- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:IPGP

Could IPG Photonics’ (IPGP) Defense Expansion Reshape Its Long-Term Competitive Edge?

Reviewed by Sasha Jovanovic

- Earlier this week, IPG Photonics Corporation announced the opening of its new office and manufacturing facility in Huntsville, Alabama, which will serve as the headquarters for its newly formed IPG Defense unit dedicated to advanced laser defense solutions.

- This move highlights the company's ongoing expansion into defense and mission-critical applications, broadening its reach beyond traditional industrial markets.

- Let's explore what the Huntsville expansion and robust third-quarter results may mean for IPG Photonics' future growth narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

IPG Photonics Investment Narrative Recap

To be an IPG Photonics shareholder, you need to believe that the company's push into advanced laser applications, particularly in defense through the new Huntsville facility, can drive meaningful, high-margin growth, even as core industrial demand faces uncertainty. While the Huntsville expansion is a positive signal for innovation and market reach, it does not significantly shift the short-term catalyst, which remains a recovery in the materials processing segment and stabilization of broader industrial demand. The biggest immediate risk is the company's exposure to volatile demand in core markets, where softness in cutting and welding persists, threatening revenue recovery if conditions do not improve materially.

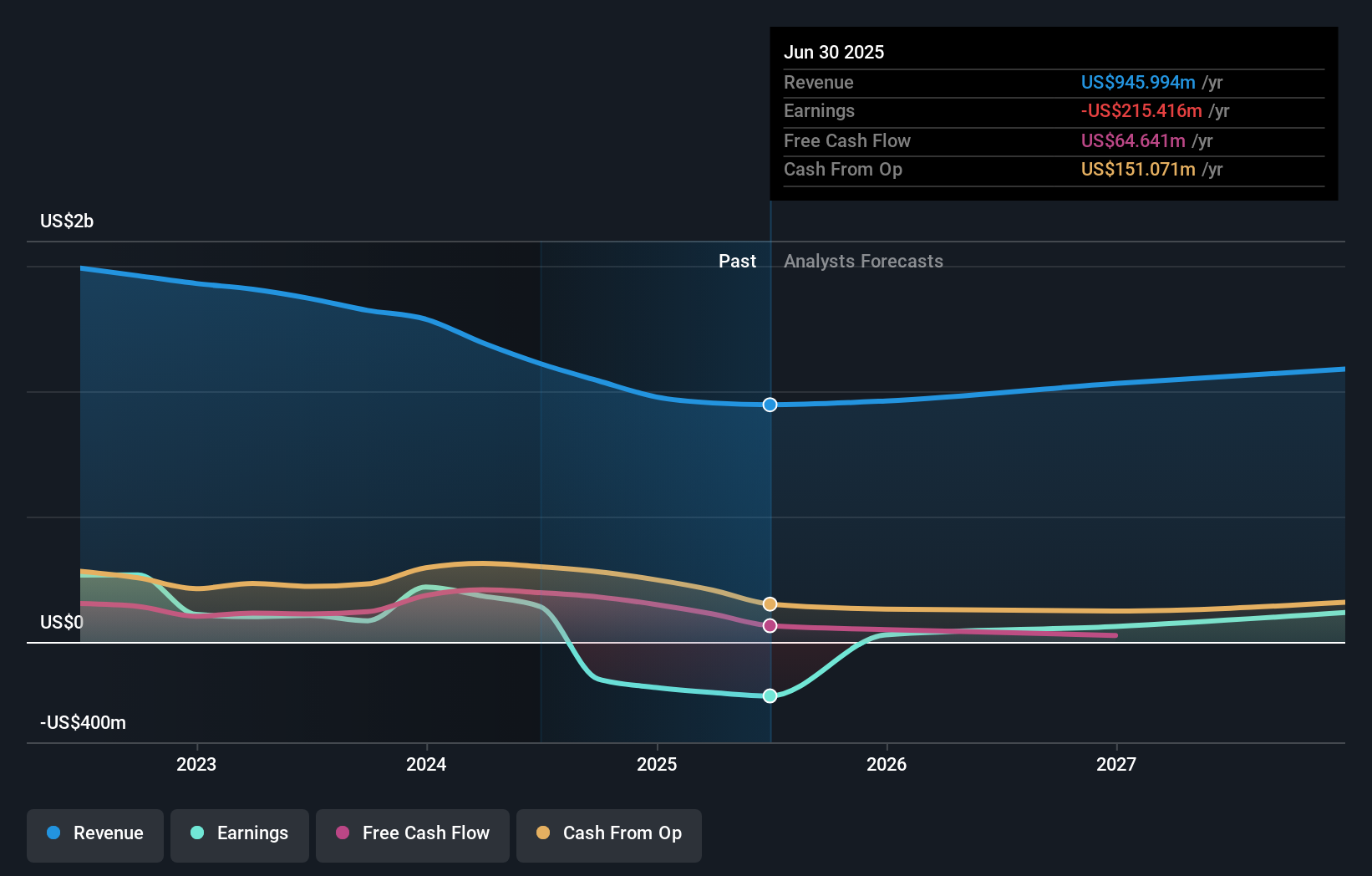

Of the recent announcements, the third-quarter results stand out as most relevant: year-on-year sales increased to US$250.79 million, and the company returned to profitability with US$7.46 million in net income. Although defense and medical innovations are promising, sustained financial improvement still relies on better performance in industrial lasers, so progress in core applications remains crucial to delivering on new growth narratives.

By contrast, investors should be aware that ongoing elevated operating expenses, and the risk of new initiatives failing to achieve scale, could...

Read the full narrative on IPG Photonics (it's free!)

IPG Photonics' narrative projects $1.2 billion revenue and $133.9 million earnings by 2028. This requires 8.1% yearly revenue growth and a $349.3 million increase in earnings from the current -$215.4 million.

Uncover how IPG Photonics' forecasts yield a $82.83 fair value, a 8% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided two fair value estimates for IPG Photonics ranging from US$7.43 to US$82.83 per share. Amid such broad differences, remember that ongoing softness in core markets remains a key factor influencing the company's performance, so consider several viewpoints before making your own assessment.

Explore 2 other fair value estimates on IPG Photonics - why the stock might be worth less than half the current price!

Build Your Own IPG Photonics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IPG Photonics research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free IPG Photonics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IPG Photonics' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IPGP

IPG Photonics

Develops, manufactures, and sells various high-performance fiber lasers, fiber amplifiers, and diode lasers used in materials processing, medical, and advanced applications worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives