recent volatility, the stock’s year-to-date price return of 193% and an impressive 1-year total shareholder return of 197% highlight strong momentum and growing investor interest in the company’s long-term potential.

If you’re interested in expanding your search beyond just nLIGHT, now is an excellent moment to check out fast growing stocks with high insider ownership.

With shares still trading at a notable discount to analyst price targets despite recent gains, is nLIGHT an undervalued opportunity waiting to be seized, or is the market already factoring in the company’s future growth trajectory?

Most Popular Narrative: 14.3% Undervalued

nLIGHT's widely followed narrative suggests a fair value of $35.58, notably above its last close of $30.50. This difference fuels fresh questions about the sustainability of recent price gains and future upside potential.

The rapid growth and expanding pipeline in aerospace and defense, particularly around high-power laser solutions (such as the HELSI-2 program, DE M-SHORAD, Golden Dome initiative, and increased directed energy orders internationally), positions nLIGHT to benefit from rising global defense spending and modernization, supporting strong multi-year revenue growth. Increasing adoption of advanced laser technologies for automation, smart manufacturing, and additive manufacturing (especially in high-growth EV, clean energy, and microfabrication segments) underpins long-term demand for nLIGHT's differentiated products, providing a runway for sustained top-line expansion.

Want to know why analysts are backing up this valuation? The secret is in a bold set of financial assumptions that break from the norm. Future earnings growth, profit margins moving toward industry standards, and a potential shift in market multiples all play a role. The real surprise is just how aggressive some of these projections get. See which forecasts are driving the fair value and what could make or break nLIGHT's case.

Result: Fair Value of $35.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution challenges in scaling mass manufacturing and ongoing weakness in the commercial segment could quickly put nLIGHT’s upbeat outlook to the test.

Find out about the key risks to this nLIGHT narrative.

Another View: What Do Market Multiples Show?

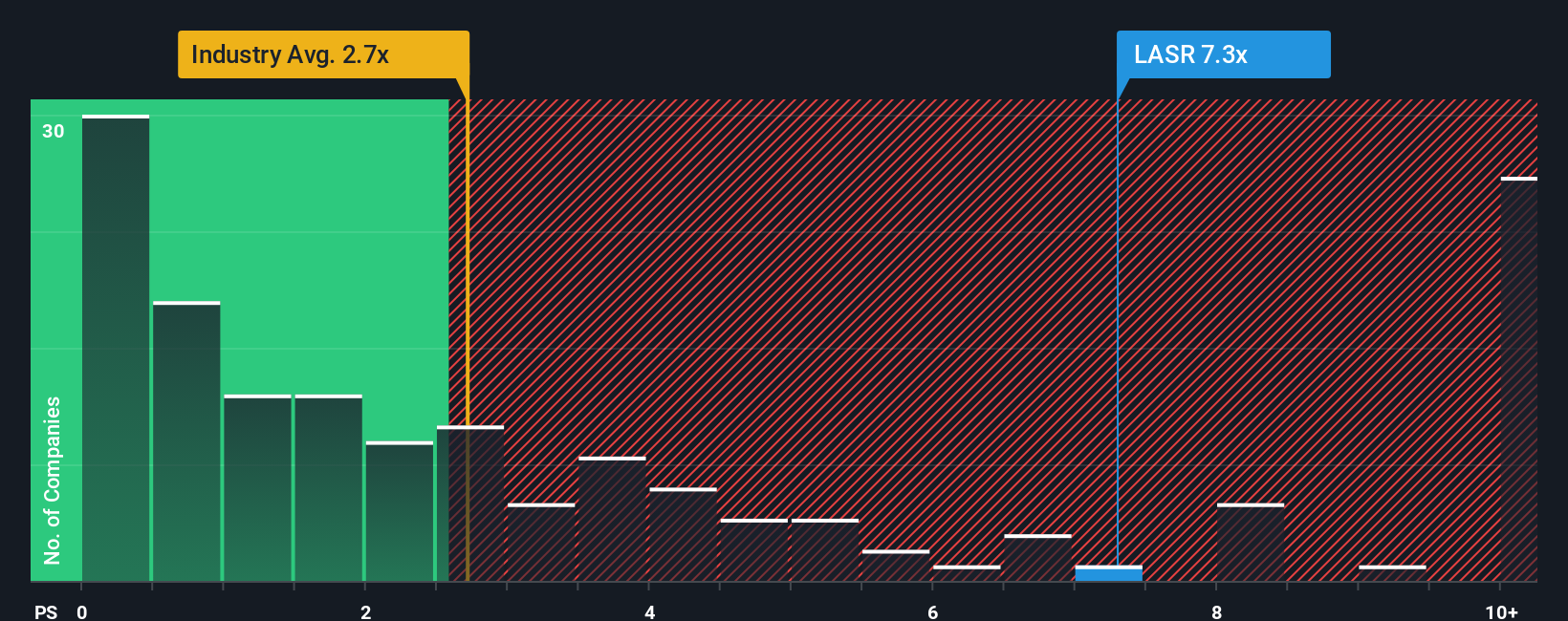

Looking through the lens of sales-based valuation, nLIGHT’s price-to-sales ratio sits at 6.8x. That is much higher than both the US Electronic industry average of 2.5x and the peer average of 5.4x, and it also exceeds the fair ratio for the company, estimated at just 1.5x. This gap points to a meaningful valuation risk if the market eventually normalizes these multiples. Does this overextension hint at misplaced optimism, or could the fundamentals catch up before sentiment fades?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own nLIGHT Narrative

If you’re looking to dig into the numbers and shape your own perspective, it’s fast and straightforward to build your own story in just a few minutes. Do it your way.

A great starting point for your nLIGHT research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Keep your edge in any market by spotting opportunities where others are still looking. These research tools make it simple to find standout stocks in minutes.

- Capture potential gains in the digital revolution when you review these 82 cryptocurrency and blockchain stocks, which is making waves with innovative solutions in blockchain and next-gen payment networks.

- Secure elevated yields for your portfolio by checking out these 16 dividend stocks with yields > 3%, focusing on reliable companies offering steady income above 3%.

- Tap into breakthrough companies with explosive growth prospects by investigating these 24 AI penny stocks, positioned at the frontier of artificial intelligence advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LASR

nLIGHT

Designs, develops, manufactures, and sells semiconductor and fiber lasers for industrial, microfabrication, and aerospace and defense applications.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives