- United States

- /

- Communications

- /

- NasdaqGS:CSCO

How Investors May Respond To Cisco Systems (CSCO) Doubling AI Order Expectations With New Infrastructure Launch

Reviewed by Sasha Jovanovic

- Cisco Systems and partners recently announced a suite of next-generation AI infrastructure innovations, including the Cisco N9100 data center switch built on NVIDIA Spectrum-X and the industry’s first AI-native wireless stack for 6G, as well as expanded enterprise security integrations and cloud reference architectures.

- Driven by very strong AI infrastructure demand, Cisco reported US$2 billion in AI-related orders for 2025, double initial expectations, highlighting the real-world traction of its latest offerings and technology partnerships.

- We’ll now examine how these record AI infrastructure orders and cutting-edge product launches may reshape Cisco’s investment narrative and near-term growth outlook.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Cisco Systems Investment Narrative Recap

To be a Cisco shareholder today, you need to believe that accelerating investments in AI infrastructure and secure, scalable networking will drive Cisco's revenue and margin expansion, outpacing risks of competition and shifts in enterprise IT architectures. The recent surge to US$2 billion in AI-related orders for 2025 strengthens confidence in Cisco's near-term growth catalyst, however, the company’s dependence on large contracts from a handful of cloud and webscale customers remains the biggest short-term risk. For now, these record orders reinforce the primary driver of investor optimism and appear material to Cisco’s immediate outlook.

Among the announcements, Cisco's launch of America’s first AI-native wireless stack for 6G with NVIDIA stands out. This breakthrough is highly relevant as it positions Cisco at the forefront of next-generation wireless infrastructure, addressing surging demand for AI-optimized networking across telecom and enterprise markets, directly supporting the catalysts around AI-driven growth.

Yet, in contrast, investors should be aware that heavy reliance on a small number of cloud and AI customers introduces exposure to sudden order volatility and ...

Read the full narrative on Cisco Systems (it's free!)

Cisco Systems' forecast points to $65.2 billion in revenue and $14.0 billion in earnings by 2028. This projection is based on annual revenue growth of 4.8% and an increase in earnings of $3.8 billion from the current $10.2 billion.

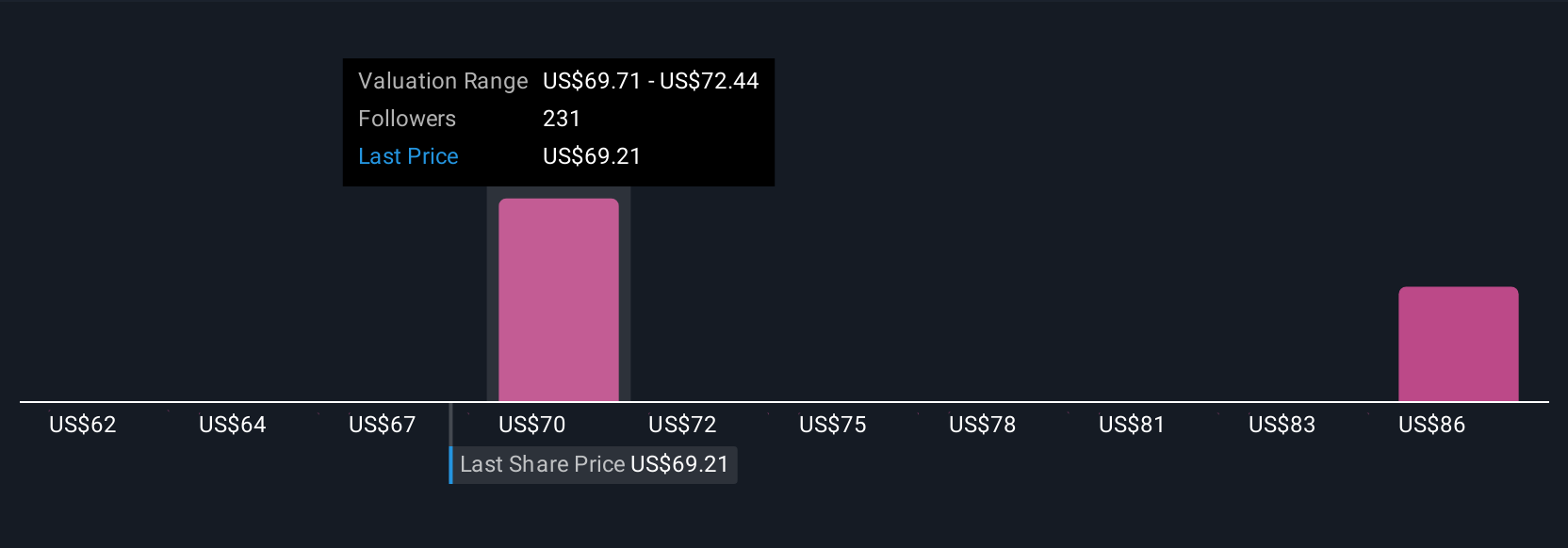

Uncover how Cisco Systems' forecasts yield a $75.81 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Nine fair value estimates from the Simply Wall St Community span US$60.75 to US$75.81 per share. While AI order growth is robust, ongoing reliance on key customers may affect Cisco's future earnings stability, so consider multiple viewpoints before making decisions.

Explore 9 other fair value estimates on Cisco Systems - why the stock might be worth 17% less than the current price!

Build Your Own Cisco Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cisco Systems research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Cisco Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cisco Systems' overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSCO

Cisco Systems

Designs, developes, and sells technologies that help to power, secure, and draw insights from the internet in the Americas, Europe, the Middle East, Africa, the Asia Pacific, Japan, and China.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives