- United States

- /

- Communications

- /

- NasdaqGS:CSCO

A Look at Cisco Systems (CSCO) Valuation Following Earnings Beat and Upgraded AI-Fueled Growth Outlook

Reviewed by Simply Wall St

Cisco Systems (CSCO) caught Wall Street’s attention this week after reporting fiscal first-quarter results that topped expectations. Strong networking growth, especially from hyperscalers, pushed the company to raise full-year revenue guidance and highlight new opportunities driven by AI demand.

See our latest analysis for Cisco Systems.

Cisco’s recent earnings beat and upbeat guidance have fueled a wave of positive momentum, sending its share price up 15% over the last 90 days and 31% year-to-date. Investors have welcomed a standout 39% total shareholder return over the past year. A new 25-year high reflects growing confidence in Cisco’s transformation and long-term AI-driven growth plans.

If Cisco’s momentum has you thinking bigger picture, this could be the perfect moment to explore the tech and AI leaders making headlines. See the full list for free with See the full list for free..

But after a historic rally and upbeat guidance, the key question is whether Cisco’s impressive growth has already been factored into the stock price, or if there is still a compelling buying opportunity ahead for investors.

Most Popular Narrative: Fairly Valued

Cisco Systems’ narrative fair value sits at $76.96, nearly matching its last close of $77.37. The stock’s price aligns with the consensus forecast and signals a balanced view of future upside.

Enterprises and governments are in a sustained cycle of digitizing operations, with Cisco seeing widespread adoption of refreshed networking (Cat9k, smart switches, ruggedized industrial IoT) and security products across industries. This digital transformation trend is expected to underpin steady order growth and recurring revenue acceleration, reinforcing both top-line and earnings visibility.

Want to know what powers this precise valuation? Deep inside the narrative lies a set of bold growth projections and margin assumptions that shape its fair value. Which future catalyst tips the scale? Click to uncover the key numbers and debates the narrative counts on.

Result: Fair Value of $76.96 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including intensifying competition and the potential for slowed cloud or AI spending. These factors could quickly challenge Cisco’s upbeat outlook.

Find out about the key risks to this Cisco Systems narrative.

Another View: Sizing Up Value Through Market Ratios

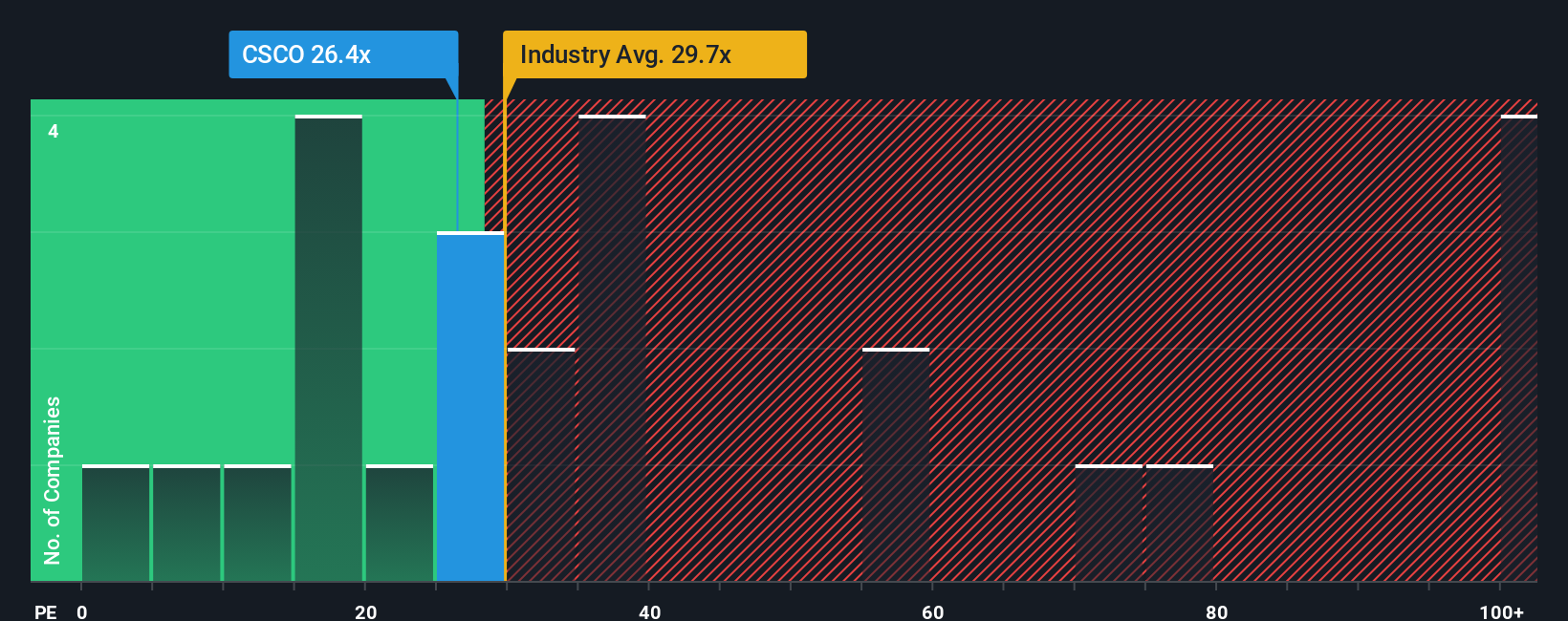

While the consensus fair value suggests Cisco is fairly priced, the market’s favorite metric tells a different story. Cisco’s price-to-earnings ratio of 29.5x sits below both its peers at 75.9x and the US industry average of 30.8x. Even compared to the fair ratio of 33x, Cisco looks attractively valued. Does the market see risks others have overlooked, or is this a real opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cisco Systems Narrative

If you see Cisco differently or want to dig into the numbers yourself, you can build a personalized narrative in just a few minutes using Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Cisco Systems.

Looking for More Smart Investment Ideas?

Take charge of your investing strategy by tapping into fresh opportunities that others might miss. Uncover new angles to grow your wealth with these handpicked stock ideas:

- Boost your income potential and pursue reliable cash flow with these 18 dividend stocks with yields > 3% featuring strong yields above 3%.

- Ride the next tech wave and unlock possibilities in artificial intelligence by checking out these 27 AI penny stocks that are reshaping tomorrow’s markets.

- Capitalize early on innovative companies shaping the future and spot hidden value among these 3583 penny stocks with strong financials making waves right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSCO

Cisco Systems

Designs, developes, and sells technologies that help to power, secure, and draw insights from the internet in the Americas, Europe, the Middle East, Africa, the Asia Pacific, Japan, and China.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives