- United States

- /

- Communications

- /

- NasdaqGS:COMM

Further Upside For CommScope Holding Company, Inc. (NASDAQ:COMM) Shares Could Introduce Price Risks After 28% Bounce

CommScope Holding Company, Inc. (NASDAQ:COMM) shares have had a really impressive month, gaining 28% after a shaky period beforehand. The annual gain comes to 234% following the latest surge, making investors sit up and take notice.

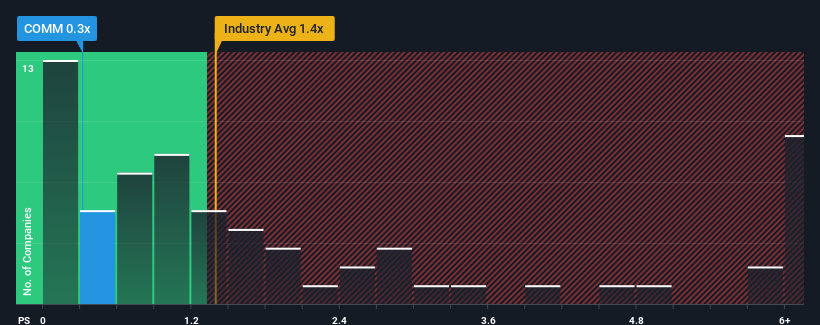

Although its price has surged higher, when close to half the companies operating in the United States' Communications industry have price-to-sales ratios (or "P/S") above 1.4x, you may still consider CommScope Holding Company as an enticing stock to check out with its 0.3x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for CommScope Holding Company

How Has CommScope Holding Company Performed Recently?

While the industry has experienced revenue growth lately, CommScope Holding Company's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on CommScope Holding Company.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as CommScope Holding Company's is when the company's growth is on track to lag the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 27%. As a result, revenue from three years ago have also fallen 38% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 8.9% each year as estimated by the five analysts watching the company. That's shaping up to be similar to the 9.1% per annum growth forecast for the broader industry.

In light of this, it's peculiar that CommScope Holding Company's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does CommScope Holding Company's P/S Mean For Investors?

The latest share price surge wasn't enough to lift CommScope Holding Company's P/S close to the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It looks to us like the P/S figures for CommScope Holding Company remain low despite growth that is expected to be in line with other companies in the industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with CommScope Holding Company (at least 1 which is concerning), and understanding them should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:COMM

CommScope Holding Company

Provides infrastructure solutions for communications, data center, and entertainment networks.

Very undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives