- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:EVLV

Evolv Technologies (EVLV) Is Up 12.8% After Columbus Crew Contract Renewal and Strong Repeat Business

Reviewed by Simply Wall St

- In July 2025, Evolv Technologies Holdings, Inc. announced it renewed its Evolv Express® subscription agreement with the Columbus Crew, maintaining advanced AI-driven threat detection systems across all entrances of Lower.com Field. The renewal underscores ongoing client retention and deepening relationships, with over 2.1 million guests screened and Evolv systems now used by 12 US professional soccer teams.

- Nearly half of Evolv's early 2025 business came from returning customers, reflecting strong customer loyalty and expansion within the sports and entertainment industry alongside broader adoption of its security technology.

- We'll now explore how this high-profile sports client renewal and repeat business could influence Evolv Technologies Holdings' broader investment outlook.

Evolv Technologies Holdings Investment Narrative Recap

To be an Evolv Technologies Holdings shareholder, you need confidence in the company’s ability to lead the shift toward AI-powered, frictionless security solutions and sustain strong recurring revenue through high customer retention. The recent Columbus Crew renewal highlights the stickiness of Evolv’s business in sports and entertainment, but does not materially change the importance of expanding into core markets like education and healthcare or address ongoing risks tied to leadership changes and financial oversight.

Of Evolv’s latest announcements, the deployment of Evolv Express systems at T-Mobile Park for the Seattle Mariners stands out alongside the Crew agreement, showcasing continued momentum among professional sports venues. These wins offer visible proof points for Evolv’s largest short-term catalyst: conversion of marquee, high-traffic venues into recurring revenue contracts, while solidifying its brand reputation for reliability at scale.

But compared to customer gains, the company’s recent leadership turnover and internal control questions remain issues that investors should be aware of...

Read the full narrative on Evolv Technologies Holdings (it's free!)

Evolv Technologies Holdings is projected to reach $184.7 million in revenue and $16.2 million in earnings by 2028, requiring 17.6% annual revenue growth and a $60.6 million increase in earnings from the current level of -$44.4 million.

Exploring Other Perspectives

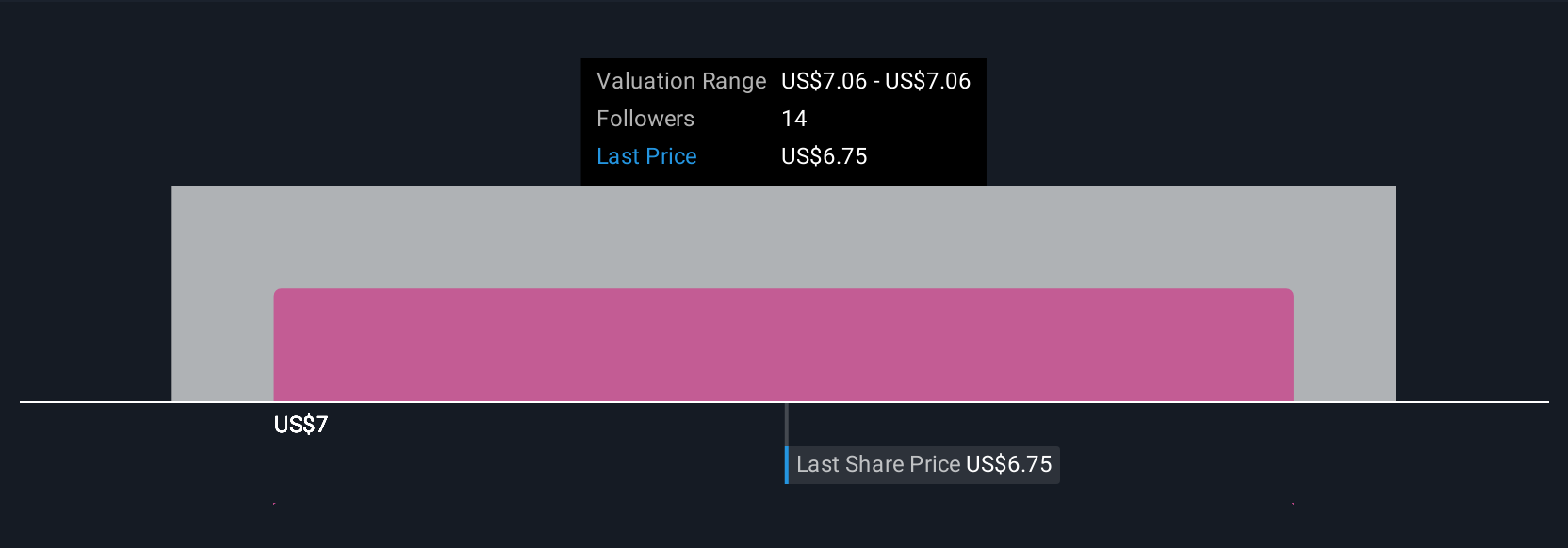

The Simply Wall St Community provided a single fair value estimate at US$7.06, with no wider range of perspectives. While many contributors see growth opportunities in sports and entertainment, some remain cautious due to Evolv’s operating losses and pressure on profitability. Explore where your outlook aligns among these differing viewpoints.

Build Your Own Evolv Technologies Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Evolv Technologies Holdings research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Evolv Technologies Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Evolv Technologies Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evolv Technologies Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:EVLV

Evolv Technologies Holdings

Provides artificial intelligence (AI)-based weapons detection for security screening in the United States and internationally.

Adequate balance sheet low.

Similar Companies

Market Insights

Community Narratives