- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:EVLV

Can Spartanburg’s Security Upgrade Reveal a Recurring Revenue Strength for Evolv (EVLV)?

Reviewed by Sasha Jovanovic

- Spartanburg District Five Schools in South Carolina recently expanded its deployment of Evolv Technologies Holdings' security screening solutions to all 14 schools in the district, incorporating both the Evolv Express and eXpedite systems to enhance safety and streamline entry for students, staff, and visitors.

- This district-wide rollout illustrates how K-12 institutions are increasingly choosing advanced sensor and AI-powered screening platforms to address modern safety requirements while easing congestion during critical entry periods and special events.

- We'll look at how Spartanburg's district-wide adoption of Evolv’s technology could impact the company’s growth outlook and recurring revenue potential.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Evolv Technologies Holdings Investment Narrative Recap

Investing in Evolv Technologies Holdings means believing that growing demand for physical security in education will steadily drive adoption of its solutions, increasing recurring revenue despite margin headwinds from direct sales and early-stage products like eXpedite. The Spartanburg District Five Schools deployment expands the installed base and reinforces the company's foothold in K-12, but does not materially alter the immediate margin and profitability risks, which remain the most significant short-term concerns for shareholders.

The September 18 announcement regarding a multi-year partnership with the NHL’s Buffalo Sabres showcases Evolv’s widening reach into sports venues and aligns closely with the core growth catalyst: landing long-term, high-volume contracts in public spaces facing increased safety demands. Pairing these agreements with the recent school rollout underlines Evolv’s dual-track approach to capturing both education and event-driven markets, feeding into recurring revenue and supporting expansion.

However, looking beyond expanding contracts and market share, investors should be aware that, despite growing deployments, Evolv’s unproven path to profitability driven by low gross margins on direct sales remains a significant risk...

Read the full narrative on Evolv Technologies Holdings (it's free!)

Evolv Technologies Holdings is projected to reach $208.0 million in revenue and $18.8 million in earnings by 2028. This scenario relies on a 19.8% annual revenue growth rate and an increase in earnings of $107.2 million from the current level of -$88.4 million.

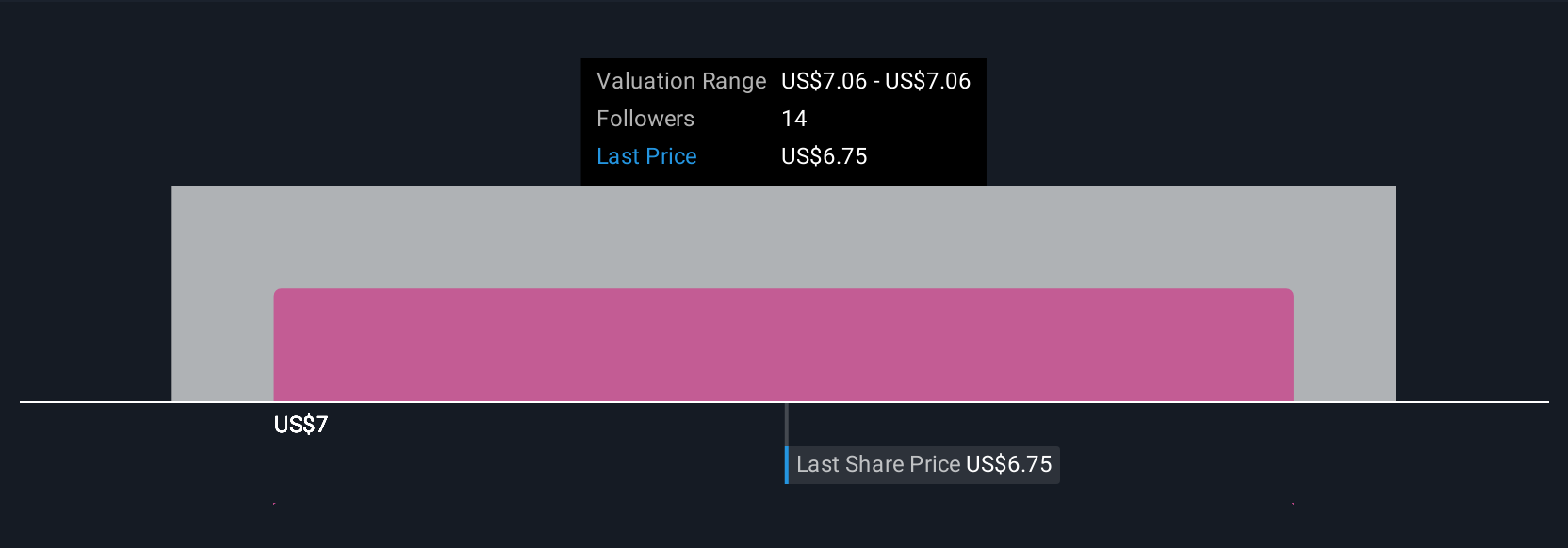

Uncover how Evolv Technologies Holdings' forecasts yield a $9.50 fair value, a 31% upside to its current price.

Exploring Other Perspectives

Two private investors in the Simply Wall St Community estimate Evolv's fair value between US$9.50 and US$9.63. While opinions vary, recurring revenue growth from new educational and sports contracts could influence future performance. Explore these differing viewpoints to form your own outlook.

Explore 2 other fair value estimates on Evolv Technologies Holdings - why the stock might be worth as much as 33% more than the current price!

Build Your Own Evolv Technologies Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Evolv Technologies Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Evolv Technologies Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Evolv Technologies Holdings' overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evolv Technologies Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:EVLV

Evolv Technologies Holdings

Provides artificial intelligence (AI)-based weapons detection for security screening in the United States and internationally.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives