- United States

- /

- Tech Hardware

- /

- NasdaqGS:CRSR

Corsair Gaming (CRSR): Five-Year Losses Deepen, Undervalued Status Sparks Turnaround Narrative Debate

Reviewed by Simply Wall St

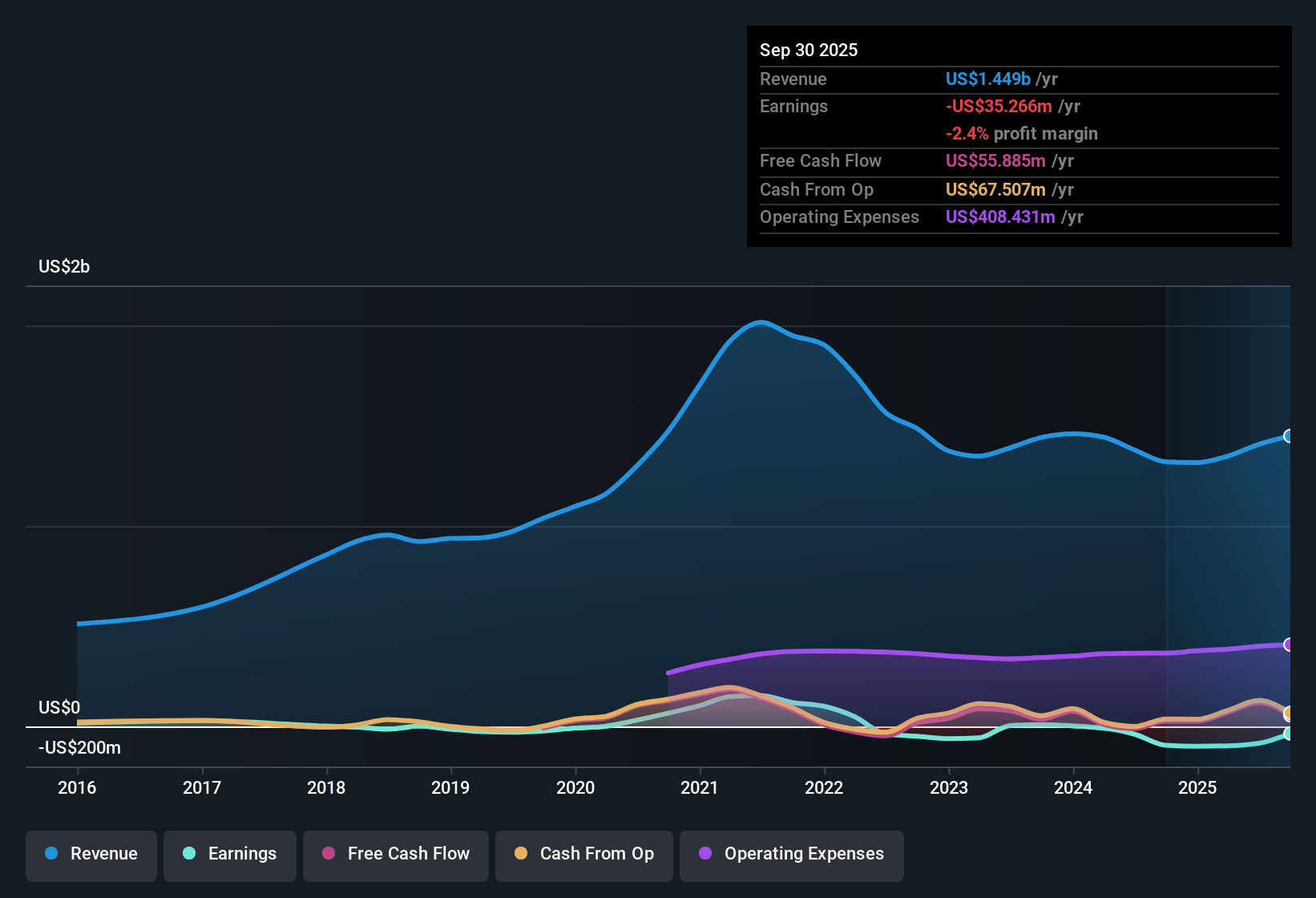

Corsair Gaming (CRSR) reported that losses have deepened at an average rate of 68.9% per year over the past five years, reflecting mounting unprofitability even as the company forecasts 8.7% annual revenue growth, which is below the 10.5% US market average. However, with earnings expected to grow at a robust 96.57% per year and profitability projected within the next three years, Corsair is seen by some investors as a turnaround candidate.

See our full analysis for Corsair Gaming.Next up, we will see how these numbers measure up against the current narratives from the Simply Wall St community. This will reveal which stories align with the fresh results and which may need a rethink.

See what the community is saying about Corsair Gaming

Margins Poised for a Turnaround

- Profit margins are expected to move up from -6.0% now to 4.0% within three years, flipping from loss to profit as Corsair implements efficiency measures and shifts its product mix.

- Analysts' consensus view expects that higher-margin premium categories and growth in direct-to-consumer sales will drive both gross margin expansion and stronger operational leverage.

- Ongoing innovation, such as AI-enabled products and modular peripherals, is positioned to support earnings growth. Efficient supply chain management should help mitigate cost pressures.

- Rising costs in R&D and product launches will need to be balanced by these margin improvements, or earnings growth could slow despite topline expansion.

- To see the full context behind these profit targets, check out how analysts weigh Corsair's strengths and risks in their complete narrative. 📊 Read the full Corsair Gaming Consensus Narrative.

Valuation Stands Out Versus Peers

- Corsair's price-to-sales ratio is 0.5x, significantly below both the US tech industry average of 1.8x and its peer average of 4.6x. This suggests the stock is viewed as undervalued by conventional metrics.

- According to the consensus narrative, this low multiple, combined with forecasts for Corsair to become profitable within three years, is seen as offering a compelling entry point for turnaround investors.

- The current share price of $6.53 remains well under the DCF fair value of $28.75, and also below the consensus analyst price target of $10.44, a 59.9% upside from today’s price.

- If Corsair meets expectations for $75.7 million in earnings by 2028, the projected PE ratio of 20.8x would be in line with the broader US tech industry. This would address concerns about persistent unprofitability.

Revenue Trajectory Hinges on Next-Gen Trends

- Corsair's annual revenue is forecast to grow at 8.7%, a bit below the broader US market average of 10.5%, but with analysts projecting faster acceleration to 10.6% over the next three years if catalysts materialize.

- Consensus narrative points out that strong demand for creator equipment and next-gen gaming (including real-time ray tracing, eSports, and AI rendering) is expected to fuel both high-margin product sales and strategic international growth.

- Growth in direct-to-consumer channels and expansion into regions like Asia and Latin America could amplify revenue momentum, though success depends on Corsair executing well on these opportunities.

- Nevertheless, heavy reliance on high-profile game launches and PC upgrade cycles means that volatility is possible if market demand shifts or if new product lines need longer to scale.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Corsair Gaming on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you interpret the results another way? Share your own perspective and shape the story in just minutes: Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Corsair Gaming.

See What Else Is Out There

Despite Corsair’s upside potential, its uneven revenue growth and years of mounting losses highlight risks related to consistent profitability and long-term stability.

If you value reliable track records, rely on stable growth stocks screener (2073 results) to spot companies delivering steady earnings and revenue through changing market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRSR

Corsair Gaming

Designs and sells gaming and streaming peripherals, components, and systems in Europe, the Middle East, North Africa, North America, Latin America, and the Asia Pacific.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives