- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:AVT

Avnet (AVT) Margin Miss Raises Questions About Quality of Earnings Despite Growth Narrative

Reviewed by Simply Wall St

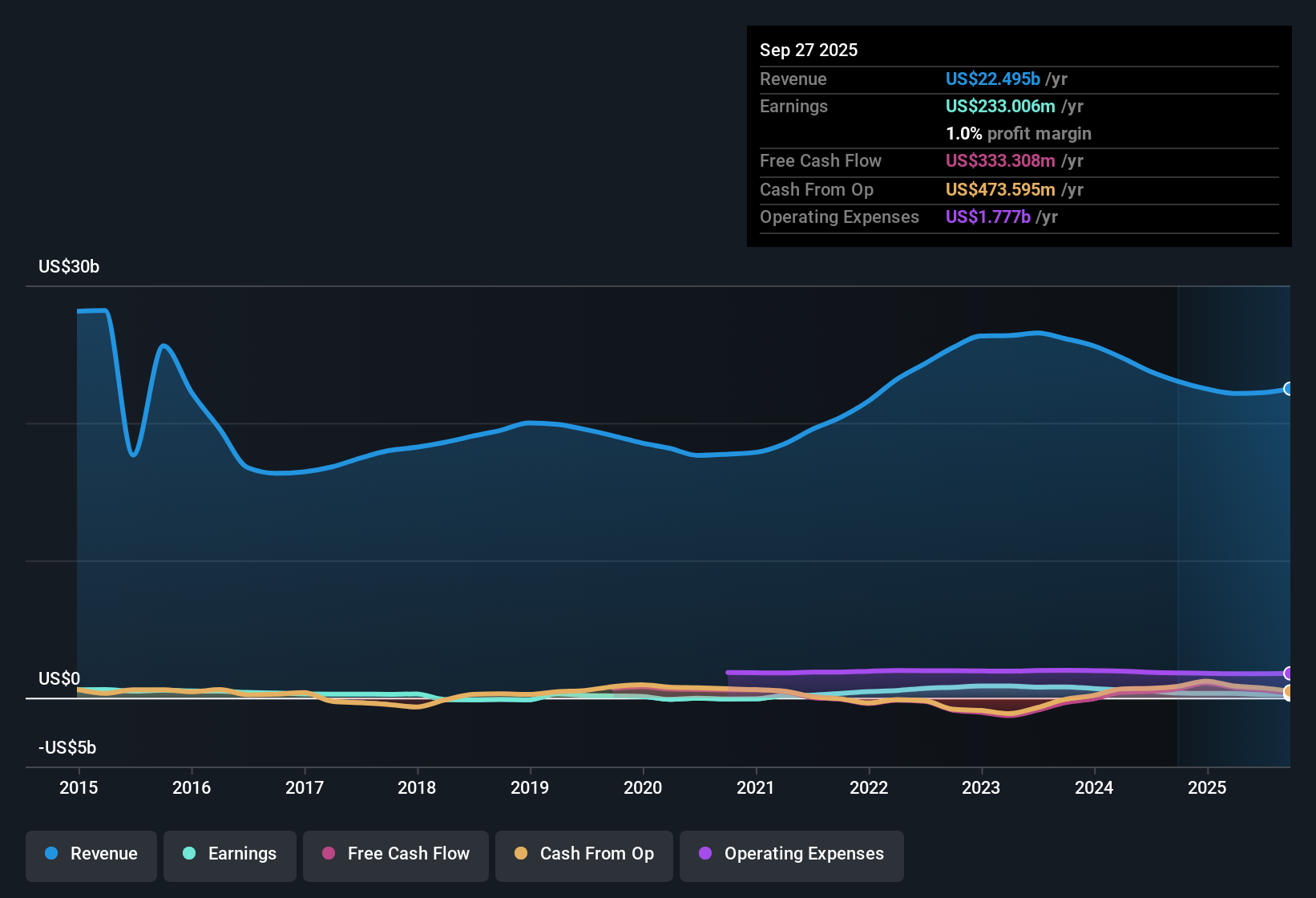

Avnet (AVT) posted forecast annual earnings growth of 40% per year, dramatically outpacing the broader US market’s 15.7% growth expectation. However, revenue for Avnet is anticipated to expand at just 5.1% per year, trailing the US average of 10.3%. Net profit margin slipped to 1% from 1.5% a year ago, with the latest twelve months reflecting a substantial one-off loss of $89.9 million. Despite these headwinds, Avnet's valuation looks compelling when measured against peers, as the stock trades at a Price-to-Earnings ratio of 16.8x. This is lower than both the peer and industry averages.

See our full analysis for Avnet.Next up, we’ll see how these headline results stack up when measured against prevailing narratives about Avnet, and whether the numbers reinforce or contradict the popular market story.

See what the community is saying about Avnet

Margin Decline Shadows Forecasted Profit Gains

- Avnet's net profit margin is now just 1%, down from 1.5% last year, with a one-off loss of $89.9 million weighing on the latest twelve-month results.

- Analysts' consensus view highlights that while profit margins are projected to rise from 1.1% today to 2.7% in three years, current margin pressure is driven by regional sales shifts and rising costs.

- Consensus notes that Avnet’s improved digital platforms and e-commerce investments are enhancing customer retention and could help offset some profitability headwinds if industry conditions improve.

- However, persistent weakness in EMEA (21% sales drop year-over-year) and inflationary cost pressures remain major risks. This keeps margin recovery far from guaranteed.

- See how margin trends feed into the broader narrative about Avnet's future with the full Consensus Narrative. 📊 Read the full Avnet Consensus Narrative.

Valuation Discount Signals Market Skepticism

- Avnet shares trade at a Price-to-Earnings ratio of 16.8x, below the peer average (17.5x) and well below the US electronic industry (25.7x), at a current share price of $48.22.

- Analysts' consensus view points out that although valuation looks attractive on a relative basis, the consensus analyst price target of $53.00 sits just 9.9% above current levels. This reflects a belief that profits must actually materialize before the market will assign a higher multiple.

- The muted upside to the target hints that analysts want to see progress toward the forecasted $680.5 million in earnings by 2028, especially with current margins still under pressure.

- If management’s investments in digital infrastructure and cost discipline translate into improved operating leverage, the current discount may prove temporary. For now, the market remains unconvinced.

Asia’s Rapid Growth Reshapes Earnings Mix

- Asia drove 18% year-over-year revenue growth, far outpacing weaker demand in EMEA, which saw a 21% decline. This intensifies Avnet’s reliance on regions with structurally lower margins.

- Analysts' consensus view considers that while expansion into high-growth sectors and geographies provides upside, it increases dependence on mix-sensitive markets where gross margins are thinner.

- Analysts note that the inflection in global demand, alongside digitalization and IoT adoption, could support top-line growth. They also warn that a higher share of Asian revenue could cap margins if EMEA recovery remains sluggish.

- Persistent margin compression from geographic mix shifts raises questions about whether anticipated margin gains can be achieved without more balanced global growth.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Avnet on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

View the numbers from a different perspective. Share your insight and shape your personal narrative in just a few minutes. Do it your way

A great starting point for your Avnet research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Avnet’s reliance on lower-margin regions, shrinking profit margins, and continued pressure from rising costs raise concerns about the consistency of its growth.

If you prefer companies with more dependable performance, use stable growth stocks screener (2113 results) to focus on those delivering steady revenue and earnings regardless of market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVT

Avnet

Distributes electronic component technology in the Americas, Europe, the Middle East, Africa, and Asia/Pacific.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives