- United States

- /

- Communications

- /

- NasdaqGS:CSCO

Do You Like Cisco Systems, Inc. (NASDAQ:CSCO) At This P/E Ratio?

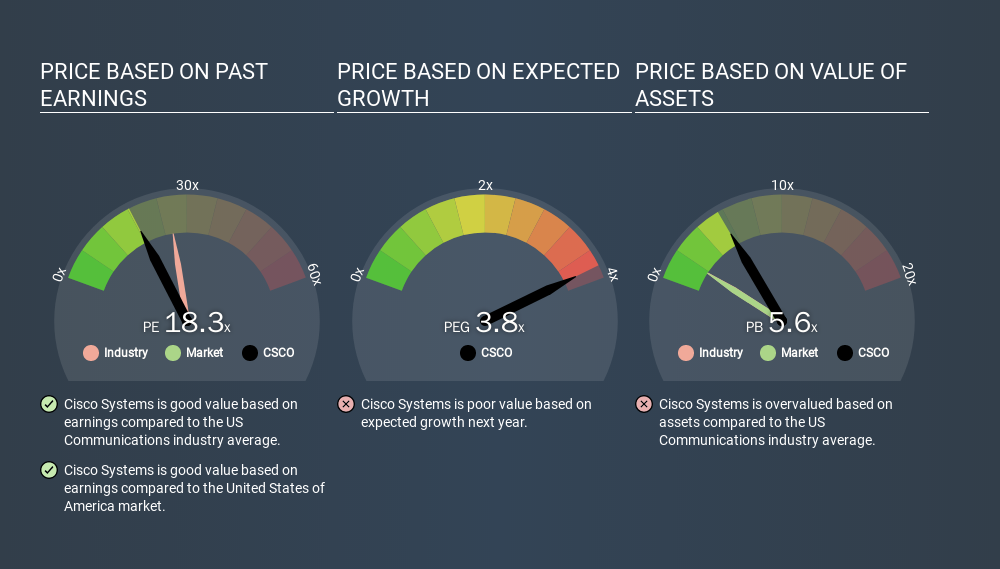

Today, we'll introduce the concept of the P/E ratio for those who are learning about investing. We'll show how you can use Cisco Systems, Inc.'s (NASDAQ:CSCO) P/E ratio to inform your assessment of the investment opportunity. What is Cisco Systems's P/E ratio? Well, based on the last twelve months it is 18.33. That means that at current prices, buyers pay $18.33 for every $1 in trailing yearly profits.

View our latest analysis for Cisco Systems

How Do You Calculate Cisco Systems's P/E Ratio?

The formula for P/E is:

Price to Earnings Ratio = Share Price ÷ Earnings per Share (EPS)

Or for Cisco Systems:

P/E of 18.33 = USD47.32 ÷ USD2.58 (Based on the trailing twelve months to January 2020.)

Is A High Price-to-Earnings Ratio Good?

The higher the P/E ratio, the higher the price tag of a business, relative to its trailing earnings. All else being equal, it's better to pay a low price -- but as Warren Buffett said, 'It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price'.

How Does Cisco Systems's P/E Ratio Compare To Its Peers?

The P/E ratio essentially measures market expectations of a company. If you look at the image below, you can see Cisco Systems has a lower P/E than the average (26.0) in the communications industry classification.

This suggests that market participants think Cisco Systems will underperform other companies in its industry. While current expectations are low, the stock could be undervalued if the situation is better than the market assumes. It is arguably worth checking if insiders are buying shares, because that might imply they believe the stock is undervalued.

How Growth Rates Impact P/E Ratios

P/E ratios primarily reflect market expectations around earnings growth rates. Earnings growth means that in the future the 'E' will be higher. That means unless the share price increases, the P/E will reduce in a few years. A lower P/E should indicate the stock is cheap relative to others -- and that may attract buyers.

Cisco Systems's earnings per share fell by 6.3% in the last twelve months. But over the longer term (5 years) earnings per share have increased by 8.9%.

A Limitation: P/E Ratios Ignore Debt and Cash In The Bank

Don't forget that the P/E ratio considers market capitalization. Thus, the metric does not reflect cash or debt held by the company. In theory, a company can lower its future P/E ratio by using cash or debt to invest in growth.

Spending on growth might be good or bad a few years later, but the point is that the P/E ratio does not account for the option (or lack thereof).

Cisco Systems's Balance Sheet

Cisco Systems has net cash of US$12b. That should lead to a higher P/E than if it did have debt, because its strong balance sheets gives it more options.

The Bottom Line On Cisco Systems's P/E Ratio

Cisco Systems's P/E is 18.3 which is about average (18.4) in the US market. While the absence of growth in the last year is probably causing a degree of pessimism, the net cash position means it's not surprising that expectations put the company roughly in line with the market average P/E.

When the market is wrong about a stock, it gives savvy investors an opportunity. As value investor Benjamin Graham famously said, 'In the short run, the market is a voting machine but in the long run, it is a weighing machine. So this free visualization of the analyst consensus on future earnings could help you make the right decision about whether to buy, sell, or hold.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with modest (or no) debt, trading on a P/E below 20.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:CSCO

Cisco Systems

Designs, develops, and sells technologies that help to power, secure, and draw insights from the internet in the Americas, Europe, the Middle East, Africa, the Asia Pacific, Japan, and China.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion