- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:FLEX

Imagine Owning Flex (NASDAQ:FLEX) And Wondering If The 20% Share Price Slide Is Justified

Flex Ltd. (NASDAQ:FLEX) shareholders should be happy to see the share price up 14% in the last month. But that doesn't change the reality of under-performance over the last twelve months. In fact, the price has declined 20% in a year, falling short of the returns you could get by investing in an index fund.

See our latest analysis for Flex

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

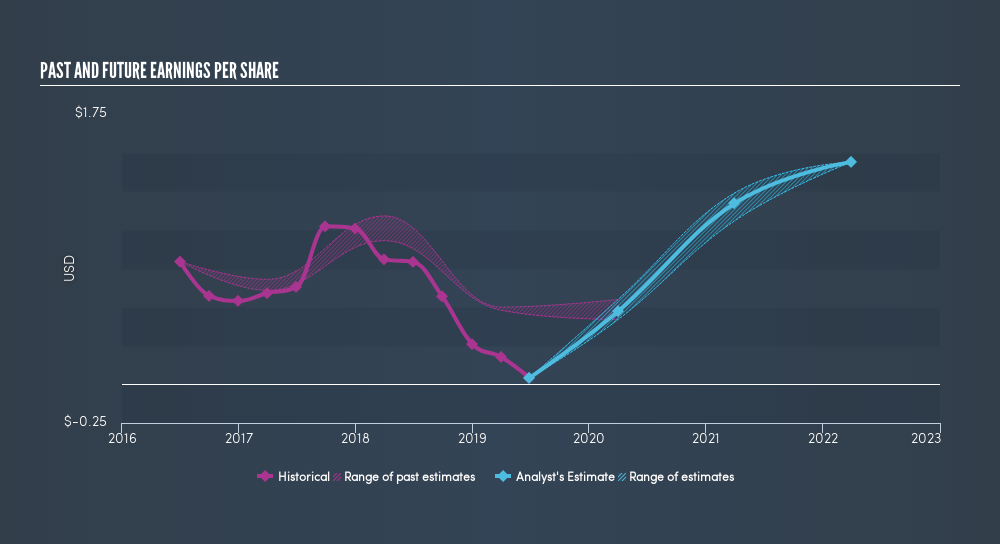

Unfortunately Flex reported an EPS drop of 95% for the last year. This fall in the EPS is significantly worse than the 20% the share price fall. So the market may not be too worried about the EPS figure, at the moment -- or it may have expected earnings to drop faster. With a P/E ratio of 262.12, it's fair to say the market sees an EPS rebound on the cards.

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Dive deeper into the earnings by checking this interactive graph of Flex's earnings, revenue and cash flow.

A Different Perspective

While the broader market gained around 6.2% in the last year, Flex shareholders lost 20%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 1.2% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

Flex is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:FLEX

Flex

Provides technology innovation, supply chain, and manufacturing solutions to data center, communications, enterprise, consumer, automotive, industrial, healthcare, industrial, and power industries in Asia, the Americas, and Europe.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives