- United States

- /

- Communications

- /

- NasdaqGS:COMM

CommScope (COMM) Is Up 5.3% After HQ Move and Return to Profitability Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- CommScope Holding Company, Inc. relocated its corporate headquarters to 2601 Telecom Parkway, Richardson, Texas on November 1, 2025, following its recent announcement of third-quarter and nine-month earnings results showing a substantial turnaround from losses to profits.

- This marked improvement in both sales and net income highlights a major operational shift and suggests renewed confidence in the company’s direction and prospects.

- We’ll explore how CommScope’s swing to profitability in its latest results might influence its broader investment narrative going forward.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

CommScope Holding Company Investment Narrative Recap

For an investor to be a shareholder in CommScope, confidence is required in the company's ability to sustain growth in its remaining segments after the sale of its high-performing CCS business, and to effectively manage significant customer concentration and the cyclical nature of project-driven revenues. The recent relocation of the corporate headquarters to Richardson, Texas, does not materially impact the short-term catalyst, which remains the pace and scale of DOCSIS 4.0 deployments by major cable operators, or the biggest risk, namely revenue unpredictability as the business becomes more focused and less diversified.

Of the company’s recent announcements, the collaboration with Comcast to launch Full Duplex DOCSIS amplifiers is most relevant to the current narrative. This direct engagement with a key anchor client highlights CommScope’s deep links into the cable operator upgrade cycle, which remains both the main catalyst for growth and a source of considerable risk due to its inherent timing and customer concentration dynamics.

In contrast, some investors may not fully appreciate how concentrated exposure to a few large cable customers can sharply impact CommScope’s revenue if industry spending patterns shift...

Read the full narrative on CommScope Holding Company (it's free!)

CommScope Holding Company's outlook projects $6.7 billion in revenue and $139.1 million in earnings by 2028. This scenario requires 12.3% annual revenue growth with earnings increasing by $48.8 million from the current $90.3 million.

Uncover how CommScope Holding Company's forecasts yield a $21.33 fair value, a 29% upside to its current price.

Exploring Other Perspectives

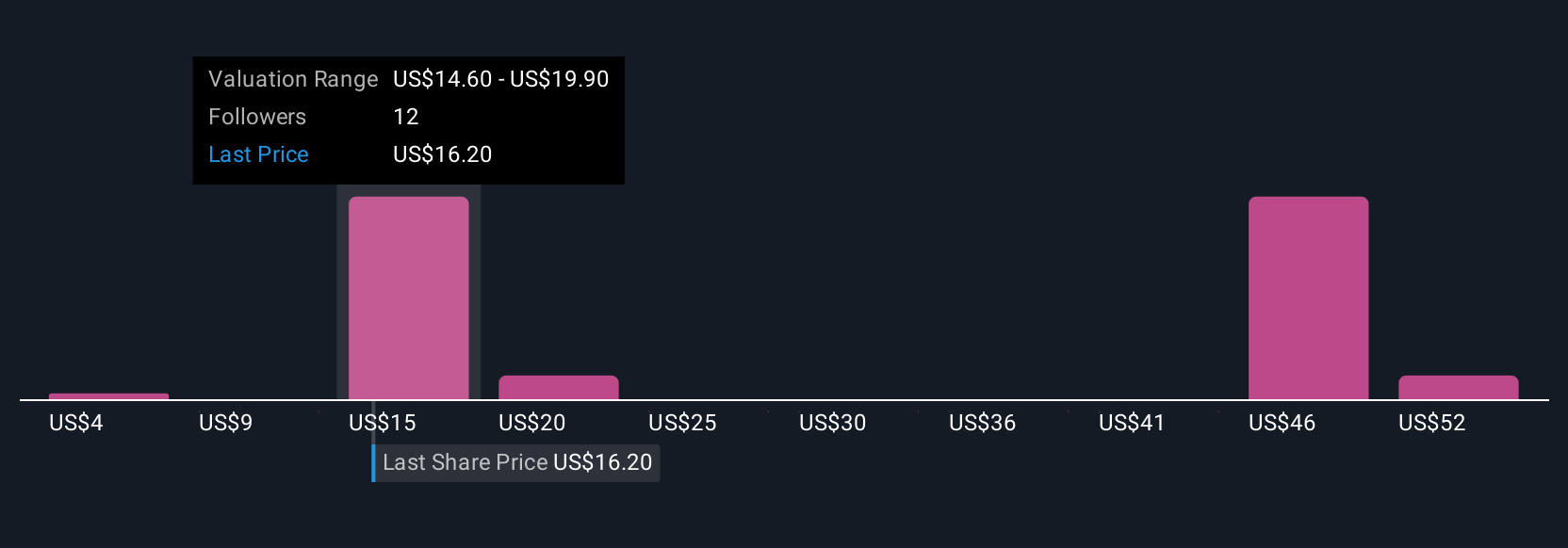

Eight individual members of the Simply Wall St Community have published fair value estimates ranging from US$4 to US$56.99 per share. While many focus on projected DOCSIS 4.0 adoption as a possible growth driver, these differences remind you to review a variety of market opinions and scenarios.

Explore 8 other fair value estimates on CommScope Holding Company - why the stock might be worth over 3x more than the current price!

Build Your Own CommScope Holding Company Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CommScope Holding Company research is our analysis highlighting 5 key rewards and 4 important warning signs that could impact your investment decision.

- Our free CommScope Holding Company research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CommScope Holding Company's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COMM

CommScope Holding Company

Provides infrastructure solutions for communications, data center, and entertainment networks.

Very undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives