- United States

- /

- Communications

- /

- NasdaqGS:DGII

Digi International (DGII) Is Up 8.4% After Record Revenue and Raised 2026 Growth Outlook – Has the Recurring Revenue Pivot Changed the Bull Case?

Reviewed by Sasha Jovanovic

- Digi International recently reported record fourth-quarter revenue of US$114.34 million and a 31% year-over-year increase in annual recurring revenue, driven by robust IoT solutions demand and the successful integration of its Jolt acquisition.

- The company’s forward guidance points to continued double-digit growth in recurring revenue and total revenue for fiscal 2026, reflecting management’s confidence bolstered by innovations in AI and expanding acquisitions in the industrial IoT sector.

- We’ll explore how Digi’s raised full-year outlook and ongoing shift to recurring revenue models shape its investment case going forward.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

Digi International Investment Narrative Recap

For shareholders in Digi International, the core belief is in the company's ability to drive consistent growth by expanding its recurring revenue base and succeeding in IoT innovation. The recent earnings and upbeat fiscal 2026 guidance reinforce the momentum in recurring revenue but do not fundamentally change the immediate catalyst: accelerating ARR through new solution adoption. Risks tied to APAC demand softness and customer acceptance of new recurring models remain, but the news does not materially alter the primary risk profile for investors today.

Among Digi International's recent news, the full integration and positive early impact of the Jolt acquisition stand out as especially relevant. This move helped boost ARR to 35% of total revenue, directly supporting the company's push toward more stable, high-quality earnings, and reflecting management’s ongoing focus on scaling through acquisitions and solution enhancements tied to the IoT opportunity.

However, investors should keep in mind that despite strong recurring revenue figures, regional sales volatility, especially in Asia-Pacific, remains a risk that could affect future performance if...

Read the full narrative on Digi International (it's free!)

Digi International's outlook forecasts $497.0 million in revenue and $72.6 million in earnings by 2028. This scenario assumes 5.7% annual revenue growth and a $29.9 million increase in earnings from $42.7 million today.

Uncover how Digi International's forecasts yield a $45.80 fair value, a 19% upside to its current price.

Exploring Other Perspectives

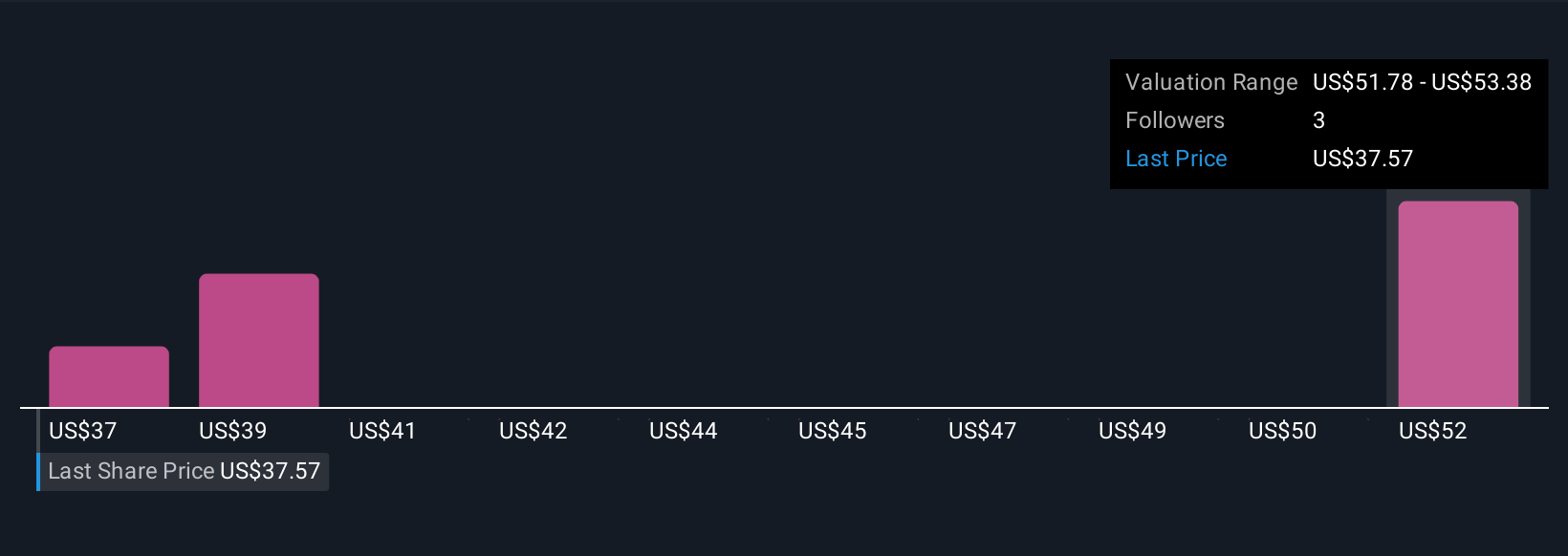

Three member views in the Simply Wall St Community place Digi's fair value from US$37.38 to US$59.84. While recurring revenue growth shapes the outlook, opinion varies, making it important to compare these viewpoints for a thorough understanding.

Explore 3 other fair value estimates on Digi International - why the stock might be worth as much as 56% more than the current price!

Build Your Own Digi International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Digi International research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Digi International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Digi International's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DGII

Digi International

Provides business and mission-critical Internet of Things (IoT) connectivity products, services, and solutions in the United States, Europe, the Middle East, Africa, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives