- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:BELF.B

Does Bel Fuse Inc. (NASDAQ:BELF.B) Have A Place In Your Dividend Portfolio?

Today we'll take a closer look at Bel Fuse Inc. (NASDAQ:BELF.B) from a dividend investor's perspective. Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth. If you are hoping to live on your dividends, it's important to be more stringent with your investments than the average punter. Regular readers know we like to apply the same approach to each dividend stock, and we hope you'll find our analysis useful.

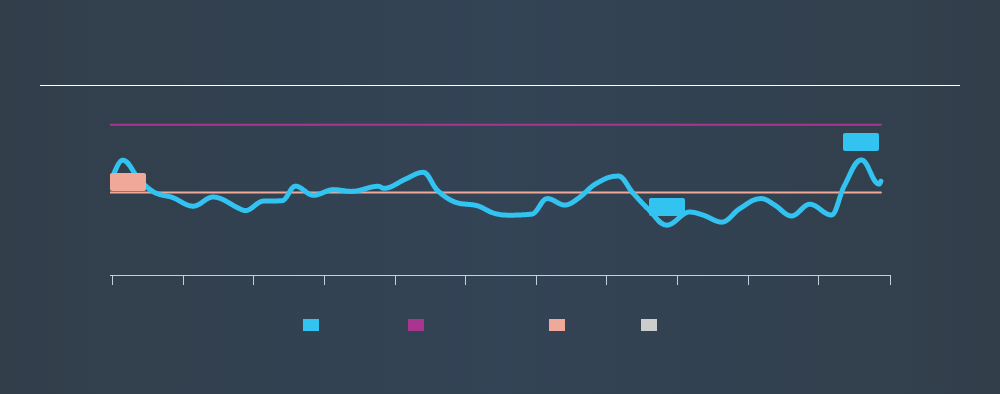

A slim 1.7% yield is hard to get excited about, but the long payment history is respectable. At the right price, or with strong growth opportunities, Bel Fuse could have potential. Remember though, due to the recent spike in its share price, Bel Fuse's yield will look lower, even though the market may now be factoring in an improvement in its long-term prospects. When buying stocks for their dividends, you should always run through the checks below, to see if the dividend looks sustainable.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. Looking at the data, we can see that 210% of Bel Fuse's profits were paid out as dividends in the last 12 months. A payout ratio above 100% is definitely an item of concern, unless there are some other circumstances that would justify it.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. Bel Fuse's cash payout ratio last year was 24%, which is quite low and suggests that the dividend was thoroughly covered by cash flow. It's good to see that while Bel Fuse's dividends were not covered by profits, at least they are affordable from a cash perspective. Still, if the company repeatedly paid a dividend greater than its profits, we'd be concerned. Very few companies are able to sustainably pay dividends larger than their reported earnings.

Is Bel Fuse's Balance Sheet Risky?

As Bel Fuse's dividend was not well covered by earnings, we need to check its balance sheet for signs of financial distress. A quick check of its financial situation can be done with two ratios: net debt divided by EBITDA (earnings before interest, tax, depreciation and amortisation), and net interest cover. Net debt to EBITDA measures total debt load relative to company earnings (lower = less debt), while net interest cover measures the ability to pay interest on the debt (higher = greater ability to pay interest costs). Bel Fuse has net debt of 1.46 times its EBITDA, which we think is not too troublesome.

We calculated its interest cover by measuring its earnings before interest and tax (EBIT), and dividing this by the company's net interest expense. With EBIT of 3.10 times its interest expense, Bel Fuse's interest cover is starting to look a bit thin.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. For the purpose of this article, we only scrutinise the last decade of Bel Fuse's dividend payments. The dividend has been stable over the past 10 years, which is great. We think this could suggest some resilience to the business and its dividends. Its most recent annual dividend was US$0.28 per share, effectively flat on its first payment ten years ago.

Dividend Growth Potential

While dividend payments have been relatively reliable, it would also be nice if earnings per share (EPS) were growing, as this is essential to maintaining the dividend's purchasing power over the long term. Over the past five years, it looks as though Bel Fuse's EPS have declined at around 37% a year. With this kind of significant decline, we always wonder what has changed in the business. Dividends are about stability, and Bel Fuse's earnings per share, which support the dividend, have been anything but stable.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. We're a bit uncomfortable with its high payout ratio, although at least the dividend was covered by free cash flow. Second, earnings per share have actually shrunk, but at least the dividends have been relatively stable. Ultimately, Bel Fuse comes up short on our dividend analysis. It's not that we think it is a bad company - just that there are likely more appealing dividend prospects out there on this analysis.

Are management backing themselves to deliver performance? Check their shareholdings in Bel Fuse in our latest insider ownership analysis.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:BELF.B

Bel Fuse

Designs, manufactures, markets, and sells products that power, protect, and connect electronic circuits.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives