- United States

- /

- Communications

- /

- NasdaqCM:CLRO

Most Shareholders Will Probably Agree With ClearOne, Inc.'s (NASDAQ:CLRO) CEO Compensation

Under the guidance of CEO Zee Hakimoglu, ClearOne, Inc. (NASDAQ:CLRO) has performed reasonably well recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 25 August 2021. Based on our analysis of the data below, we think CEO compensation seems reasonable for now.

Check out our latest analysis for ClearOne

How Does Total Compensation For Zee Hakimoglu Compare With Other Companies In The Industry?

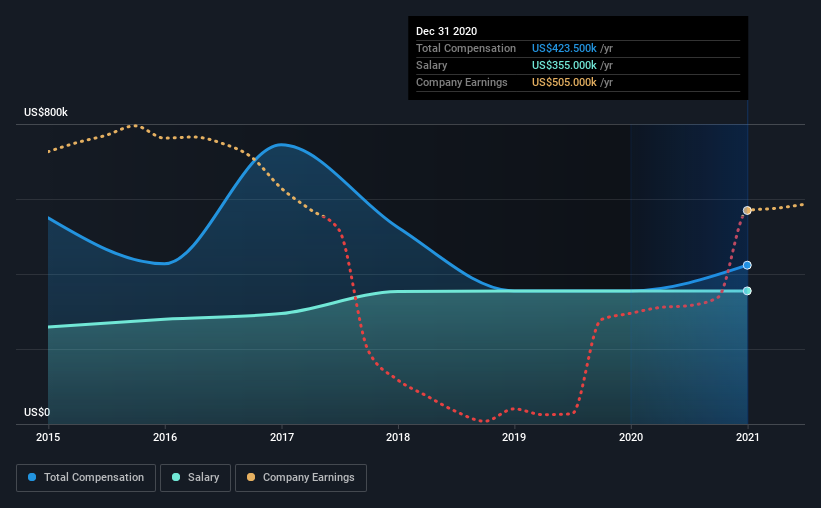

At the time of writing, our data shows that ClearOne, Inc. has a market capitalization of US$48m, and reported total annual CEO compensation of US$424k for the year to December 2020. Notably, that's an increase of 19% over the year before. We note that the salary portion, which stands at US$355.0k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the industry with market capitalizations below US$200m, reported a median total CEO compensation of US$556k. This suggests that ClearOne remunerates its CEO largely in line with the industry average. Moreover, Zee Hakimoglu also holds US$2.2m worth of ClearOne stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$355k | US$355k | 84% |

| Other | US$69k | - | 16% |

| Total Compensation | US$424k | US$355k | 100% |

Speaking on an industry level, nearly 22% of total compensation represents salary, while the remainder of 78% is other remuneration. ClearOne pays out 84% of remuneration in the form of a salary, significantly higher than the industry average. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

ClearOne, Inc.'s Growth

ClearOne, Inc. has seen its earnings per share (EPS) increase by 90% a year over the past three years. Its revenue is up 30% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. Most shareholders would be pleased to see strong revenue growth combined with EPS growth. This combo suggests a fast growing business. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has ClearOne, Inc. Been A Good Investment?

ClearOne, Inc. has not done too badly by shareholders, with a total return of 7.5%, over three years. It would be nice to see that metric improve in the future. Accordingly, a proposal to increase CEO remuneration without seeing an improvement in shareholder returns might not be met favorably by most shareholders.

To Conclude...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. However, we still think that any proposed increase in CEO compensation will be examined closely to make sure the compensation is appropriate and linked to performance.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We did our research and spotted 3 warning signs for ClearOne that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading ClearOne or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:CLRO

ClearOne

Designs, develops, and sells conferencing, collaboration, and network streaming solutions for voice and visual communications in the United States and internationally.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives