- United States

- /

- Chemicals

- /

- NasdaqCM:ALTO

3 Promising Penny Stocks With Market Caps Up To $300M

Reviewed by Simply Wall St

As U.S. markets navigate a landscape marked by fluctuating indices and record highs in safe-haven assets like gold, investors are keenly assessing opportunities amid ongoing economic uncertainties. For those looking beyond the well-trodden paths of large-cap stocks, penny stocks—often representing smaller or newer companies—present intriguing possibilities. Despite the term's historical connotations, these investments remain relevant today, offering potential growth at attractive price points when backed by strong fundamentals and resilient balance sheets.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.86 | $387.89M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.86 | $647.38M | ✅ 4 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.76 | $275.17M | ✅ 4 ⚠️ 2 View Analysis > |

| WM Technology (MAPS) | $1.14 | $189.83M | ✅ 4 ⚠️ 2 View Analysis > |

| Global Self Storage (SELF) | $4.93 | $55.56M | ✅ 5 ⚠️ 1 View Analysis > |

| Performance Shipping (PSHG) | $1.8401 | $23.5M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.26 | $554.22M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.9848 | $6.97M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.61 | $77.26M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 357 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Alto Ingredients (ALTO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Alto Ingredients, Inc. is involved in the production, distribution, and marketing of specialty alcohols, renewable fuels, and essential ingredients in the United States with a market cap of $86.69 million.

Operations: The company's revenue is primarily derived from Pekin Campus Production at $576.59 million, Western Production at $150.51 million, and Marketing and Distribution at $209.62 million.

Market Cap: $86.69M

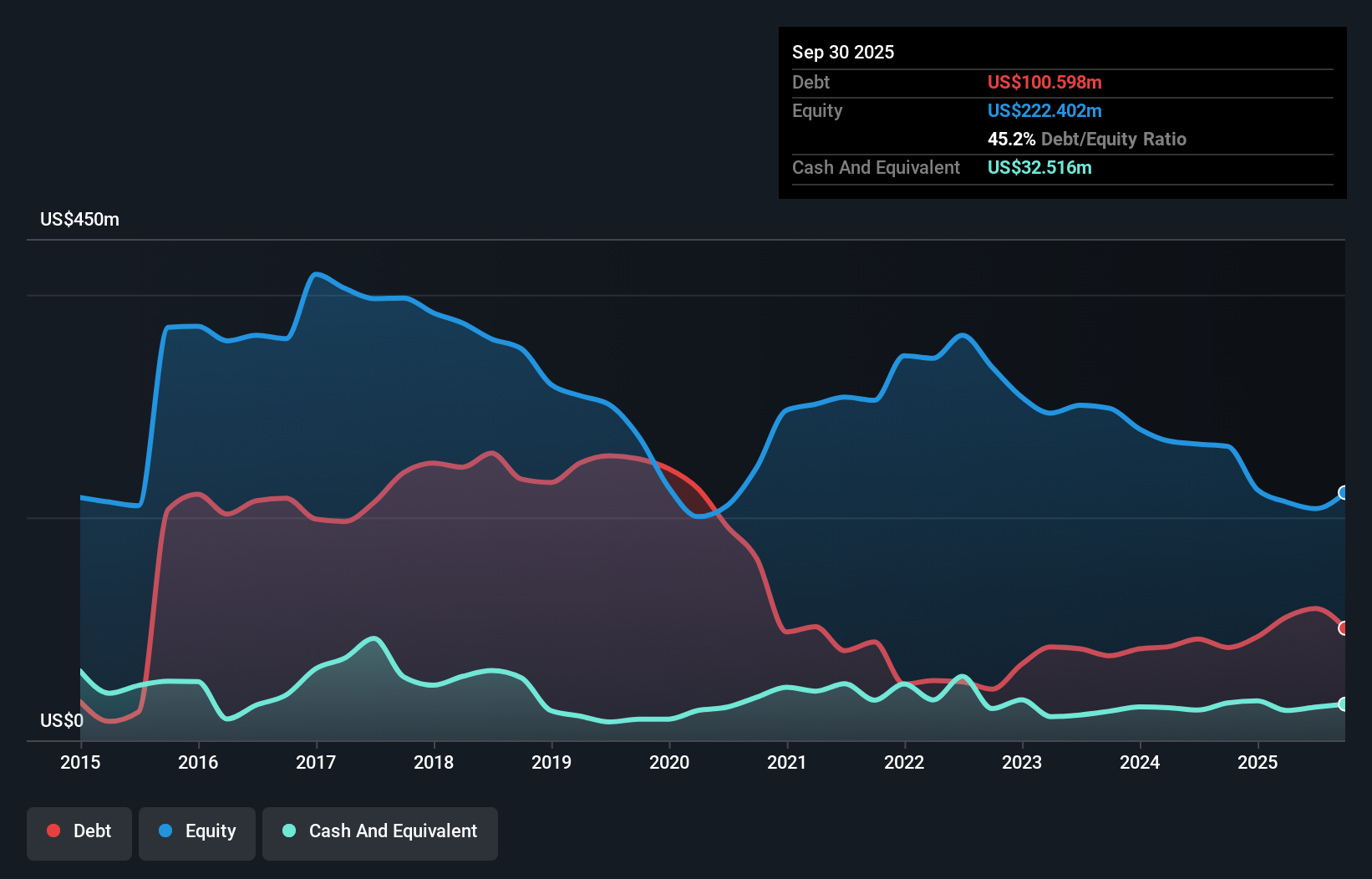

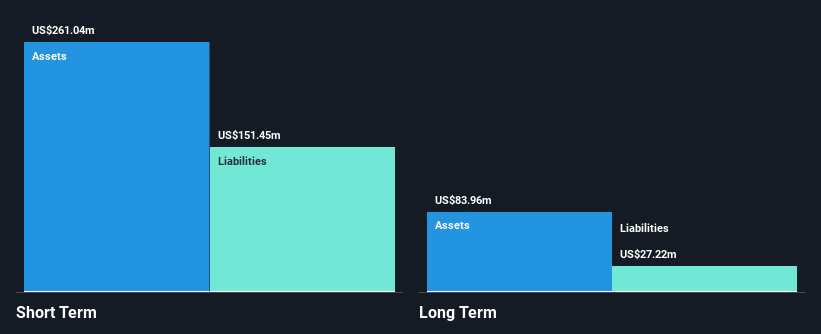

Alto Ingredients, with a market cap of US$86.69 million, is navigating the penny stock landscape with mixed financial health indicators. Despite reducing its debt to equity ratio from 91.1% to 56.9% over five years, the company remains unprofitable and has seen losses increase annually by 25.6%. Recent earnings reports highlight a decline in sales and widening net losses compared to the previous year, reflecting ongoing challenges in achieving profitability. However, Alto's short-term assets exceed both its short-term and long-term liabilities, providing some financial stability amidst high share price volatility and an inexperienced board.

- Take a closer look at Alto Ingredients' potential here in our financial health report.

- Learn about Alto Ingredients' future growth trajectory here.

Ceragon Networks (CRNT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ceragon Networks Ltd. offers wireless transport solutions for cellular operators and other wireless service providers across various global regions, with a market cap of approximately $218.43 million.

Operations: Ceragon Networks generates revenue of $380.52 million from its role as a global innovator and leading solutions provider in wireless transport.

Market Cap: $218.43M

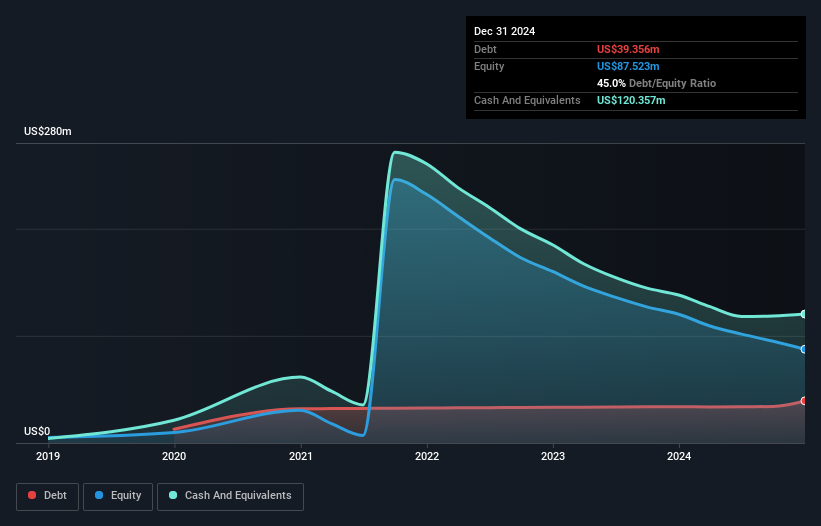

Ceragon Networks, with a market cap of US$218.43 million, is making strides in the penny stock arena by leveraging its established position in wireless transport solutions. Despite recent earnings showing a net loss of US$1.27 million for Q2 2025, the company has maintained profitability over five years with annual earnings growth of 54.6%. Its strong balance sheet features short-term assets exceeding both short- and long-term liabilities, while debt is well-covered by operating cash flow. Recent product innovations and strategic partnerships are poised to enhance revenue streams, although challenges remain in sustaining consistent profit margins amidst industry volatility.

- Dive into the specifics of Ceragon Networks here with our thorough balance sheet health report.

- Examine Ceragon Networks' earnings growth report to understand how analysts expect it to perform.

Sight Sciences (SGHT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sight Sciences, Inc. is an ophthalmic medical device company that develops and commercializes surgical and nonsurgical technologies for treating prevalent eye diseases, with a market cap of $174.38 million.

Operations: Sight Sciences generates revenue through two main segments: Dry Eye, contributing $2.56 million, and Surgical Glaucoma, accounting for $73.75 million.

Market Cap: $174.38M

Sight Sciences, Inc., with a market cap of US$174.38 million, is navigating the penny stock landscape through its focus on ophthalmic medical devices. The company remains unprofitable but has reduced losses over five years and forecasts revenue growth of 10.08% annually. Its short-term assets significantly exceed liabilities, providing a stable financial footing alongside more cash than debt and an experienced board with an average tenure of 5.3 years. Recent amendments to its Hercules Loan Agreement extend interest-only periods, supporting liquidity while clinical studies highlight the effectiveness of its OMNI Surgical System in reducing intraocular pressure for glaucoma patients.

- Jump into the full analysis health report here for a deeper understanding of Sight Sciences.

- Evaluate Sight Sciences' prospects by accessing our earnings growth report.

Taking Advantage

- Unlock more gems! Our US Penny Stocks screener has unearthed 354 more companies for you to explore.Click here to unveil our expertly curated list of 357 US Penny Stocks.

- Looking For Alternative Opportunities? Uncover 9 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ALTO

Alto Ingredients

Produces, distributes, and markets specialty alcohols, renewable fuel, and essential ingredients in the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026