- United States

- /

- Communications

- /

- NasdaqGS:COMM

How CommScope's AI-Driven RUCKUS MDU Suite Launch Could Shape the (COMM) Investment Narrative

Reviewed by Sasha Jovanovic

- CommScope recently announced the launch of its new RUCKUS® MDU suite, featuring AI-powered management capabilities and Wi-Fi 7 technology to enhance connectivity for multi-dwelling unit properties.

- This suite introduces an AI-driven assistant and advanced analytics to simplify network management and improve resident experiences in residential complexes, highlighting CommScope’s focus on digital transformation in connected living spaces.

- We'll examine how the integration of AI-powered analytics in the RUCKUS suite could influence CommScope's forward-looking investment narrative.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

CommScope Holding Company Investment Narrative Recap

Investors considering CommScope are betting on the company’s ability to shift from a hardware-focused business to an integrated provider of AI-driven connectivity solutions, especially as it leverages technology upgrades like Wi-Fi 7 and cloud-based analytics. The recent RUCKUS MDU suite launch is a potential short-term catalyst, but it does not materially offset lingering risks related to revenue concentration and the cyclical, project-driven nature of CommScope’s remaining businesses following the CCS divestiture.

The DOCSIS 4.0 amplifier deployment with Comcast, announced in September 2025, directly supports CommScope’s growth narrative around broadband infrastructure upgrades and reinforces the importance of timely next-gen rollouts for revenue stability. While strong product innovation is a positive, future growth for CommScope still depends heavily on the speed and scale of technology adoption by key clients, underscoring the project-driven uncertainties facing the business.

However, investors should also consider the risk of customer concentration in the ANS segment and what that means if a major partner scales back or delays spending...

Read the full narrative on CommScope Holding Company (it's free!)

CommScope Holding Company is projected to reach $6.7 billion in revenue and $139.1 million in earnings by 2028. This outlook is based on a forecasted annual revenue growth rate of 12.3% and an increase in earnings of $48.8 million from the current $90.3 million.

Uncover how CommScope Holding Company's forecasts yield a $22.67 fair value, a 32% upside to its current price.

Exploring Other Perspectives

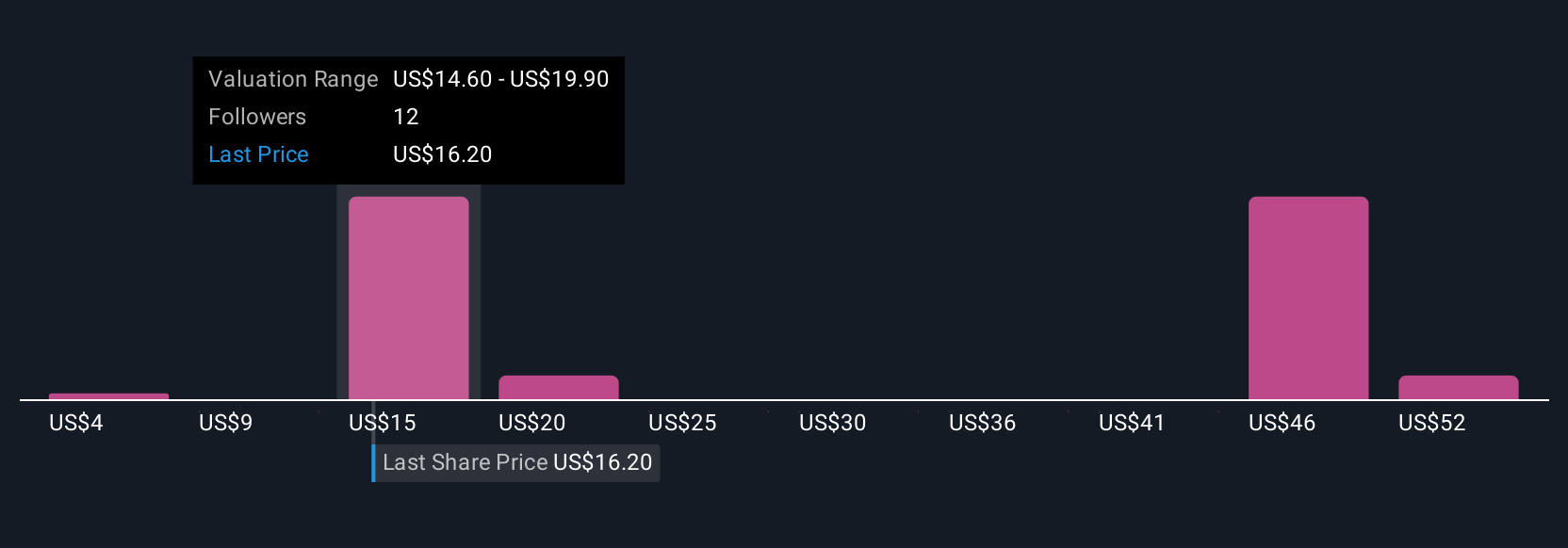

Six members of the Simply Wall St Community value CommScope from as little as US$13.93 to as high as US$53.27 per share. Many see strength in network upgrades and emerging enterprise solutions, but concentrated revenue streams could still drive volatile performance, review these varied perspectives to broaden your view.

Explore 6 other fair value estimates on CommScope Holding Company - why the stock might be worth 19% less than the current price!

Build Your Own CommScope Holding Company Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CommScope Holding Company research is our analysis highlighting 5 key rewards and 4 important warning signs that could impact your investment decision.

- Our free CommScope Holding Company research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CommScope Holding Company's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COMM

CommScope Holding Company

Provides infrastructure solutions for communications, data center, and entertainment networks.

Very undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives