- United States

- /

- Communications

- /

- NasdaqGS:DGII

Digi International (DGII): Assessing Valuation Following Q4 Earnings and Fresh Revenue Guidance

Reviewed by Simply Wall St

Digi International (DGII) just shared its fourth quarter financials, revealing revenue growth compared to last year but a dip in net income. Along with these results, the company provided guidance for 2026, including projected revenue and recurring revenue gains.

See our latest analysis for Digi International.

Digi International’s latest guidance and double-digit recurring revenue growth targets have kept investors’ attention, helping fuel a strong 22.7% year-to-date share price return and a solid 12.5% total shareholder return over the past year. With momentum clearly building, recent company updates seem to have reinforced optimism around longer-term prospects, even as underlying earnings remain a watchpoint.

If Digi’s upward trajectory has you searching for more tech opportunities, you might enjoy discovering the leading edge of innovation with our curated list. See the full range of high-growth tech and AI stocks: See the full list for free.

Given Digi International’s ongoing growth and double-digit revenue ambitions, is the current price a bargain for investors, or are expectations for future gains already fully reflected in the stock’s value?

Most Popular Narrative: 11.2% Undervalued

With Digi International’s fair value set by the most popular narrative at $40.50, the latest closing price of $35.97 suggests there is still meaningful upside, according to consensus projections. Investors are watching for whether the anticipated subscription and cloud-driven growth can deliver on these expectations.

The accelerating transition of customers to Digi's subscription-based and recurring revenue solutions, including higher attach rates on IoT products such as cellular routers and infrastructure management devices, points to ongoing double-digit annual recurring revenue (ARR) growth and improved profit margins. This is boosting both revenue stability and long-term earnings. Increased adoption of cloud and hybrid infrastructure, especially as enterprises and data centers pursue AI and edge deployments, is creating heightened demand for Digi's edge connectivity and remote management solutions. This supports higher sales volumes and more premium-priced contracts, which positively impact topline revenue and net margins.

Want to know the force behind this bullish fair value? There is a key financial forecast that signals a strategic profit surge. Guess what kind of growth and future multiples are being priced in here? Find out what numbers make this valuation tick and explore the next layer to see why expectations are running high for Digi International.

Result: Fair Value of $40.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, flat year-over-year revenue guidance and uncertain regional demand could pressure Digi's growth story if recurring revenue momentum or hardware sales weaken.

Find out about the key risks to this Digi International narrative.

Another View: Multiples Paint a Pricier Picture

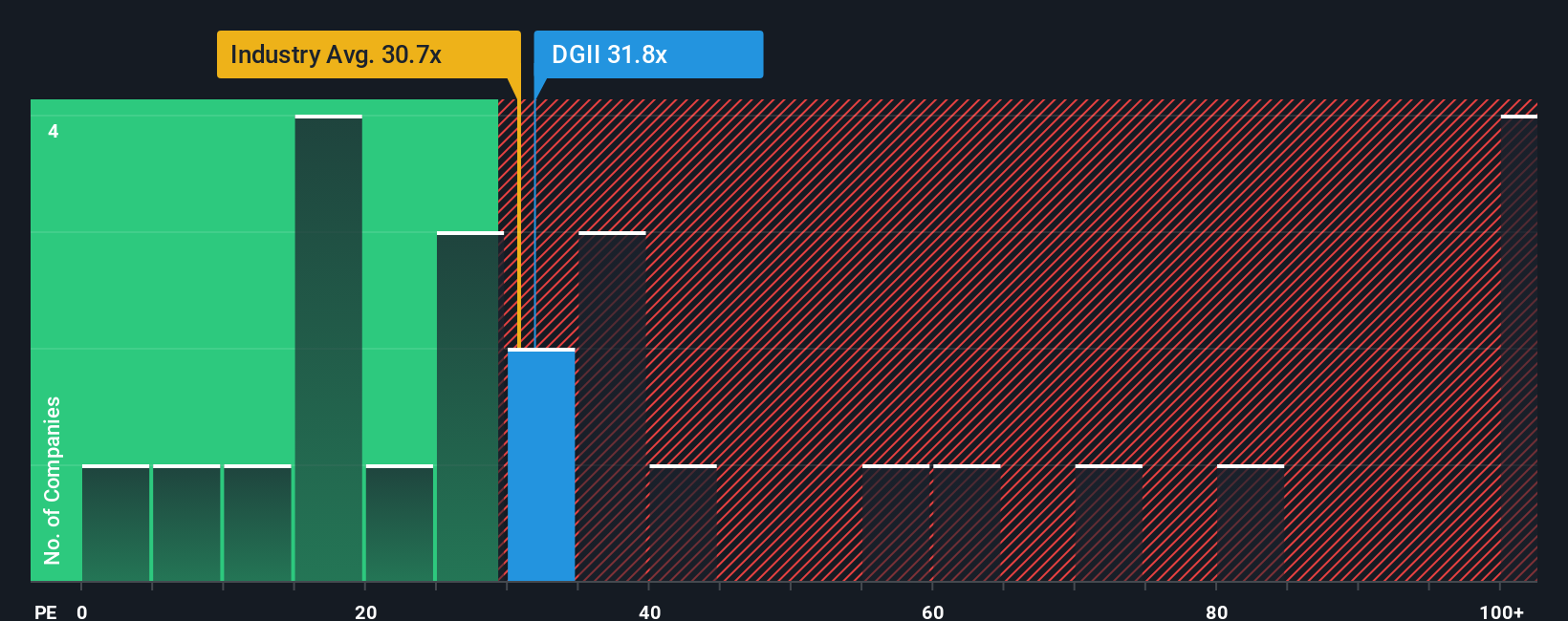

While analyst forecasts suggest Digi International has room to run, a look at its valuation through the lens of price-to-earnings tells a different story. The company trades at 31.3x earnings, above both the industry average of 29.3x and the peer average of 24.5x. Its valuation is also notably higher than its fair ratio of 26.3x. This raises the question: Are investors paying too much for Digi International given where the market could gravitate next?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Digi International Narrative

If you have a different perspective or want to dig into the numbers yourself, it takes just a couple of minutes to build your own investment story. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Digi International.

Looking for More Investment Ideas?

Unlock even more opportunities by checking out these carefully selected stock ideas. Don’t let the next big winner slip off your radar.

- Capture growth potential as you pursue these 885 undervalued stocks based on cash flows that the market may have overlooked, offering attractive entry points for sharp investors.

- Target future innovation by tracking the surge of these 27 AI penny stocks at the forefront of artificial intelligence and automation.

- Supercharge your passive income and amplify portfolio stability with these 14 dividend stocks with yields > 3% featuring yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DGII

Digi International

Provides business and mission-critical Internet of Things (IoT) connectivity products, services, and solutions in the United States, Europe, the Middle East, Africa, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives