- United States

- /

- Communications

- /

- NasdaqGS:CSCO

Did Cisco's (CSCO) AI Venture in Saudi Arabia Just Shift Its Next-Gen Infrastructure Narrative?

Reviewed by Sasha Jovanovic

- On November 19, 2025, AMD, Cisco, and HUMAIN announced the formation of a joint venture to develop large-scale AI data center infrastructure in Saudi Arabia, aiming to deliver up to 1 GW of AI capacity by 2030 and advance the country's global AI ambitions.

- This collaboration will see Cisco and AMD serve as exclusive technology partners, combining cutting-edge hardware and HUMAIN’s data centers to deliver efficient, cost-effective AI infrastructure for both regional and global customers.

- We'll explore how Cisco's role as a founding investor in this AI-focused venture could further strengthen its position in next-generation infrastructure.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Cisco Systems Investment Narrative Recap

To be a Cisco Systems shareholder, you have to believe in the company’s ability to capitalize on accelerating global AI infrastructure demand, particularly by deepening partnerships and securing large-scale data center contracts. While the new joint venture with AMD and HUMAIN in Saudi Arabia showcases Cisco’s expanding role in AI infrastructure, this announcement does not materially change the biggest near-term catalyst (AI-driven network orders) or address the most pressing risk: exposure to order volatility from hyperscale customers.

Among the latest announcements, Cisco’s updated revenue guidance for fiscal 2026 ($60.2 billion to $61.0 billion) stands out as most relevant. The guidance reflects the anticipated impact from strong AI infrastructure demand and highlights investors’ ongoing focus on short-term order flow and execution, especially as Cisco aims to convert partnerships like the AMD-HUMAIN venture into meaningful revenue growth.

But on the other hand, investors should pay close attention to how concentrated exposure to order cycles from a handful of hyperscale customers could...

Read the full narrative on Cisco Systems (it's free!)

Cisco Systems' outlook anticipates $65.2 billion in revenue and $14.0 billion in earnings by 2028. This is based on a 4.8% annual revenue growth rate and a $3.8 billion increase in earnings from the current $10.2 billion.

Uncover how Cisco Systems' forecasts yield a $84.81 fair value, a 11% upside to its current price.

Exploring Other Perspectives

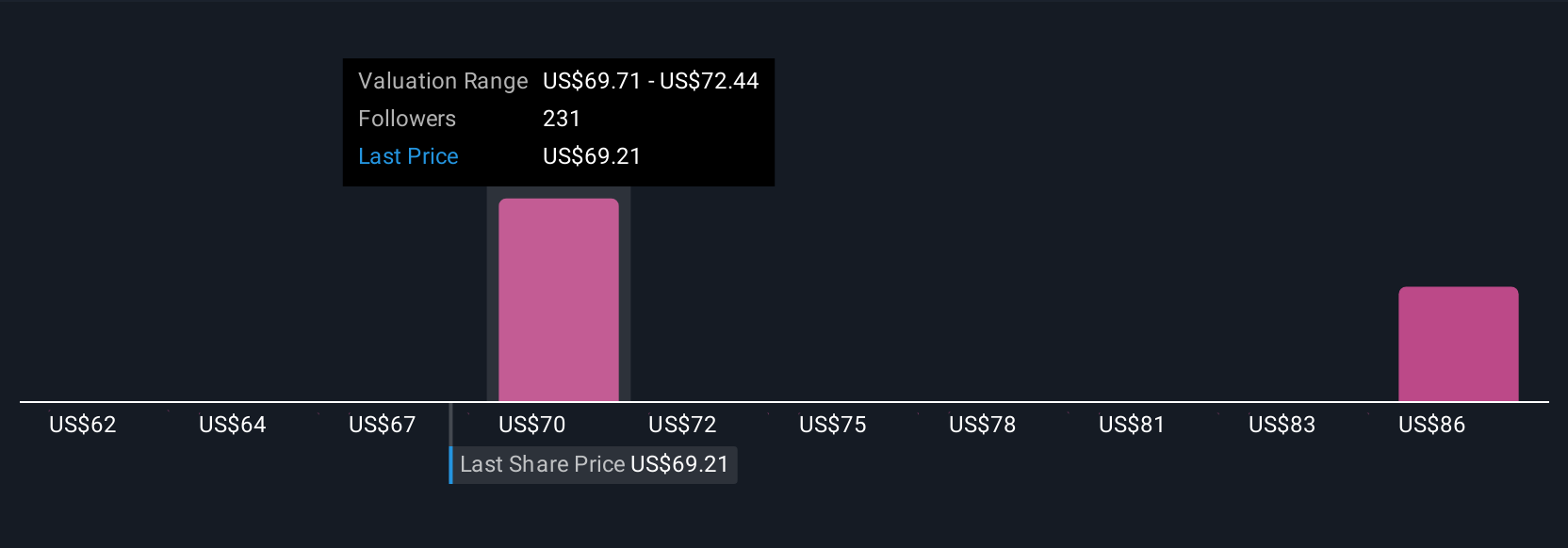

Fair value estimates from 11 Simply Wall St Community members range from US$61.52 to US$84.81 per share. With this breadth of views, keep in mind that both AI-driven catalysts and cyclical hyperscale customer risk can shape Cisco’s future in different ways, explore how these perspectives might inform your own outlook.

Explore 11 other fair value estimates on Cisco Systems - why the stock might be worth as much as 11% more than the current price!

Build Your Own Cisco Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cisco Systems research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Cisco Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cisco Systems' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSCO

Cisco Systems

Designs, developes, and sells technologies that help to power, secure, and draw insights from the internet in the Americas, Europe, the Middle East, Africa, the Asia Pacific, Japan, and China.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success