- United States

- /

- Communications

- /

- NasdaqGS:COMM

CommScope Holding Company, Inc.'s (NASDAQ:COMM) Price Is Right But Growth Is Lacking After Shares Rocket 107%

Despite an already strong run, CommScope Holding Company, Inc. (NASDAQ:COMM) shares have been powering on, with a gain of 107% in the last thirty days. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 44% over that time.

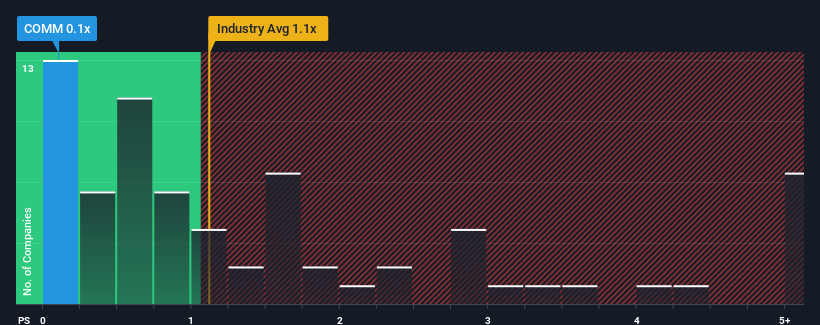

Although its price has surged higher, given about half the companies operating in the United States' Communications industry have price-to-sales ratios (or "P/S") above 1.1x, you may still consider CommScope Holding Company as an attractive investment with its 0.1x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for CommScope Holding Company

How CommScope Holding Company Has Been Performing

CommScope Holding Company could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on CommScope Holding Company will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For CommScope Holding Company?

CommScope Holding Company's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 24% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 38% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 2.7% as estimated by the eight analysts watching the company. With the industry predicted to deliver 4.6% growth, that's a disappointing outcome.

In light of this, it's understandable that CommScope Holding Company's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

CommScope Holding Company's stock price has surged recently, but its but its P/S still remains modest. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that CommScope Holding Company's P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, CommScope Holding Company's poor outlook justifies its low P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 3 warning signs for CommScope Holding Company (of which 2 are a bit concerning!) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COMM

CommScope Holding Company

Provides infrastructure solutions for communications, data center, and entertainment networks.

Very undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives