- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:FLEX

Shareholders May Not Be So Generous With Flex Ltd.'s (NASDAQ:FLEX) CEO Compensation And Here's Why

Key Insights

- Flex to hold its Annual General Meeting on 8th of August

- Total pay for CEO Revathi Advaithi includes US$1.33m salary

- The overall pay is 39% above the industry average

- Flex's EPS grew by 2.0% over the past three years while total shareholder return over the past three years was 152%

Performance at Flex Ltd. (NASDAQ:FLEX) has been reasonably good and CEO Revathi Advaithi has done a decent job of steering the company in the right direction. As shareholders go into the upcoming AGM on 8th of August, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders may still want to keep CEO compensation within reason.

See our latest analysis for Flex

How Does Total Compensation For Revathi Advaithi Compare With Other Companies In The Industry?

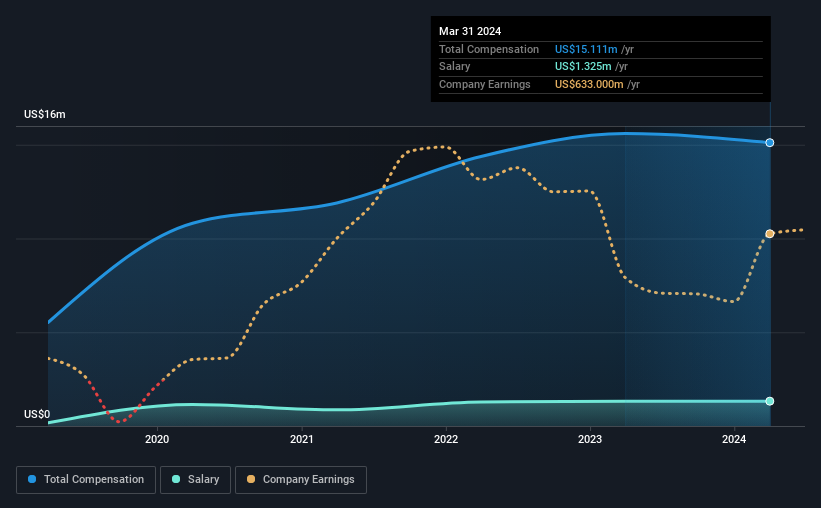

Our data indicates that Flex Ltd. has a market capitalization of US$13b, and total annual CEO compensation was reported as US$15m for the year to March 2024. That's slightly lower by 3.1% over the previous year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$1.3m.

In comparison with other companies in the American Electronic industry with market capitalizations over US$8.0b, the reported median total CEO compensation was US$11m. Accordingly, our analysis reveals that Flex Ltd. pays Revathi Advaithi north of the industry median. What's more, Revathi Advaithi holds US$51m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | US$1.3m | US$1.3m | 9% |

| Other | US$14m | US$14m | 91% |

| Total Compensation | US$15m | US$16m | 100% |

On an industry level, roughly 31% of total compensation represents salary and 69% is other remuneration. It's interesting to note that Flex allocates a smaller portion of compensation to salary in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Flex Ltd.'s Growth

Flex Ltd.'s earnings per share (EPS) grew 2.0% per year over the last three years. Its revenue is down 7.9% over the previous year.

We would argue that the lack of revenue growth in the last year is less than ideal, but it is good to see a modest EPS growth at least. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Flex Ltd. Been A Good Investment?

Most shareholders would probably be pleased with Flex Ltd. for providing a total return of 152% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. However, if the board proposes to increase the compensation, some shareholders might have questions given that the CEO is already being paid higher than the industry.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 2 warning signs for Flex that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FLEX

Flex

Provides technology innovation, supply chain, and manufacturing solutions to data center, communications, enterprise, consumer, automotive, industrial, healthcare, industrial, and power industries.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Align Technology Stock: Premium Orthodontics in a Cost-Sensitive World

Micron Technology will experience a robust 16.5% revenue growth

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion