Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Extreme Networks, Inc. (NASDAQ:EXTR) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Extreme Networks

What Is Extreme Networks's Debt?

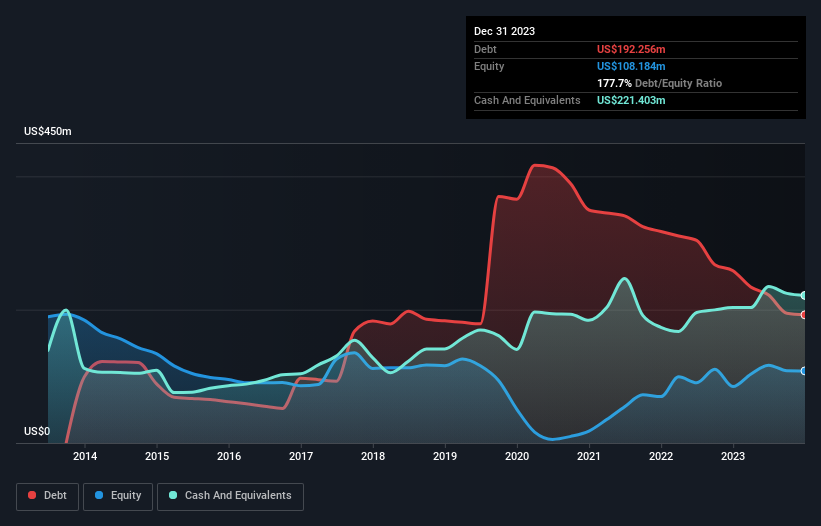

You can click the graphic below for the historical numbers, but it shows that Extreme Networks had US$192.3m of debt in December 2023, down from US$258.5m, one year before. But it also has US$221.4m in cash to offset that, meaning it has US$29.1m net cash.

A Look At Extreme Networks' Liabilities

Zooming in on the latest balance sheet data, we can see that Extreme Networks had liabilities of US$549.0m due within 12 months and liabilities of US$485.5m due beyond that. Offsetting these obligations, it had cash of US$221.4m as well as receivables valued at US$112.0m due within 12 months. So its liabilities total US$701.0m more than the combination of its cash and short-term receivables.

Extreme Networks has a market capitalization of US$1.40b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt. While it does have liabilities worth noting, Extreme Networks also has more cash than debt, so we're pretty confident it can manage its debt safely.

In addition to that, we're happy to report that Extreme Networks has boosted its EBIT by 71%, thus reducing the spectre of future debt repayments. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Extreme Networks's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. Extreme Networks may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last three years, Extreme Networks actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Summing Up

Although Extreme Networks's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of US$29.1m. And it impressed us with free cash flow of US$221m, being 191% of its EBIT. So we don't think Extreme Networks's use of debt is risky. We'd be motivated to research the stock further if we found out that Extreme Networks insiders have bought shares recently. If you would too, then you're in luck, since today we're sharing our list of reported insider transactions for free.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Extreme Networks might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:EXTR

Extreme Networks

Develops, markets, and sells network infrastructure equipment and related software in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Industrialist of the Skies – Scaling with "Automotive DNA

The "End-to-End" Space Prime – The Only Real Competitor to SpaceX

De-Risked Production Ramp with Exceptional Silver Price Leverage

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026