- United States

- /

- Communications

- /

- NasdaqGM:CMBM

After Leaping 30% Cambium Networks Corporation (NASDAQ:CMBM) Shares Are Not Flying Under The Radar

Cambium Networks Corporation (NASDAQ:CMBM) shareholders are no doubt pleased to see that the share price has bounced 30% in the last month, although it is still struggling to make up recently lost ground. But the last month did very little to improve the 72% share price decline over the last year.

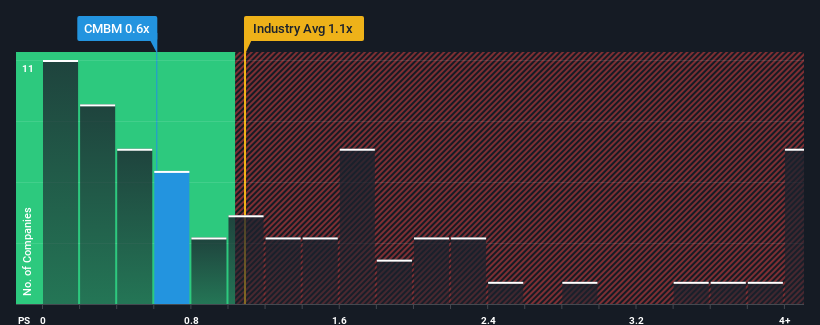

Although its price has surged higher, you could still be forgiven for feeling indifferent about Cambium Networks' P/S ratio of 0.6x, since the median price-to-sales (or "P/S") ratio for the Communications industry in the United States is also close to 1.1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Cambium Networks

What Does Cambium Networks' Recent Performance Look Like?

While the industry has experienced revenue growth lately, Cambium Networks' revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Cambium Networks.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Cambium Networks' is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 9.1%. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 2.8% each year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 3.6% per annum, which is not materially different.

In light of this, it's understandable that Cambium Networks' P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Bottom Line On Cambium Networks' P/S

Cambium Networks appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've seen that Cambium Networks maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Cambium Networks, and understanding them should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:CMBM

Cambium Networks

Designs, develops, and manufactures fixed wireless, fiber broadband, and enterprise networking infrastructure solutions in North America, Europe, the Middle East, Africa, the Caribbean and Latin America, and the Asia Pacific.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives