- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:CGNX

Is Cognex's (CGNX) New AI Focus a Real Shift in Competitive Positioning?

Reviewed by Sasha Jovanovic

- Cognex Corporation presented at the Stephens Annual Investment Conference in Nashville on November 19, 2025, highlighting its latest company updates and technological progress.

- Artisan Small Cap Fund recently reestablished its position in Cognex, attributing the move to a refreshed management approach, commitment to customer service, cost efficiency, and new AI-driven opportunities among previously unreachable customers.

- We'll explore how the fund's renewed investment and Cognex's AI cost-reduction strategies may influence its growth potential and proposed investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Cognex Investment Narrative Recap

To be a Cognex shareholder today, you must believe in the company’s ability to drive long-term growth through AI-powered vision solutions and cost efficiencies, despite competitive pricing pressures and uncertainty in key cyclical markets. The recent announcements at the Stephens Investment Conference reinforce Cognex’s efforts on expanding its customer reach through AI, but these developments do not fundamentally change the immediate catalyst of a potential cyclical recovery or the persistent risk of margin erosion from commoditization and competition.

Among recent developments, the appointment of Matt Moschner as CEO is most relevant, given his emphasis on customer centricity and AI-driven initiatives. This leadership transition aligns with current investor focus on Cognex’s ability to execute operational improvements and pursue higher-value growth opportunities across diversified end markets.

However, investors should also keep in mind the ongoing risk around continued pricing pressures and...

Read the full narrative on Cognex (it's free!)

Cognex's outlook anticipates $1.2 billion in revenue and $241.2 million in earnings by 2028. This scenario relies on annual revenue growth of 10.2% and a $119.1 million increase in earnings from the current $122.1 million.

Uncover how Cognex's forecasts yield a $48.90 fair value, a 40% upside to its current price.

Exploring Other Perspectives

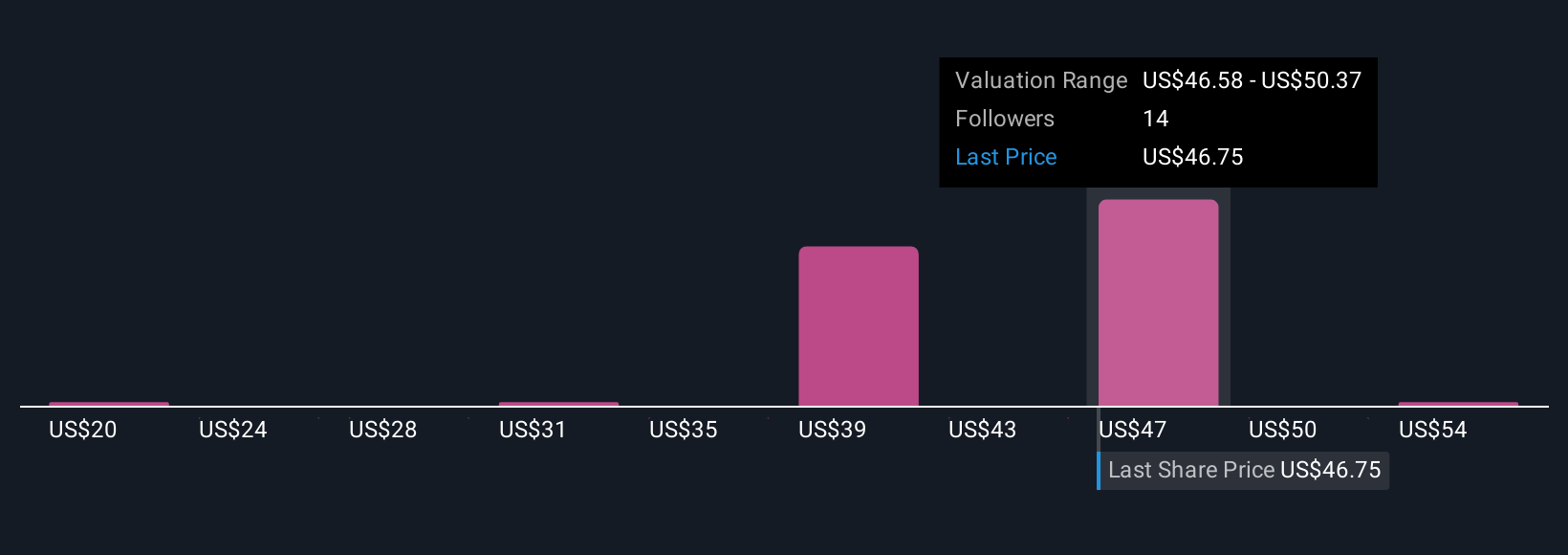

Simply Wall St Community members produced four fair value estimates for Cognex, ranging widely from US$20 to US$48.90 per share. In light of persistent pricing competition and potential margin pressure, your expectations for Cognex’s future pricing power could shape your own outlook, consider reviewing several viewpoints before drawing conclusions.

Explore 4 other fair value estimates on Cognex - why the stock might be worth 43% less than the current price!

Build Your Own Cognex Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cognex research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Cognex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cognex's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CGNX

Cognex

Provides machine vision products that capture and analyze visual information to automate manufacturing and distribution tasks worldwide.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives