- United States

- /

- Communications

- /

- NasdaqGS:DGII

Does Digi International's Raised Earnings Guidance Signal New Strength in Its Recurring Revenue Pivot (DGII)?

Reviewed by Simply Wall St

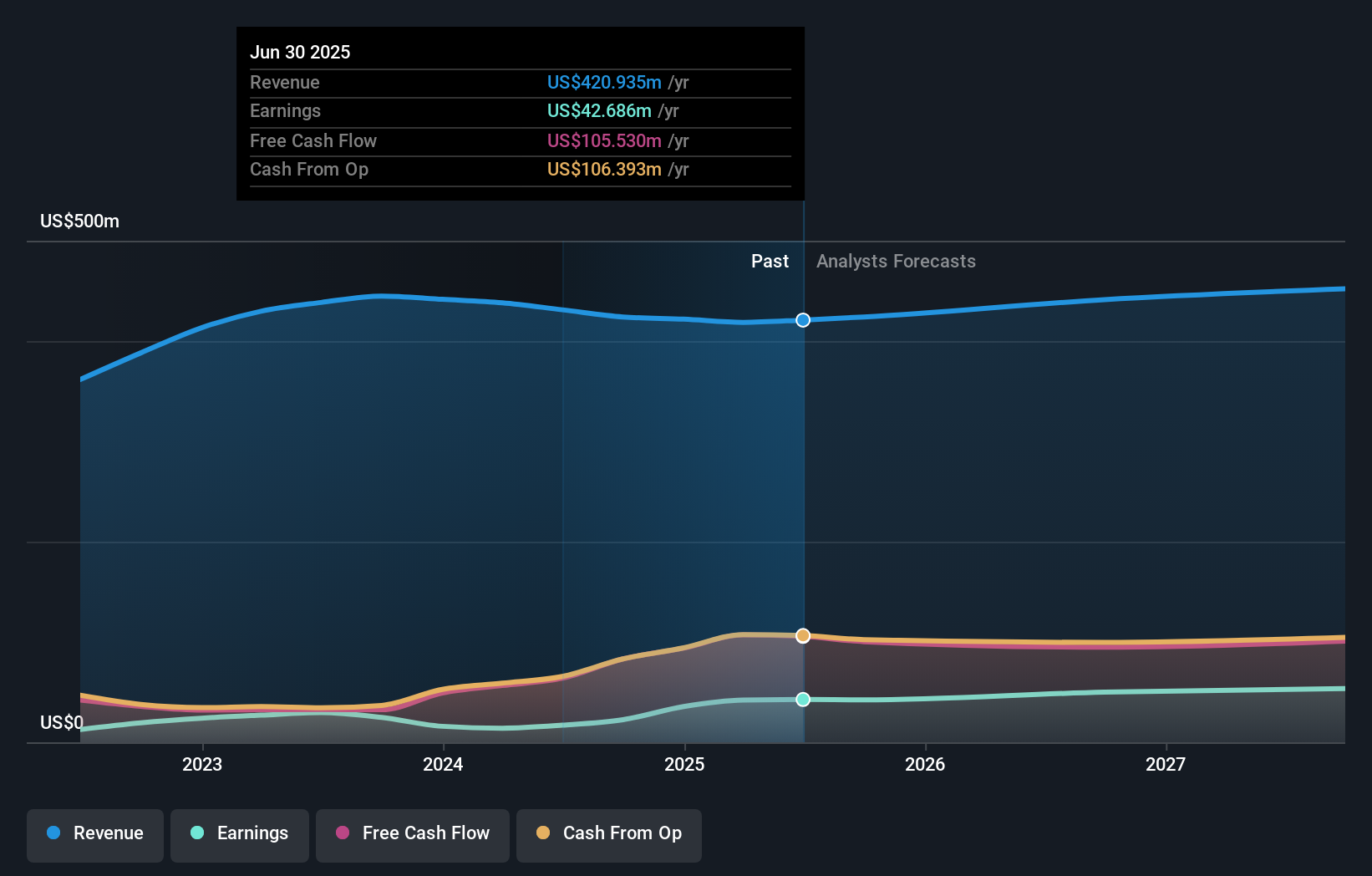

- Digi International recently reported third quarter 2025 results, posting revenue of US$107.51 million and net income of US$10.24 million, along with updated earnings guidance for the full year that raises profit expectations while keeping flat revenue projections amid ongoing operational investments by customers.

- The company's ability to lift its annual profit outlook despite steady revenue targets suggests improved efficiency and cost control are supporting margin expansion.

- Let's examine how Digi International's heightened profit guidance, despite steady revenue, shapes its ongoing shift to a recurring revenue model.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Digi International Investment Narrative Recap

Shareholders in Digi International are generally betting on the company's push toward a recurring revenue model driving sustained profit growth, even when overall topline momentum is steady. The recent upgrade to annual profit guidance is positive in the short term but has not shifted the most important catalyst, continued robust growth in Annual Recurring Revenue (ARR), nor changed the main risk: potential revenue softness if the recurring transition slows or hardware sales weaken, meaning the news does not materially change the investment thesis right now.

Of Digi's recent announcements, the launch of Digi LifeCycle Assurance On-Prem Manager stands out for its alignment with demand for on-premises solutions and secure device management. This product complements the company’s focus on software-driven offerings, which remains a key catalyst for margin improvement and stickier customer relationships, linking directly to management’s confidence in profit growth even while revenues are flat.

Yet, despite these encouraging developments, investors should be aware that if recurring ARR growth fails to offset challenges in hardware or regional demand softness, then...

Read the full narrative on Digi International (it's free!)

Digi International's narrative projects $459.9 million revenue and $58.1 million earnings by 2028. This requires 3.2% yearly revenue growth and a $16.0 million earnings increase from $42.1 million today.

Uncover how Digi International's forecasts yield a $37.17 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided 2 fair value estimates for Digi International, ranging from US$37.17 to US$51.77 per share. With management holding firm on flat revenue guidance and aiming for margin expansion through efficiency, these varied viewpoints show how opinions can differ based on expectations for recurring revenue momentum and profitability, encouraging you to explore more alternative views when considering the company.

Explore 2 other fair value estimates on Digi International - why the stock might be worth as much as 62% more than the current price!

Build Your Own Digi International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Digi International research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Digi International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Digi International's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 19 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DGII

Digi International

Provides business and mission-critical Internet of Things (IoT) connectivity products, services, and solutions in the United States, Europe, the Middle East, Africa, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives