- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:FLEX

How Investors May Respond To Flex (FLEX) Raising Guidance and Deepening NVIDIA Collaboration Amid AI Surge

Reviewed by Sasha Jovanovic

- Flex Ltd. recently reported second-quarter earnings, posting net sales of US$6.80 billion and raising its full-year sales guidance to a range of US$26.7 billion to US$27.3 billion, citing robust demand in its Power and Cloud businesses.

- Flex announced its ongoing collaboration with NVIDIA to develop modular data center systems using advanced manufacturing solutions and a newly opened, 400,000 square foot Dallas facility, signaling a focus on AI-driven infrastructure expansion.

- We'll now examine how Flex's strong guidance raise, driven by booming data center demand and its NVIDIA partnership, impacts its investment narrative.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Flex Investment Narrative Recap

To be a Flex shareholder, you need to believe that the company's leadership in advanced manufacturing, especially in data center and AI infrastructure, will enable it to capture growth opportunities, even as thin operating margins and customer concentration remain key risks. The latest raised sales guidance and record Q2 performance imply that robust demand in its Power and Cloud segments continues to drive near-term momentum, but the risk of major customers internalizing manufacturing for critical components still looms large and could quickly shift the revenue outlook if it materializes.

The announcement of Flex’s expanded partnership with NVIDIA to supply modular data center systems and the opening of its new Dallas facility directly tie into the ongoing demand surge in cloud and AI infrastructure, which has been the primary catalyst for upgraded guidance and is central to Flex’s current growth narrative.

However, what could challenge this positive story is the fact that while sales are up and AI infrastructure demand is high, Flex’s concentrated customer base means even one major partner choosing a different path could...

Read the full narrative on Flex (it's free!)

Flex's narrative projects $29.1 billion revenue and $1.3 billion earnings by 2028. This requires 3.7% yearly revenue growth and a $409 million earnings increase from $891.0 million currently.

Uncover how Flex's forecasts yield a $60.43 fair value, a 3% downside to its current price.

Exploring Other Perspectives

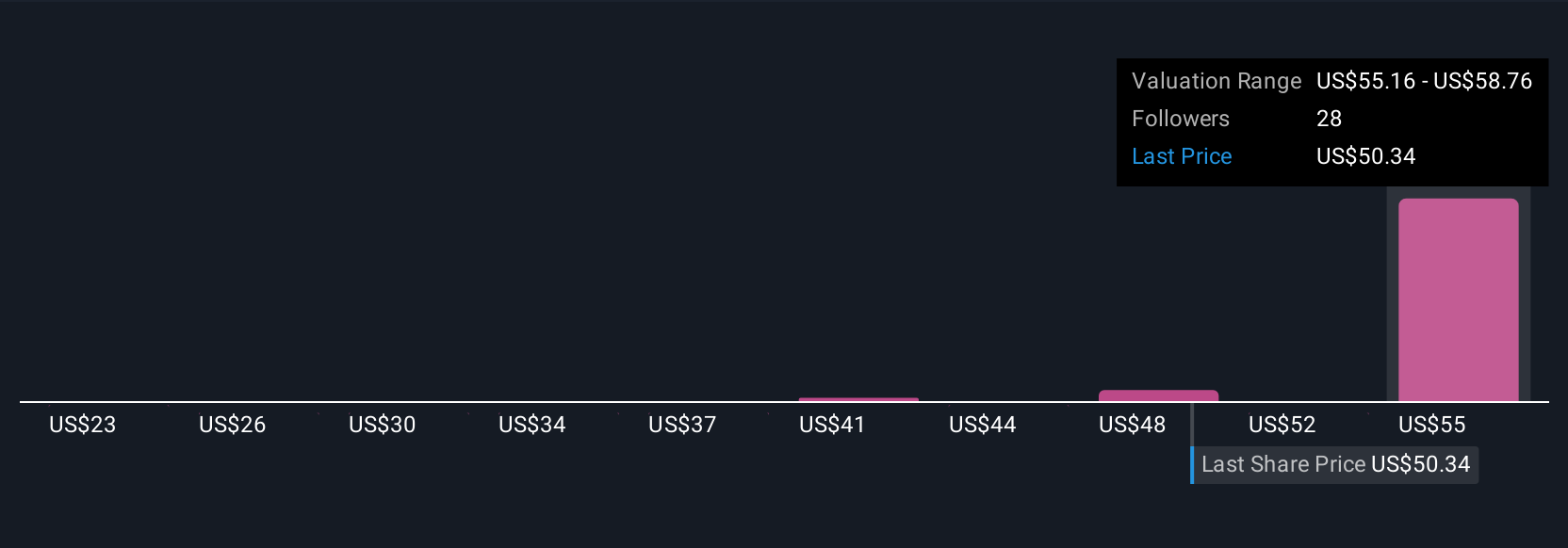

Six different fair value estimates from the Simply Wall St Community for Flex range from US$44.27 to US$64.39 per share. Yet with customer concentration risk flagged as a possible disruptor to future growth, it is clear that investors are factoring in a wide variety of scenarios, explore the range of views to understand what could impact performance ahead.

Explore 6 other fair value estimates on Flex - why the stock might be worth 29% less than the current price!

Build Your Own Flex Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Flex research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Flex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Flex's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FLEX

Flex

Provides technology innovation, supply chain, and manufacturing solutions to data center, communications, enterprise, consumer, automotive, industrial, healthcare, industrial, and power industries.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives