- United States

- /

- IT

- /

- NasdaqGS:BCOV

Brightcove And 2 More US Penny Stocks To Watch

Reviewed by Simply Wall St

Major U.S. stock indexes have experienced mixed performance, with the Nasdaq and S&P 500 gaining ground while the Dow Jones Industrial Average faces a potential fifth straight decline. For investors looking beyond large-cap stocks, penny stocks—often representing smaller or newer companies—can present intriguing opportunities. Although the term "penny stocks" may seem outdated, these investments continue to hold relevance by offering growth potential at lower price points when backed by strong financials and fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.7553 | $5.71M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.15 | $526.12M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.60 | $2.03B | ★★★★★★ |

| ARC Document Solutions (NYSE:ARC) | $3.43 | $147.91M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.58 | $53.13M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $3.68 | $112.23M | ★★★★★★ |

| MIND C.T.I (NasdaqGM:MNDO) | $1.88 | $39.99M | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.05 | $96.23M | ★★★★★☆ |

Click here to see the full list of 760 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Brightcove (NasdaqGS:BCOV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Brightcove Inc. offers cloud-based streaming services across various regions including the Americas, Europe, Asia Pacific, Japan, India, and the Middle East with a market cap of $94.34 million.

Operations: The company generates its revenue primarily from the Software & Programming segment, which amounts to $200.86 million.

Market Cap: $94.34M

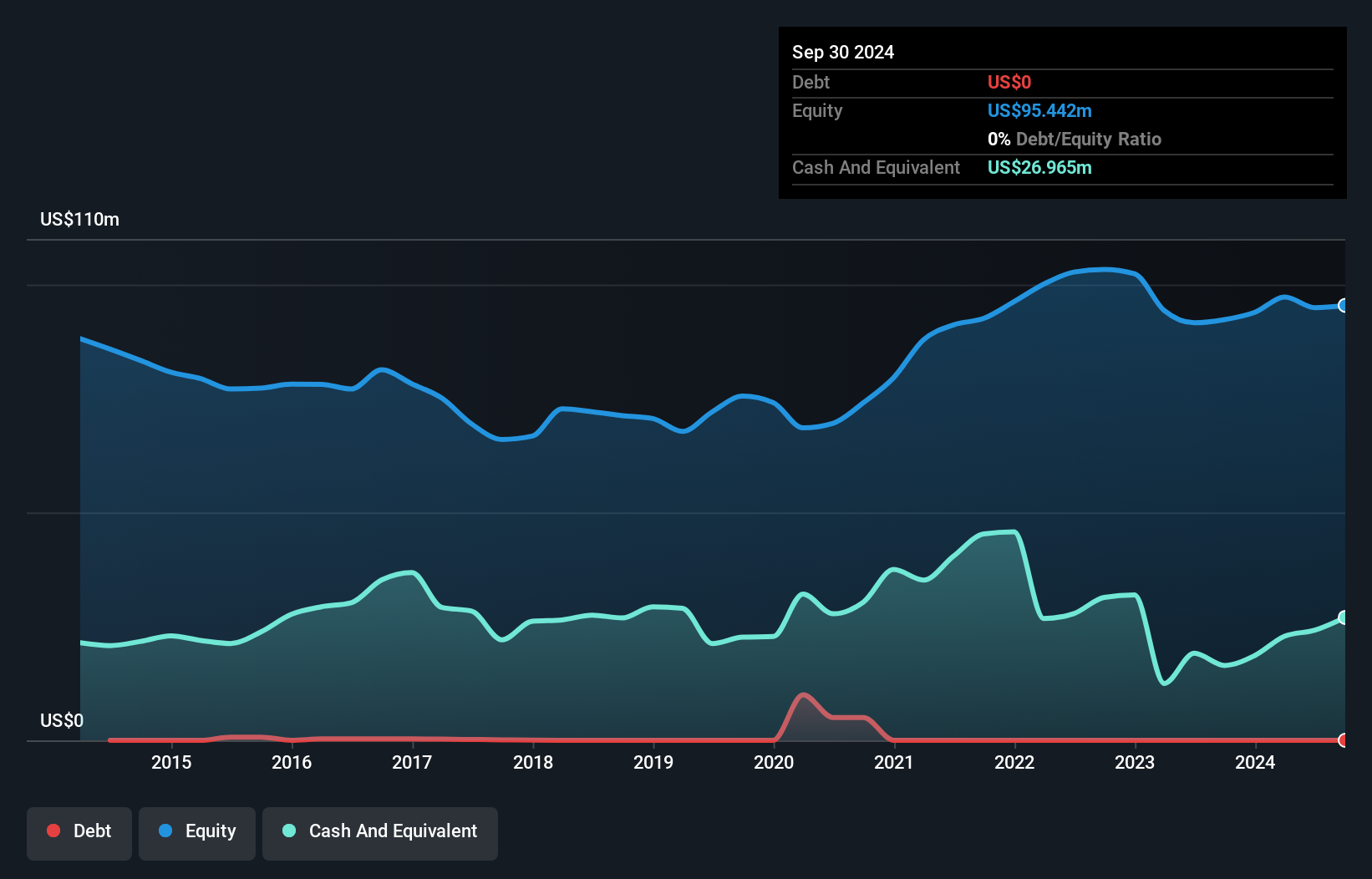

Brightcove Inc., with a market cap of US$94.34 million, operates in the cloud-based streaming sector, generating revenue primarily from its Software & Programming segment. Despite being unprofitable, the company has reduced losses over five years and maintains a sufficient cash runway for over three years due to positive free cash flow. Recent earnings showed a slight revenue decline compared to last year, but net loss improved significantly. The company raised its full-year 2024 revenue guidance slightly and remains debt-free, though shareholders experienced dilution with increased shares outstanding by 3.9%.

- Jump into the full analysis health report here for a deeper understanding of Brightcove.

- Learn about Brightcove's future growth trajectory here.

Comtech Telecommunications (NasdaqGS:CMTL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Comtech Telecommunications Corp., along with its subsidiaries, provides next-generation telecommunication solutions both in the United States and internationally, with a market capitalization of approximately $103.92 million.

Operations: The company generates revenue from two main segments: Terrestrial and Wireless Networks, contributing $216.36 million, and Satellite and Space Communications, which accounts for $346.66 million.

Market Cap: $103.92M

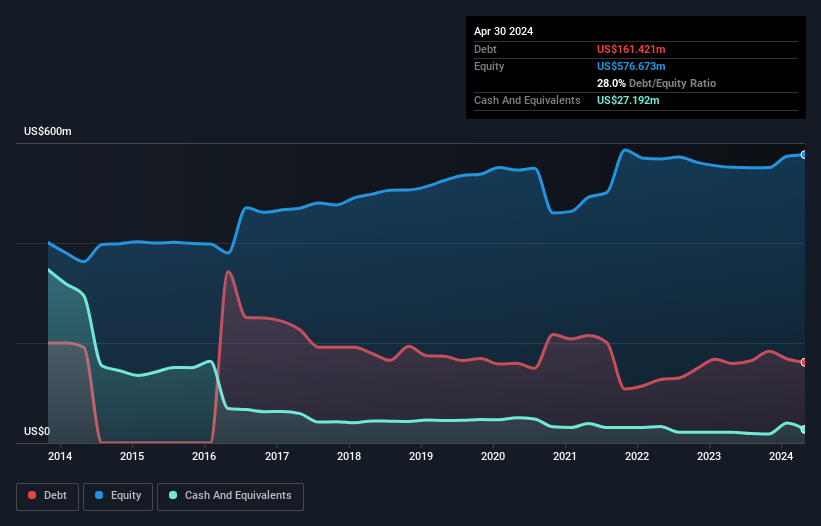

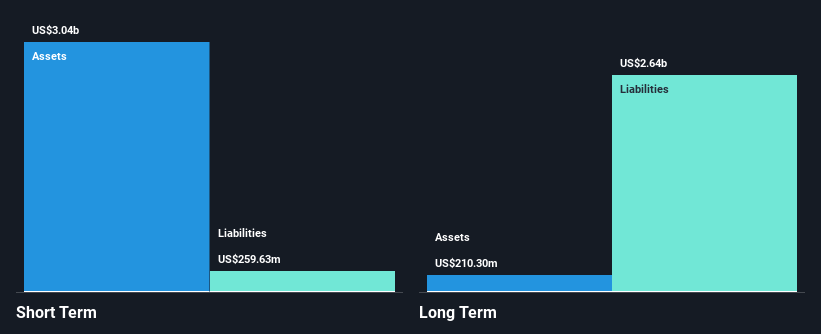

Comtech Telecommunications, with a market cap of US$103.92 million, operates in the telecommunications sector, generating significant revenue from its Terrestrial and Wireless Networks (US$216.36 million) and Satellite and Space Communications (US$346.66 million) segments. Despite its unprofitability and increasing losses over the past five years, Comtech's short-term assets exceed both short- and long-term liabilities, indicating a stable financial position relative to debt obligations. The company faces internal challenges with recent executive changes and board nominations aimed at strategic redirection. Recent client contracts highlight potential growth opportunities in defense communications technology despite ongoing volatility concerns.

- Dive into the specifics of Comtech Telecommunications here with our thorough balance sheet health report.

- Assess Comtech Telecommunications' future earnings estimates with our detailed growth reports.

Oportun Financial (NasdaqGS:OPRT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Oportun Financial Corporation offers financial services and has a market cap of approximately $94.31 million.

Operations: The company's revenue segment includes Financial Services - Consumer, generating $824.04 million.

Market Cap: $94.31M

Oportun Financial Corporation, with a market cap of US$94.31 million, is navigating financial challenges as it remains unprofitable and has seen losses increase over the past five years. Despite this, the company has a positive cash flow and sufficient cash runway for more than three years. However, its high net debt to equity ratio of 768.8% raises concerns about financial leverage. Recent earnings reports show decreasing revenue and increasing net losses compared to previous periods, while activist investors have called for board changes due to perceived value destruction. The company recently secured a US$245 million warehouse facility to support loan originations.

- Click here to discover the nuances of Oportun Financial with our detailed analytical financial health report.

- Examine Oportun Financial's earnings growth report to understand how analysts expect it to perform.

Seize The Opportunity

- Jump into our full catalog of 760 US Penny Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brightcove might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BCOV

Brightcove

Provides cloud-based streaming services the Americas, Europe, the Asia Pacific, Japan, India, and the Middle East.

Excellent balance sheet and fair value.